Concrete Prices Won’t Fall Before Spring Despite Lower Energy Prices

The prices of many building materials have been decreasing lately. However, the prices of concrete, cement and bricks are still creeping up. Despite the decrease in energy prices, we don’t expect lower prices for these energy-intensive building materials before the spring.

Source: Shutterstock

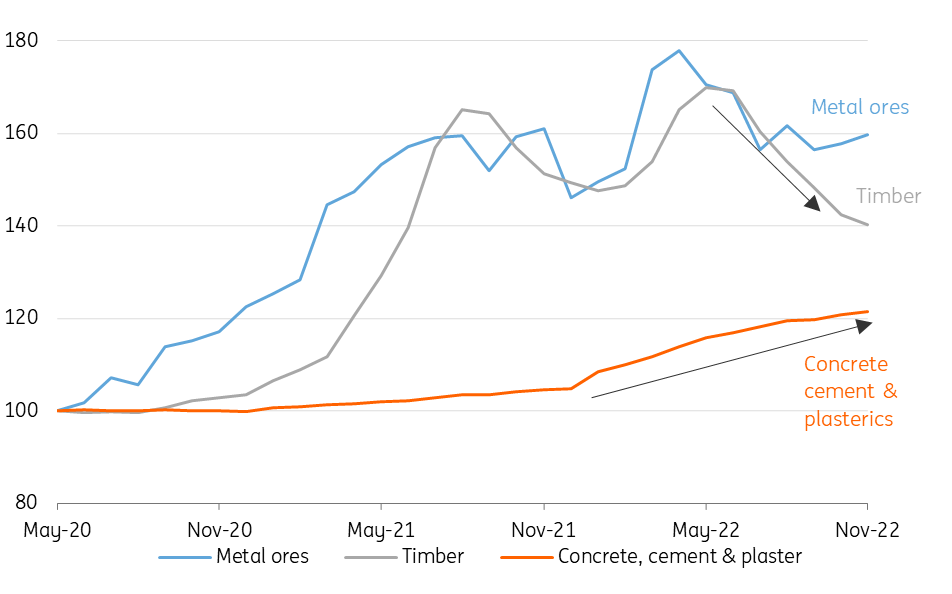

Building material inputs of wood and metals have decreased

The prices of many building materials reached a peak during the summer of 2022 and have steadily fallen since. The reasons why building material prices have fallen are the diminishing of supply chain disruptions and weakening demand (as expected) as forecasts for economic development in many countries are lowered. Output prices of sawmills declined by 17% in November 2022 compared to their peak in April. This is due to lower demand and moderating supply chain problems. The producer prices of metal ores have come down as well but to a lesser extent.

Producer prices of timber and metal ores have decreased, while concrete prices are increasing

Producer Price Index, Index May 2020=100, European Union

Source: Eurostat, ING Research

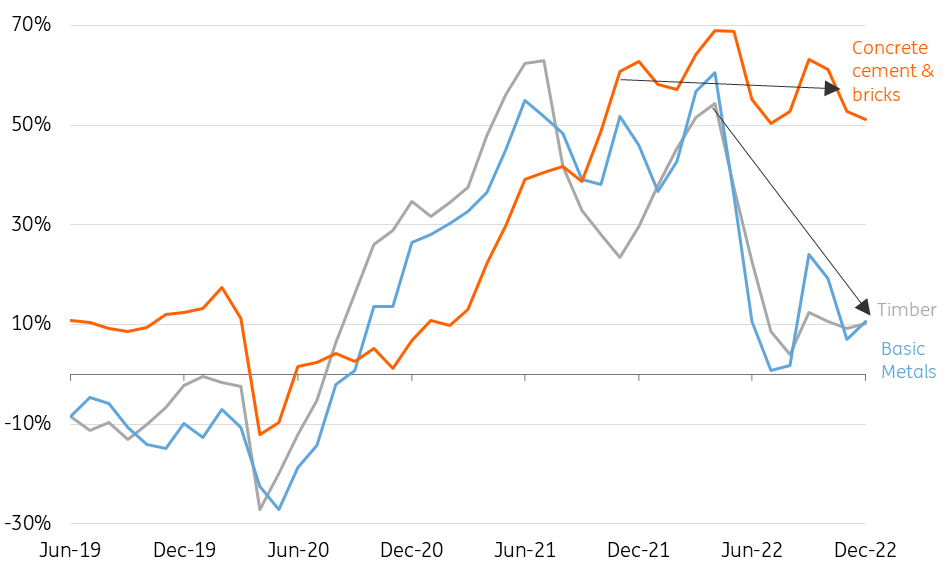

Prices of concrete are still increasing

However, not all building material prices are decreasing. The normally stable prices of concrete, cement and bricks increased steadily in 2022 due to rising energy prices as the production processes of these materials are very energy intensive. Temporarily higher transport costs due to low water levels in many European rivers during the 2022 summer drove up these costs further. However, energy prices (particularly gas) have decreased enormously in the last few months. You might expect that this would put downward pressure on concrete prices. Yet, an almost record number of concrete, cement and brick suppliers said in December 2022 that they were planning to increase their sales prices further. In contrast, many building material suppliers of timber products and metals planned to increase prices during the summer of 2022, but in December, plans to increase their output prices failed to materialise.

Number of concrete suppliers that plan to increase output prices remains high

Balance of manufactures in European Union who expect to increase/decrease output prices (over the next three months)

Source: European Commission, ING Research

So, why are the output prices of the concrete, cement and bricks industry still surging and (when) can we expect them to drop?

We see two reasons why the prices of concrete, cement and bricks are still surging:

1. Input prices for concrete, cement and bricks started to increase later

The concrete, cement and brick industry is a very energy-intensive sector. Energy prices started to increase when the Covid-19 pandemic eased. This is in contrast to price increases of wooden building materials which mainly soared during the Covid pandemic as sawmills scaled-down production. However, timber demand unexpectedly increased due to more refurbishing assignments for rebuilding homes. Consumers needed extra space at home and had more savings due to not being able to go on holiday.

2. Concrete, cement and bricks prices are less vulnerable than timber and steel prices

Timber and steel prices react relatively quickly to changes in the market. If stocks of suppliers and wooden building materials increase, this leads to price declines of wood within one to two months. The (global) market for these products is very competitive, so changing purchase prices are quickly passed on. On the contrary, building materials such as concrete and cement are heavy and voluminous. For this reason, they are often traded on relatively small local markets resulting in less competition. This gives the suppliers of these products more market power, which usually results in both higher prices and lower price volatility. For this reason, they do not have to pass on price reductions of raw materials or energy costs directly because of the relatively limited competition. As a result, the output prices of these products rise (and fall) at a slower rate compared to building materials such as wood which are traded in more competitive markets.

But (when) will cement, concrete and brick prices decrease?

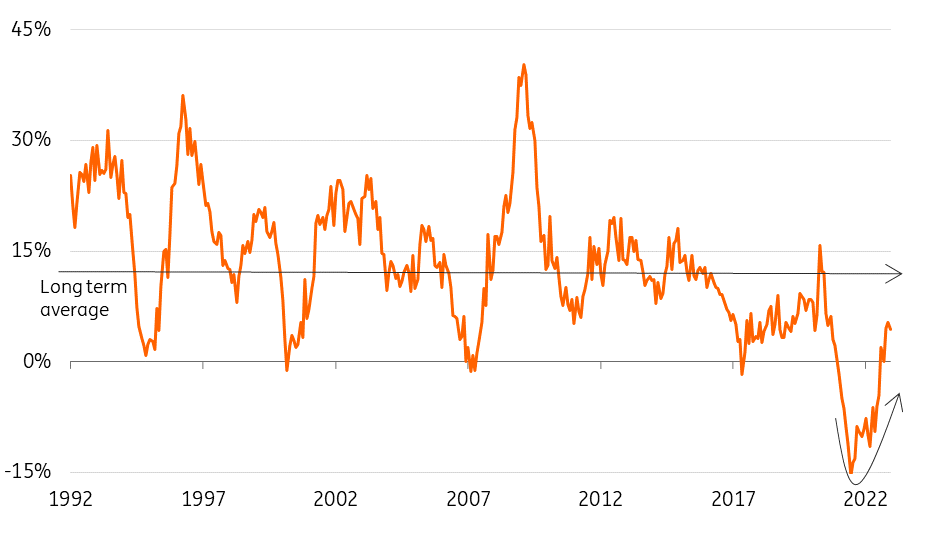

Inventories of concrete, cement and bricks suppliers are improving

Balance of assessment of stocks of finished products. Building material suppliers (concrete, cement and bricks), European Union

Source: European Commission & ING Research

Inventories increase first before prices

Before building material suppliers even think about lowering sales prices, we have to see an increasment in their inventories. That's because a rise in their stock signals that sales are slowing down. To counterbalance this, companies will (have to) squeeze prices.

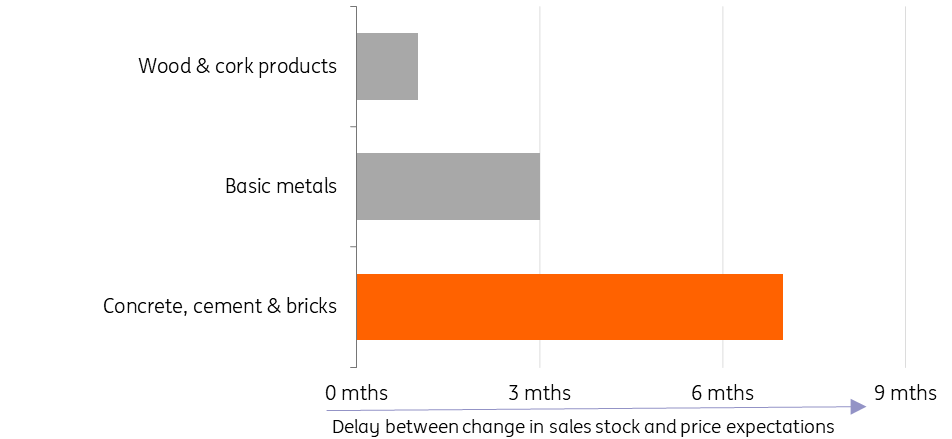

Long delay in price reaction in concrete, cement and brick industry

The delay between the start of a strong increase (decrease) of stocks and the start of a strong decrease (increase) of sales price expectation (based on correlation analyses period 1991-2022) in different building material industries

Source: European Commission & ING Research

No price decrease for concrete, cement and bricks until at least spring 2023

A correlation analysis shows that building materials such as concrete, bricks and cement react with a delay of more than six months to changes in the assessment of their inventories due to the aforementioned reasons. Building material stock in the concrete, cement and brick industry has been improving since the beginning of the third quarter of 2022. In general, this would mean that the prices of these products will soon come down. Nevertheless, inventories are still at low levels and input prices of energy (mainly gas) remain high, although they have been decreasing since August 2022. We, therefore, think that it could still take a couple of months more than normal, at least until the spring, before concrete, cement and brick prices decrease. This is based on the assumption that energy prices won’t spike again.

More By This Author:

China Reopening Boosts Copper Outlook

Hungary’s Inflation Accelerates, But Less Than Expected

China’s PBoC Injects Liquidity To Support Growth

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more