Beneath The Surface The Market Is Rotating Toward Defensive Names; A Regime Change May Be At Hand

(Click on image to enlarge)

There is something interesting happening beneath the surface in the market right now. While the S&P is on the verge of making new all time highs above 7,000, the stocks that are really working are defensive in nature.

The S&P Consumer Staples ETF (XLP) is one of the best performing sectors of the year so far with stocks like Walmart (WMT), Procter & Gamble (PG), Phillip Morris (PM), Coke (KO), Pepsi (PEP) and Mondelez (MDLZ) significantly outperforming. On the other hand, the Mag 7 – which have led for most of this 3-year bull market – have gone sideways for the last three months. You can see this in the chart that heads this blog which shows XLP (+10.78%) versus The Magnificent 7 ETF (MAGS) (-2.66%) over the last three months.

In general, you don’t want to see defensive stocks like XLP leading in a bull market as these are the kinds of stocks that hold up best in difficult economic environments. While it’s just one interpretation, it seems to me like investors are rotating out of the former technology stock winners into defensive stocks that will do better in a tougher tape.

(Click on image to enlarge)

Another theme is Hard Assets > Digital Assets. You can see this in the major outperformance of S&P Metals and Mining ETF (XME) versus The Magnificent 7 ETF (MAGS) – even despite the steep pullback in commodities and commodity stocks in the last couple sessions.

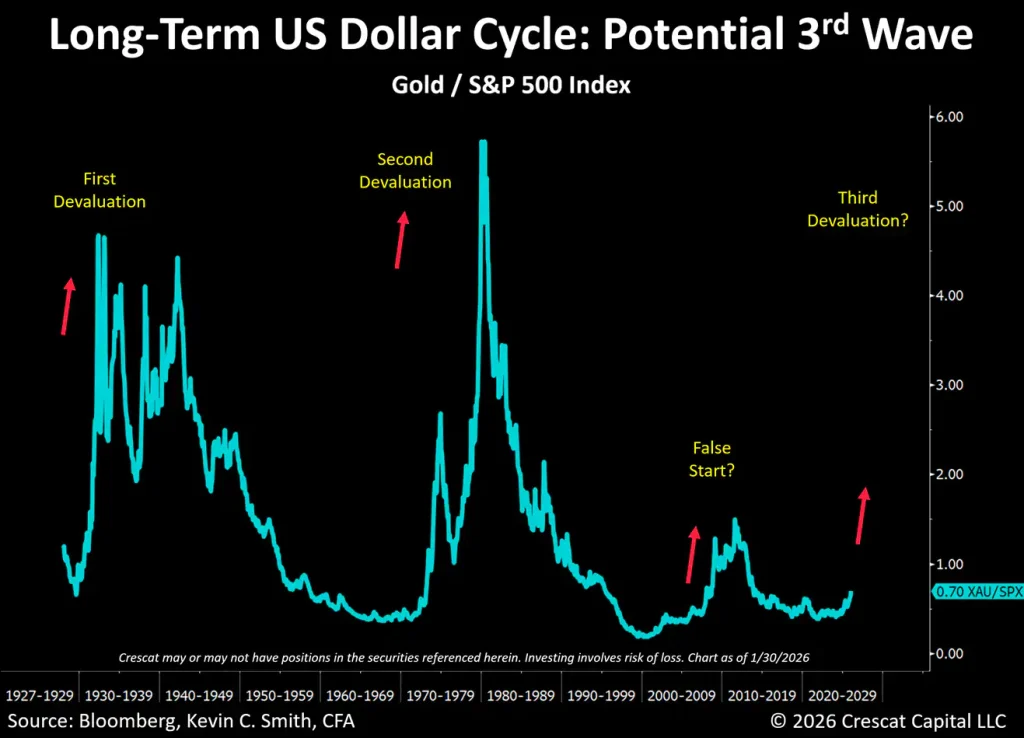

What I think it all adds up to is a regime change that was best captured by Kevin Smith in Crescat Capital’s Monthly Letter from January 31 (“Third Wave of the US Dollar Cycle”):

We believe we are on the cusp of the third devaluation wave of the long-term US dollar cycle. The first wave was during the Great Depression, when President Franklin D. Roosevelt issued Executive Order 6102 on April 5, 1933, requiring Americans to surrender most of their privately held gold to the Federal Reserve by May 1, 1933. He then officially devalued the dollar by raising the gold price from $20.67 to $35 per ounce on January 31, 1934. The second major wave began on August 15, 1971. That was when President Richard Nixon announced the closing of the “gold window”, which ended both the direct convertibility of the U.S. dollar to gold for foreign governments as well as the Bretton Woods system of fixed exchange rates.

If correct, this suggests that the mega-cap technology stocks that have led the market for the last 15+ years will be replaced by new leaders from the commodities and precious metals miners (i.e. Hard Assets > Digital Assets). Defensive stocks like those in the XLP will do just fine as well as we work through this difficult macro transition in which the dollar – and all fiat currencies – are devalued against hard assets. That this is already happening can be seen in the changing composition of central bank reserves away from dollars and toward gold.

While the shakeout in silver on Friday suggested to many that that move is over, this framework suggests that in fact it is only getting started.

While most investors continue to hang out in the technology stocks that have worked so well over the last 15+ years, I believe a regime change is in the early stages and continues to favor hard assets and defensive stocks over the previous technology leaders. Those who are positioned correctly stand to reap a fortune while those whose positioning is rooted in the previous regime will significantly underperform.

More By This Author:

Disney's Post-Earnings Selloff

Betting On A Countertrend Move In The Dollar And Related Intermarket Moves

Three Stocks For The Era Of Casino Capitalism