Gold Price Sprints To Fresh Record High, Closer To $3,300 Amid Trade War Concerns And Weaker USD

Image Source: Pixabay

- Gold price continues to attract safe-haven flows amid persistent trade-related uncertainties.

- Bets for aggressive policy easing by the Fed and a weaker USD also benefit the XAU/USD pair.

- Investors now look forward to Fed Chair Jerome Powell’s speech for some meaningful impetus.

Gold price (XAU/USD) continues scaling new record highs heading into the European session on Wednesday, with bulls eyeing to conquer the $3,300 mark as trade-related uncertainties continue to boost demand for traditional safe-haven assets. Moreover, US recession fears and the growing acceptance that the prospects for more aggressive policy easing by the Federal Reserve (Fed) turn out to be other factors that contribute to driving flows toward the non-yielding yellow metal.

Apart from this, the underlying bearish sentiment surrounding the US Dollar (USD), amid the uncertainty over US President Donald Trump's trade policies and the weakening confidence in the US economy, further benefits the Gold price. The momentum, meanwhile, seems rather unaffected by slightly overbought conditions on short-term charts, suggesting that the buying interest is still far from being over. Investors now look to Fed Chair Jerome Powell's comments for a fresh impetus.

Daily Digest Market Movers: Gold price buying remains unabated amid the global rush to safety

- US President Donald Trump took a U-turn last week and abruptly backed off his hefty reciprocal tariffs on most US trading partners for 90 days. Moreover, Trump suggested that he might grant exemptions on auto-related levies after removing smartphones, computers, and some other electronics from steep tariffs on China.

- Trump, however, said that exemptions were only temporary and kept in place 145% duties on other Chinese imports. Trump further promised to unveil tariffs on imported semiconductors over the next week and also threatened that he would impose levies on pharmaceuticals in the not-too-distant future, raising uncertainty.

- China, on the other hand, increased its tariffs on US imports to 125% last Friday, fueling concerns that a tit-for-tat trade war between the world's two largest economies would weaken global growth. This continues to weigh on investors' sentiment and benefits safe-haven assets, lifting the Gold price to a fresh record high on Wednesday.

- Meanwhile, Trump's rapid shifts in tariff announcements have eroded investors' faith in US policies and weakened confidence in the US economy. Adding to this, bets that the Federal Reserve (Fed) will lower borrowing costs by 100 basis points in 2025 sent the US Dollar sharply lower, to its lowest level since April 2022 last week.

- Data released earlier this Wednesday showed that China's economy grew 5.4% in the first quarter from a year earlier, beating expectations. Other Chinese macro data – Retail Sales, Industrial Production, and Fixed Asset Investment – also came in better than estimates, though it was overshadowed by rising trade tensions with the US.

- Investors now await comments from Fed Chair Jerome Powell for more clues on the interest rate path, which will play a key role in influencing the USD price dynamics. Apart from this, trade-related developments should provide some meaningful impetus to the XAU/USD pair, which seems poised to prolong the uptrend.

Gold price bulls not ready to give up yet despite overbought conditions on short-term chart

From a technical perspective, the Relative Strength Index (RSI) on daily/4-hour charts is flashing slightly overbought conditions and warrants some caution for bullish traders. Hence, it will be prudent to wait for some near-term consolidation or a modest pullback before positioning for any further appreciating move for the Gold price.

In the meantime, any corrective pullback might now find some support near the $3,246-3,245 area ahead of the Asian session low, around the $3,230-3,229 region. Any further slide, however, might still be seen as a buying opportunity and is more likely to remain limited ahead of the $3,200 round-figure mark.

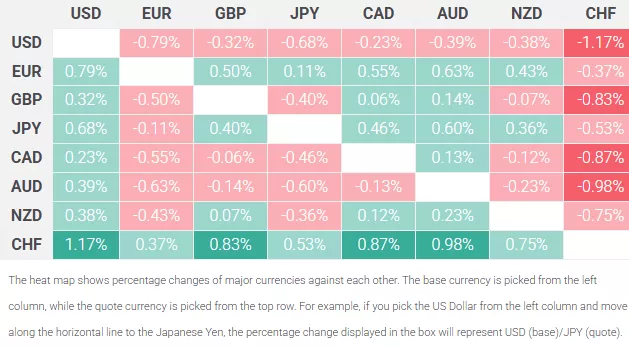

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Canadian Dollar.

More By This Author:

USD/JPY Price Analysis: Modest Recovery Fails To Alter Broader Bearish OutlookJapanese Yen Trims Part Of Modest Intraday Losses Against Bearish USD

Australian Dollar Pulls Back As US Dollar Attempts Recovery From Multi-Year Lows

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more