Crypto Versus Commodities

An oil derrick at dusk. Image via Laredo Petroleum.

Crypto Versus Commodities

In a recent post (Too Much Crypto, Not Enough Stuff), we mentioned there was a surfeit of cryptocurrencies, but not enough commodities to power the real economy:

According to CoinMarketCap.com, there are currently 9,888 different crypto currencies. While so much money and brainpower has poured into this new class of intangibles, the world economy is apparently running low on all sorts of tangibles. Bloomberg's Big Take on Monday was that "the world is suddenly running low on everything".

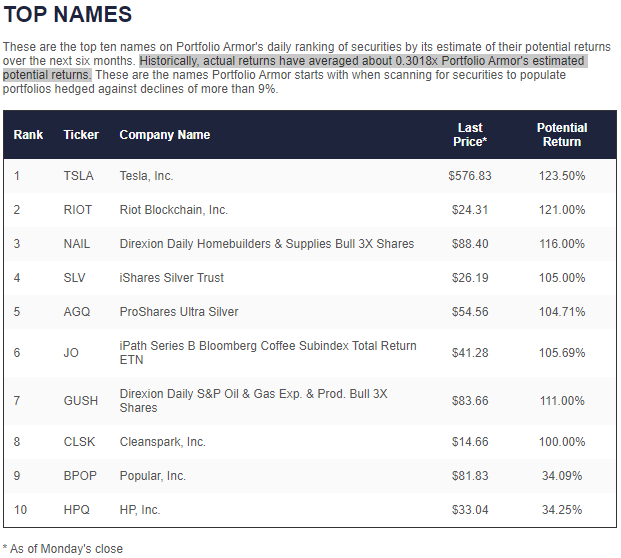

We mentioned that one of the commodities Bloomberg said the world was running low on was coffee and that the ETN tracking Bloomberg's coffee index happened to be one of our system's top ten names at the time.

In a nice bit of synergy, Bloomberg licenses its commodity indexes to the sponsors of exchange traded products. So not only does it report on rising commodity prices, but it also profits from them. Coincidentally, one of those exchange traded products, the iPath Series B Bloomberg Coffee Subindex Total Return ETN (JO) was one of our system's top ten names on Monday.

Screen capture via Portfolio Armor on 5/17/2021.

Note too, that the Direxion Daily S&P Oil & Gas E&P Bull 2X ETF (GUSH) was in our top ten then. Back to that in a moment, but first, let's address another connection between commodities and crypto.

Crypto Isn't Just Diverting Brainpower

Flash forward to June and per CoinMarketCap, the number of cryptocurrencies has grown from 9,888 to 10,211. Crypto isn't just diverting brainpower from efforts to produce more commodities; it's also, via ransomware, making commodities scarcer, and more expensive. First, we had the cyberattack on the Colonial Pipeline, and now the attack on JBS, one of America's largest meatpacking plant operators.

A Rally In Crypto And Commodity Names

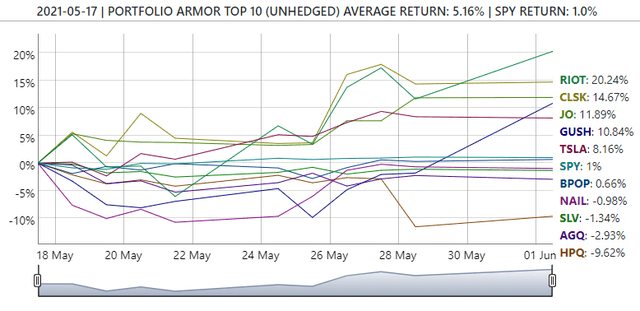

Perhaps not coincidentally, in the last couple of weeks, we've had a rally in crypto and commodity names. Consider, for example, those top ten names of ours from May 17th. Four of them are up double digits so far: the leveraged oil producer ETF GUSH, the coffee ETN JO, the Bitcoin miners Riot Blockchain (RIOT), and CleanSpark (CLSK).

Another Commodity Name Rallying

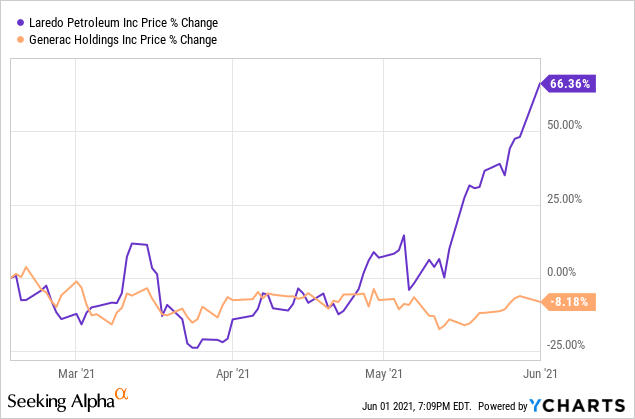

Another commodity name that's been rallying is the Texas-based oil E&P Laredo Petroleum (LPI). Readers may recall we mentioned it in our post about the weather disaster in Texas in February (Trouble In Texas):

Generac (GNRC) was up 7.25% on Tuesday, but another recent top name of ours boosted by the crisis in Texas was Permian producer Laredo Petroleum (LPI). It was up 11.43% on the day. Laredo was one of our top ten names on January 21st.

In our February article, we prefaced that paragraph by describing Laredo Petroleum as a former top name "that may be peaking", as it was up 55% since appearing in our top ten the previous month.

We got that prediction wrong. It's up another 66% since we wrote that article, including 12% so far this week.

If you're long Laredo and want to lock in some gains while aiming for a bit more, below is a way to do so.

Locking In Laredo Petroleum Gains

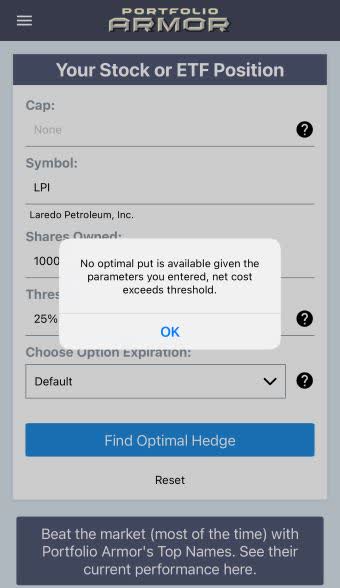

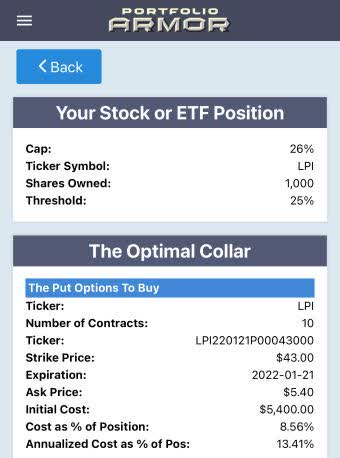

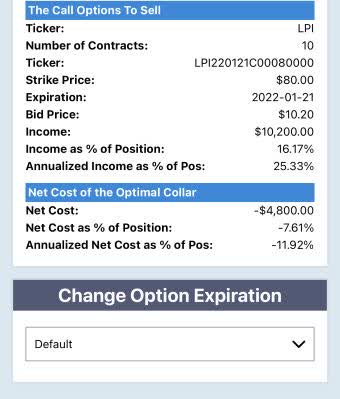

Let's say you owned 1,000 shares of LPI on Tuesday and wanted to protect against a greater-than-25% drop over the next several months. You'd run into the same problem we had trying this with Marathon Digital Holdings (MARA) last time.

Uncapped Upside: Unavailable

This and the subsequent screen captures are via the Portfolio Armor iPhone app.

Like Marathon, Laredo was too expensive to hedge against a >25% decline with puts, because the puts themselves would cost >25% of position value.

Capped Upside, Negative Cost

If you were willing to cap your upside at 26%, this was the optimal collar to hedge LPI against a >25% decline over the same time frame.

Here the net cost was negative, so you would have collected $4,800, or 7.61% of position value when opening this hedge. That's assuming, again, to be conservative, that you bought the puts and sold the calls at the worst ends of their respective spreads. So your maximum upside here would be the 26% cap minus that negative hedging cost of 7.61%: 26% - (-7.61%) = 26% + 7.61% = 33.61%, assuming you bought the puts at the ask and sold the calls at the bid.

That's a chance to gain another third on your position while locking in most of your gains so far this year.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more