Gold Is A Buy During Market Dips Amid Geopolitical Tensions

The gold market is experiencing strong bullish momentum, fueled by geopolitical uncertainties and a weakening US Dollar. Several factors support gold's positive outlook, including recent stimulus measures by China that have bolstered investor confidence, rising geopolitical tensions in the Middle East that are increasing gold’s appeal as a safe-haven asset, and expectations of an interest rate cut by the Federal Reserve. Additionally, with the US Dollar under sustained pressure, gold has become increasingly attractive to foreign investors. This article explores the factors driving gold’s bullish trend and potential trading strategies amidst the ongoing global uncertainties.

Geopolitical Uncertainty and Weak Dollar

The gold market is showing bullish momentum and is expected to remain positive in the near term due to several supporting factors. Firstly, China’s recent stimulus measures have increased risk appetite among investors, which indirectly benefits gold as a hedge against potential economic uncertainties. Despite being defensive during Monday's European session, gold remains resilient, just below last week's record peak, suggesting strong underlying demand. Additionally, rising geopolitical tensions in the Middle East contribute to gold’s appeal as a safe-haven asset, limiting any significant downside for the commodity. As long as uncertainty persists, investors will likely maintain their positions in gold, supporting the bullish outlook.

Moreover, expectations of another interest rate cut by the Federal Reserve in November further reinforce gold’s bullish stance. Lower borrowing costs make non-yielding assets like gold more attractive, as they reduce the opportunity cost of holding the metal. At the same time, the US Dollar is struggling to gain traction and remains near its recent lows, making gold more appealing for foreign investors. With the USD in consolidation mode and no immediate signs of recovery, the path of least resistance for gold is to the upside. All eyes are now on Fed Chair Jerome Powell’s upcoming speech, which could provide further clues on monetary policy direction, potentially adding more fuel to gold’s bullish trend.

The interest rate cuts have induced bearish pressure on the US Dollar, breaking the triangle formation on the weekly chart. The US Dollar Index remains under bearish pressure after the breakout, which is providing additional support to the gold market.

(Click on image to enlarge)

Gold Price Projection

The chart below shows the technical outlook, indicating that gold has broken out of the triangle formation established from April to August. This breakout has triggered a strong rally in the gold market. However, based on a deeper analysis of the gold market, this surge could be the last one before a significant correction develops in October or November, although the overall outlook remains strong. The daily chart suggests a potential minor correction, but momentum is still strong. Gold may skip this correction and continue rising toward the $3,000 target. However, if a correction does occur, it will further strengthen the bullish price patterns.

(Click on image to enlarge)

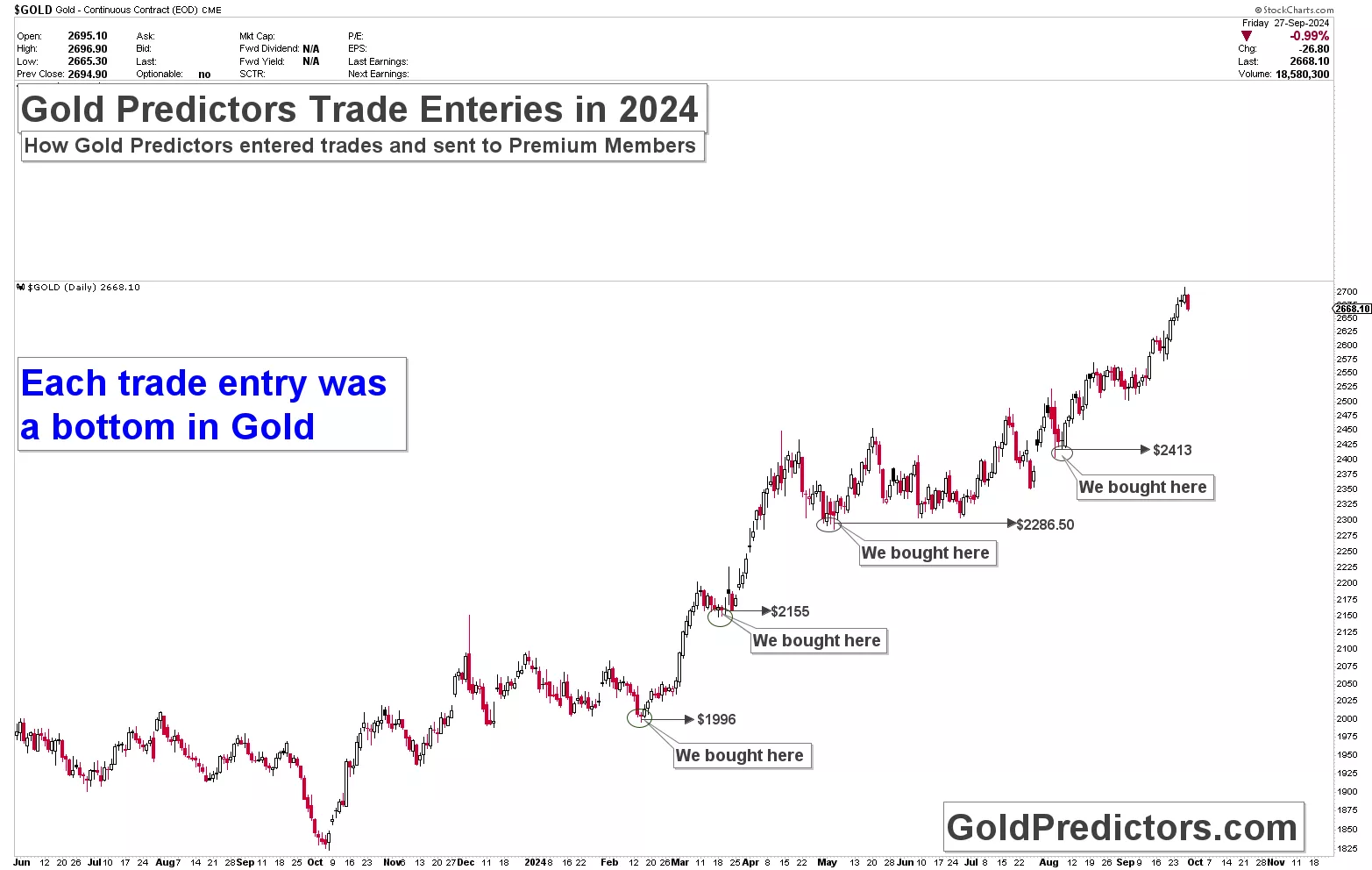

The most difficult challenge is determining how to trade gold during the ongoing geopolitical crisis. This requires conducting an extensive analysis. The strategy is to buy gold when the price has been corrected to lower and reaches significant support levels after thorough technical and cyclical evaluations. For example, Gold Predictors executed trades in 2024, and all trades were initiated when the price completed its bottom formation, as shown in the chart below. Gold prices rallied after each trade entry. Since prices are now reaching their targets, there may be another correction that could set the stage for the next rally. Therefore, this potential correction could present another strong buying opportunity during the geopolitical crisis. You can also become a premium member to receive the gold and silver trading signals.

(Click on image to enlarge)

Conclusion

In conclusion, the gold market displays strong bullish momentum driven by geopolitical uncertainties, a weak US Dollar, and supportive monetary policies. China’s stimulus measures heightened geopolitical tensions, and the anticipation of further interest rate cuts are contributing factors that continue to bolster gold’s appeal as a safe-haven asset. While a potential short-term correction could occur, it may serve as a new buying opportunity, reinforcing the overall positive outlook. Investors are advised to keep a close watch on key technical levels and Fed announcements for further guidance, as gold’s path to higher targets remains intact amidst ongoing uncertainty.

More By This Author:

Gold Continues Upward Trend Amid Rising Geopolitical Tensions

Gold Remains Bullish Amid Easing Inflation And Federal Reserve Policies

Economic Data And Technical Trends Point To Bullish Gold Market

Disclosure: Materials distributed by GoldPredictors.com has no regard to the specific investment objectives, financial situation or the particular needs of any visitor or subscriber. This site ...

more