Hungary’s Inflation Accelerates, But Less Than Expected

On the one hand, Hungary has joined its regional peers with headline inflation delivering a downside surprise. On the other hand, it is still moving higher. The lifting of fuel price caps has pushed inflation up while underlying inflation strengthened too. The good news is the peak might be close.

Highest inflation in 27 years

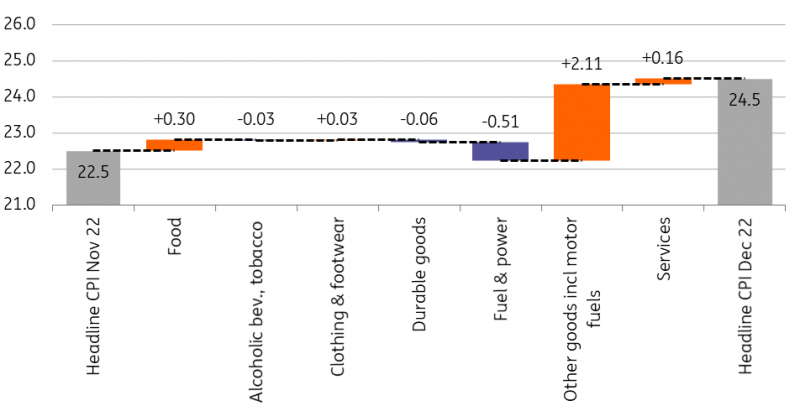

Inflation in Hungary continues to surge, but not as much as the market expected. Headline inflation came in at 24.5% year-on-year, which is the result of a 1.9% month-on-month price increase. The main culprit behind the monthly acceleration is the motor fuel component, which didn’t catch markets off guard as it was a result of the lifted fuel price cap. But we have some ideas about what the market missed, resulting in the downside surprise.

Main drivers of the change in headline CPI (%)

Source: HCSO, ING

The details

- After months of stagnation (due to price caps) fuel prices emerged as the most important contributor to the acceleration in inflation. The fuel price cap was removed on 7 December, which resulted in long-brewing inflationary pressure on households. Motor fuel prices rose by 24.4% on a monthly basis, but the entire effect was not registered in December’s data due to methodological issues. We see an additional inflationary impact from this item in January due to technicalities and further rising prices.

- Food prices registered a 44.8% year-on-year increase. While processed food prices posted a 3.0% month-on-month increase, the price of unprocessed food decreased by 0.3% on a monthly basis. The good news is that the overall 2.1% MoM food inflation was the lowest in 2022 and responsible for the vast majority of the downside surprise in the headline reading. The bad news is that the overall picture remains bleak especially as basic food caps will remain with us until the end of April and retailers face a higher tax burden from January.

- The biggest surprise came from the fuel and power component, where prices decreased by 6% MoM shaving off around 0.5ppt from the headline inflation print. The main driver was natural gas with an 11.8% price decrease from November to December. This is attributed to favorable (warmer) weather conditions and demand destruction caused by the reshaped utility bill support scheme. The volume of household gas usage dropped by 23% in December, thus the consumption by a larger proportion of consumers fell below the quantity limit of the lower gas price, resulting in a decrease in the estimated average gas price.

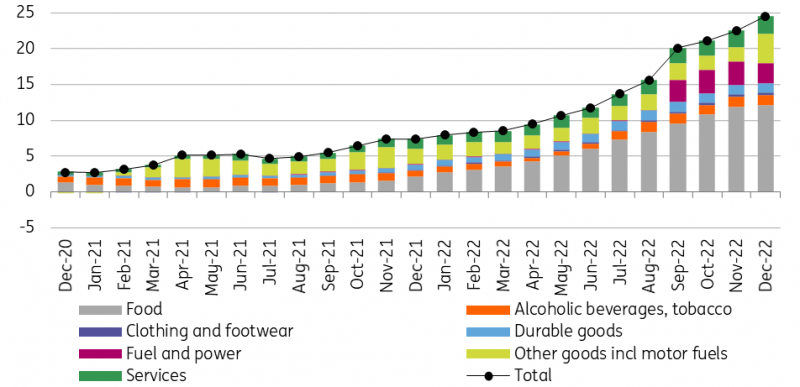

The composition of headline inflation (ppt)

Source: HCSO, ING

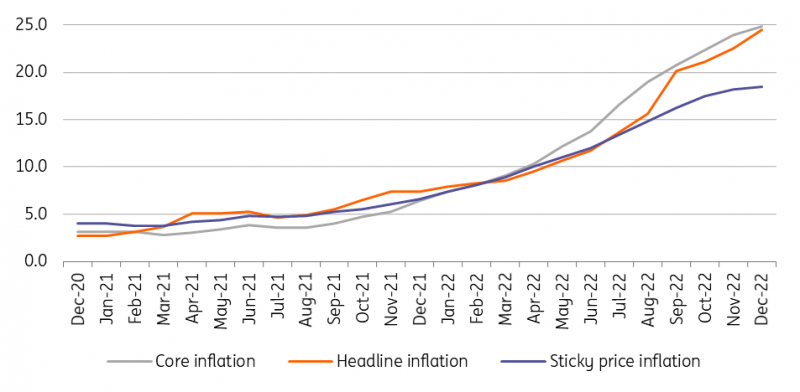

Core inflation remains above headline

Core inflation jumped to 24.8% year-on-year, remaining above headline inflation by a mere 0.3ppt. On a monthly basis, core inflation posted a 1.6% increase, mainly due to processed food and services. In all, the downside surprise in headline inflation is a result of non-core elements, while underlying price pressure remains significant. According to our estimates, 54% of the items in the consumer basket already showed at least a 20% YoY inflation figure in December.

Headline and underlying inflation measures (% YoY)

Source: HCSO, ING

We are not out of the woods yet

We expect a further acceleration in headline inflation. One key source of it will be the fuel price impact. The usual start-of-the-year repricing in retail could also be stronger than history suggests, especially considering the changes in wages and taxes. This will impact processed food and services prices. The wild card will be the energy price of households in January. The moderation of energy consumption due to the two-tiered price system in electricity and natural gas, and the warmer-than-usual winter might reduce the average monthly bill value in utilities. In all, we see headline and core inflation starting the year at around 25.2% YoY followed by some sideway moves before starting a gradual descent during the second quarter of 2023. We see both core and headline inflation ending up in the range of 18-19% when it comes to the full-year average.

Too early for the central bank to pull the trigger

Even with the December downside surprise, we don’t think that the National Bank of Hungary (NBH) will be ready to pull the trigger on a monetary policy pivot. The Monetary Council wants to see a trend improvement in risk perceptions; thus, it is adopting a patient approach. Though global market sentiment has improved a lot since the last rate-setting meeting, the central bank might want to see more of the same. Unless there is an unexpectedly significant forint strengthening in the coming weeks, we see the NBH sticking to the temporary, targeted measures and to the 18% marginal rate until late March. By then we might see a long-enough period of improved global risk-taking and evidence of a peak in Hungarian inflation. The March Inflation Report (thus the updated staff projection) would be an ideal time to announce the start of the gradual turnaround.

More By This Author:

China’s PBoC Injects Liquidity To Support GrowthFX Daily: Focus Will Be On Japan, China And The UK This Week

Asia Morning Bites - Monday, Jan. 16

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more