Gold Continues Upward Trend Amid Rising Geopolitical Tensions

- The ongoing geopolitical tensions between Hezbollah and Israel have created significant uncertainty in global markets.

- Historically, geopolitical conflicts have driven investors toward gold as a safe-haven asset.

- The formation of an inverted head and shoulders pattern within a broadening wedge suggests further bullish momentum for gold.

The ongoing geopolitical tensions, including the exchange of heavy fire between Hezbollah and Israel, have created significant uncertainty in the global markets. Historically, these conflicts have driven investors towards gold. The intensified violence has prompted a flight to safety, pushing the gold price higher as demand for the metal increases during political instability. Moreover, the start of rate cuts by the Federal Reserve has created a favourable environment for gold. However, if forced liquidation of short positions occurs due to market volatility, it could drive the price of gold further toward historical highs.

The mixed signals from the Federal Reserve add another layer of complexity to the outlook for gold prices. Fed Philadelphia President Patrick Harker’s remarks about the Fed's effective navigation of a challenging economy suggest that economic stability remains a priority. However, Fed Governor Michelle Bowman’s preference for a cautious approach to adjusting the Fed funds rate, coupled with Fed Governor Christopher Waller’s openness to pausing interest rate cuts, points to the uncertainty in future monetary policy decisions. A smaller rate cut or pause could reduce inflation concerns, but it may also temper the appeal of gold as a hedge against rising consumer prices.

Understanding Gold Bullish Momentum

The gold market is on its way toward the primary target of $3,000, which was determined and calculated in 2022. This target was further reinforced when the gold market broke above the $2,075 level, initiating a higher surge. The formation of an inverted head and shoulders pattern within an ascending broadening wedge suggests that the price is poised to move much higher. The ascending broadening wedge is typically a volatile pattern, reflecting significant volatility in the gold market. As geopolitical tensions escalate, the gold market could continue its upward trajectory toward the primary target.

(Click on image to enlarge)

How to Trade Gold During Geopolitical Tensions

During a geopolitical crisis, trading gold can present opportunities and risks due to the metal’s role as a safe-haven asset. Typically, rising geopolitical tensions lead to increased demand for gold as investors seek to protect their capital from market volatility and uncertainty. In such times, gold prices often experience upward pressure. To trade gold effectively during a crisis, investors should closely monitor geopolitical developments and their potential impact on global markets. It’s advisable to adopt a cautious yet opportunistic approach, focusing on technical analysis and key resistance levels to identify potential entry and exit points. Additionally, staying updated on central bank policies and macroeconomic indicators, which may counterbalance geopolitical effects, is crucial for making informed trading decisions. A balanced strategy, possibly including partial profit-taking and stop-loss orders, can help mitigate risks while capitalizing on gold’s price movement.

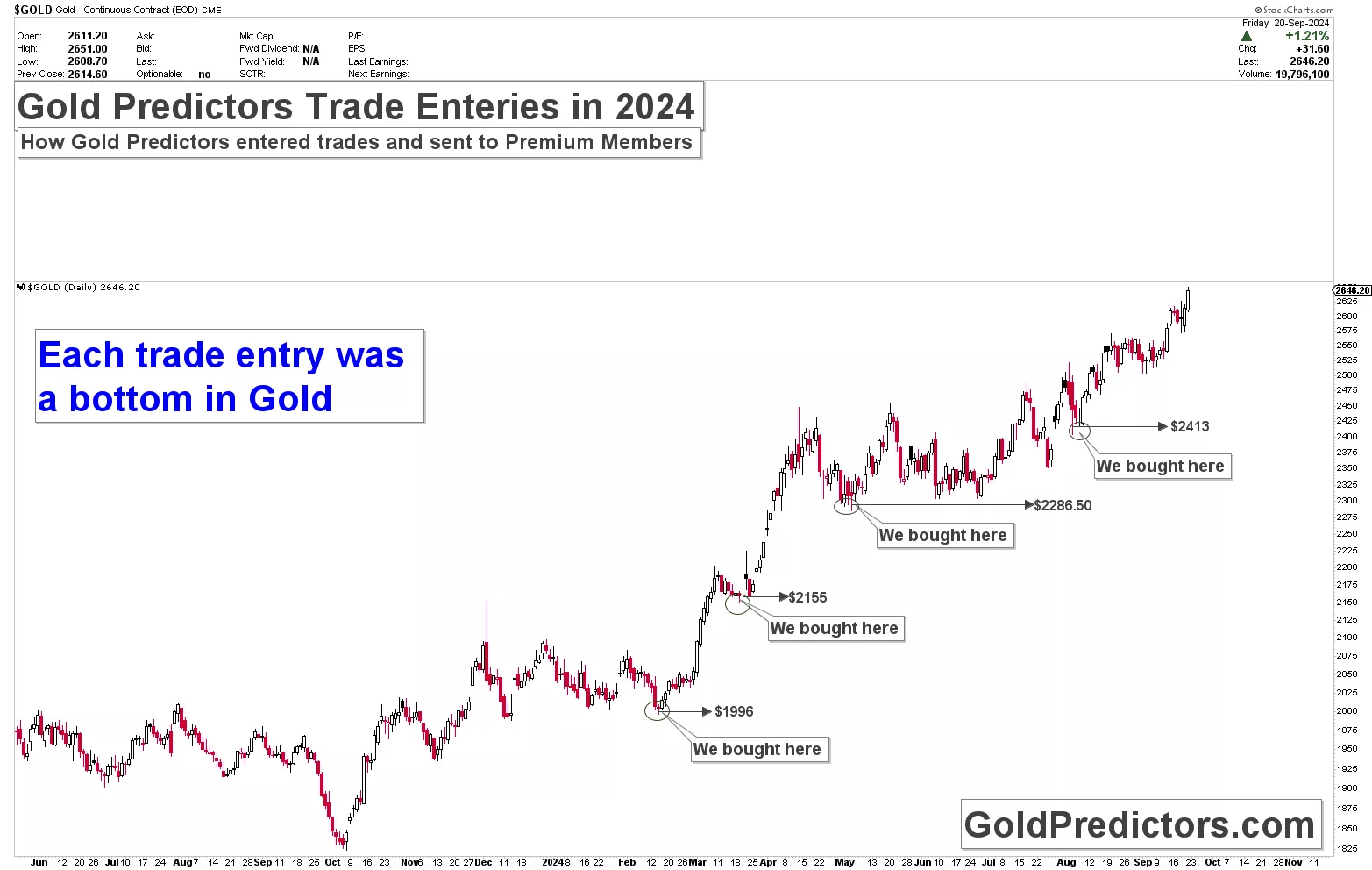

As volatility increases during geopolitical turmoil, traders should enter positions at key support levels and allow for the maximum possible range based on technical analysis. One example is the trades Gold Predictors sent to premium members in 2024. The geopolitical crisis intensified in 2024, and these trades were part of a Swing trading strategy. The chart below shows the trade entries made in the spot gold market. Once the trades were entered, the price surged higher without retracing. Trade entries at $1,996, $2,155, $2,286.50, and $2,413 were Swing trade entries, and the price has not looked back after these levels were reached.

(Click on image to enlarge)

Moreover, the first Swing trade entry at $1,996, a lower level, is now showing strong profits, and we are looking to book these profits soon.

(Click on image to enlarge)

Bottom Line

In conclusion, the ongoing geopolitical tensions and shifting Federal Reserve policies create challenges and opportunities for gold traders. As a safe-haven asset, gold continues to benefit from increased market volatility and uncertainty, particularly in times of conflict like the escalating violence between Hezbollah and Israel. Strong technical patterns and favourable macroeconomic conditions support the bullish momentum toward the $3,000 target, including the Fed’s rate cuts. However, mixed signals from the Federal Reserve highlight the need for cautious optimism, as future policy adjustments may impact inflation concerns and gold's appeal. Traders should focus on strategic entries at key support levels, stay updated on geopolitical and economic developments, and employ risk management techniques to capitalize on gold’s upward trajectory while mitigating potential downsides.

More By This Author:

Gold Remains Bullish Amid Easing Inflation And Federal Reserve Policies

Economic Data And Technical Trends Point To Bullish Gold Market

Gold's Bullish Surge: Navigating Breakout Patterns and Trading Strategies Amid Economic Uncertainty

Disclosure: Materials distributed by GoldPredictors.com has no regard to the specific investment objectives, financial situation or the particular needs of any visitor or subscriber. This site ...

more