Be Careful What You Wish For – But Smalls Caps Are Delivering

Image Source: Unsplash

Friday saw a strong opening after the less-than-expected jobs numbers. Think about that. Stocks rallied. Bonds rallied. Gold rallied. And all because of a weaker-than-expected economic report. Many people would say that is counterintuitive. After all, shouldn’t markets rally on good news and sell off on bad news? Well, that really depends on the market regime. And right now, bad news is good news because it means the Fed is closer to cutting interest rates.

I always tell people to be careful what they wish for. Let’s recall that the Fed started cutting rates in early 2001. And yet stocks collapsed another 40%+ through a series of rate cuts straight to October 2002. Let’s remember that the Fed started cutting rates in September 2007, a month before the final bull market peak. And then stocks imploded by 58%. Rate cuts are absolutely not a one-way street.

I do not believe the markets resemble 2001 nor 2007. I do not believe it’s even close.

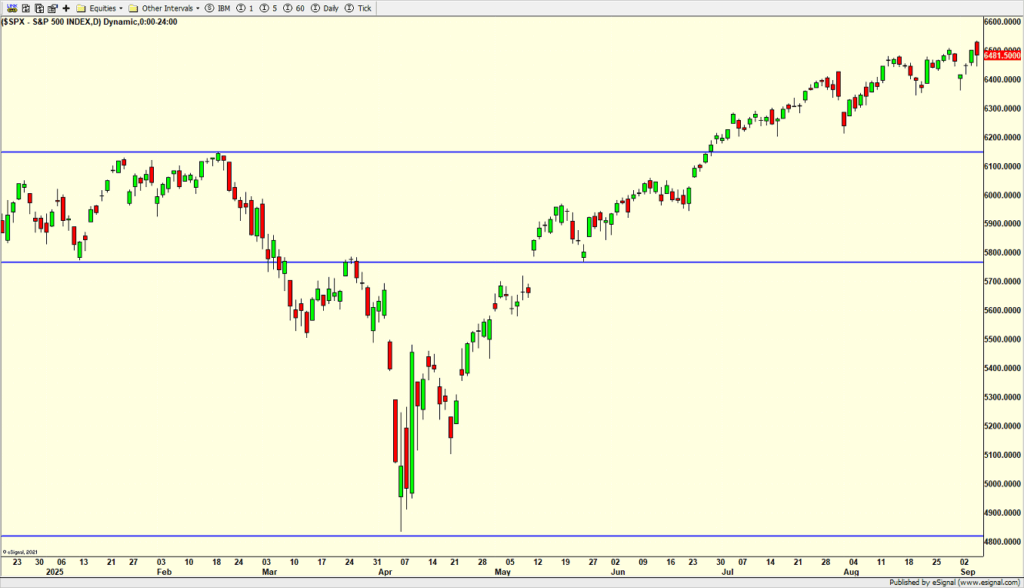

On Friday, stocks sold off from the open. Many will observe that fresh all-time highs were rejected, which is true. However, we have seen this film before. Only a continuation of the decline would lead to any kind of short-term concern.

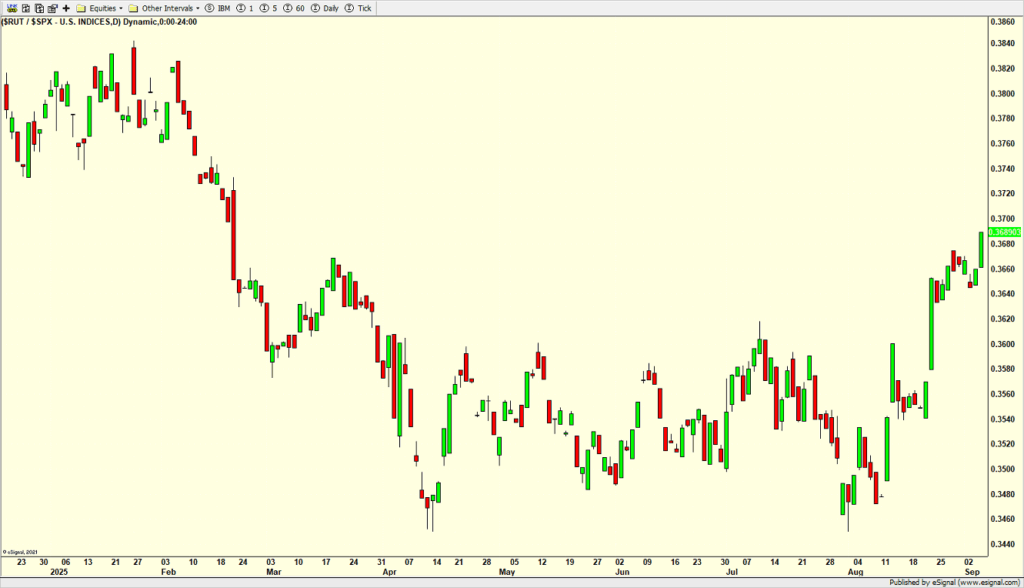

One thing really stuck out to me on Friday. The chart below should be familiar as I have posted it many times since spring. It is the Russell 2000 versus the S&P 500. Notice that on up and down days of late, the Russell 2000 is beating the S&P 500, which tells you all you need to know about leadership. This is not an every single day deal, but it is important to note and confirms the broadening thesis I have written about. Of course, there will be days when the AI stocks are strong at the expense of everything else.

On Friday, we bought SSO. We sold QLD, some GWRE, some PCY, and some EMB.

More By This Author:

Less Tariffs Now Bad, Weaker Jobs & Finally A Rate Cut

Nvidia & Less Government Intervention

Powell Pivoted & Small Caps Loved it

Disclosure: Please see HC's full disclosure here.