Fear Drives The Demand For Gold. Baby Boomers Should Be Very Afraid.

- US stocks are dangerously overvalued: The P/E ratio is 30, so the earnings yield (E/P) of 3.33% is below bond yields, and prices are more than 3 standard deviations above historical norms — conditions that have led to sharp corrections or crashes in the past.

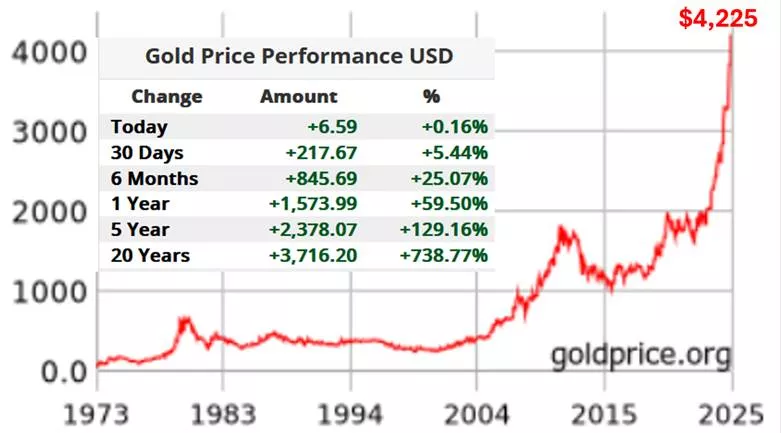

- Fear is shifting money into gold: While FOMO keeps the stock rally alive (especially in AI names), investors are simultaneously hedging by buying gold at a record pace; gold is now outperforming stocks even during a bull market, an unusual warning sign of expected trouble ahead.

- This bull market cannot last forever (Stein’s Law): We are in the longest bull market in history with classic late-cycle overvaluation; history shows these conditions do not end well.

- Baby Boomers are most at risk and should act now: Holding roughly one-third of all US stocks and currently living in the “Retirement Risk Zone,” baby boomers cannot afford a 30–50% crash. Target-date funds offer no real protection. Moving to gold, T-bills, and short-to-intermediate TIPS is the prudent step before the crowd panics, not after.

Investors are concerned about inflation and the looming threat of a long overdue stock market correction. Gold addresses both concerns. That’s why demand for gold is skyrocketing, driving its price to a record high above $4,200 per ounce. Baby boomers should be very afraid because they are in the Retirement Risk Zone when investment losses hurt most.

Read more here.

More By This Author:

High Earnings Growth Does Not Justify High Price/Earnings

The Santa Rally Could Fizzle This Year

Tipping Point: Baby Boomers Beware

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!