Gold Remains Bullish Amid Easing Inflation And Federal Reserve Policies

Inflation trends and monetary policy decisions are at the forefront of economic discussions, as recent data indicates a shift in the landscape. The Consumer Price Index (CPI) figures show a noticeable decline in headline and core inflation, raising questions about the Federal Reserve's next steps. This article presents the technical charts of the gold market to evaluate its potential future direction.

Inflation Trends and the Expected Federal Reserve Rate Cut

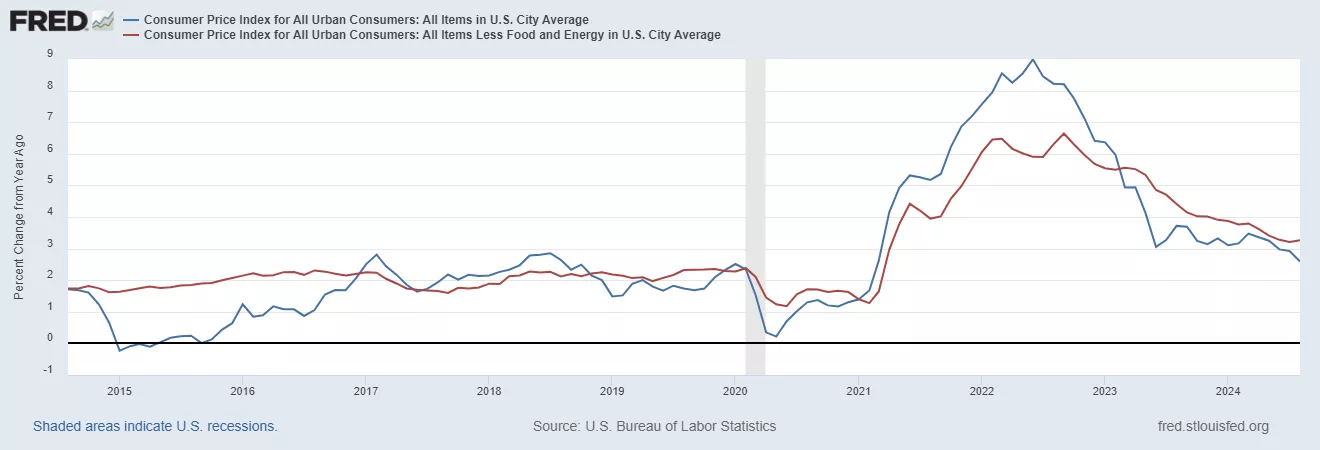

The chart below shows the year-over-year percentage change in the CPI for all urban consumers in the U.S. It is found that the overall CPI and the CPI excluding food and energy are declining. The overall CPI captures the general inflation rate, including all goods and services, while the CPI excluding food and energy, focuses on core inflation, often used to gauge underlying inflation trends because it excludes the more volatile food and energy prices.

The chart shows that both measures of inflation have fluctuated over time, with a significant increase in 2021 and 2022, indicating rising inflationary pressures. The overall CPI experienced sharper peaks compared to the core CPI, suggesting that food and energy prices contributed significantly to the overall inflation during this period. Recently, both measures show a downward trend, indicating that inflationary pressures are easing.

(Click on image to enlarge)

Federal Reserve is expected to cut interest rates in response to the recent signs of easing inflationary pressures and concerns over economic growth. The latest CPI data indicates that both headline and core inflation are on a downward trajectory, which could give the Fed the room it needs to adopt a more accommodative monetary policy stance. Lowering interest rates can stimulate economic activity by reducing borrowing costs for consumers and businesses, thereby encouraging spending and investment. There are growing concerns about the potential economic slowdown and geopolitical risks, such as the ongoing tensions in the Middle East, which could further impact market stability. By cutting rates, the Fed aims to buffer against these uncertainties, support the labor market, and ensure economic recovery remains on track. This decision also reflects the Fed's commitment to achieving its dual mandate of maximum employment and price stability, especially in a climate where inflation appears to be moving closer to the central bank's target.

Gold Bullish Price Developments

The gold market has been strongly bullish in 2024 due to the ongoing geopolitical crisis in the Middle East and economic uncertainty. The expectation of rate cuts has further driven the U.S. Dollar Index lower, creating an opportunity for a gold surge. The chart below shows that the price has already broken out of the black channel and is moving higher. This breakout after the black channel has resulted in a strong consolidation in the gold market, reinforcing market strength. The consolidation in gold from April to June was due to the seasonal correction, and the breakout above $2,530 has further strengthened the market.

(Click on image to enlarge)

To further understand the chart, the price data is zoomed out on the weekly chart, revealing that the consolidation within the channel followed strong historical bullish price action. There have been two long-term pivots in the market, $2,075 and $1,680. Gold has been trading within this range for a long time, and a breakout above $2,075 has opened the door for much higher prices in the gold market, with the primary target of $3,000. The first strong resistance will be the target of an ascending broadening wedge around $2700-$2800. Additionally, during the seasonal correction from April to June 2024, the market failed to correct toward the $2,200 region, indicating that prices are so strong that the seasonal correction did not bring prices back to normal levels. Instead, prices broke to record highs.

(Click on image to enlarge)

Conclusion

In conclusion, the downward trend in headline and core inflation has set the stage for the Federal Reserve's expected interest rate cut, aiming to mitigate economic slowdown risks and support growth. This potential rate cut, driven by easing inflationary pressures and global economic uncertainties, has contributed to a bullish outlook in the gold market. The gold price has surged to new highs, fueled by the weakening US dollar and geopolitical tensions. Above key technical levels, the breakout suggests that gold remains strong, with further upside potential. As the market adjusts to the Fed's policy stance and ongoing global risks, gold will continue serving as a hedge and a key asset for investors in an environment of economic uncertainty.

Gold Predictors delivers free newsletters, gold and silver trading signals and premium updates. Please click here to subscribe to free newsletters.

More By This Author:

Economic Data And Technical Trends Point To Bullish Gold Market

Gold's Bullish Surge: Navigating Breakout Patterns and Trading Strategies Amid Economic Uncertainty

Marvel Technologies Emerges Bullish Patterns

Disclosure: Materials distributed by GoldPredictors.com has no regard to the specific investment objectives, financial situation or the particular needs of any visitor or subscriber. This site ...

more