Powell Pivoted & Small Caps Loved It

Image Source: Unsplash

Jay Powell blinked, finally. Powell and the FOMC have been dead wrong according to my work. They were wrong to wait to hike rates and they are wrong in waiting to cut them. Frankly, I always prefer to be a little early than late and forced to play catch up. The markets don’t like and the economy certainly doesn’t like that.

On Friday in what was Jay Powell’s likely last speech from the Jackson Hole symposium, he opened the door to a rate cut. Let’s remember that the Fed only control the Federal Funds Rate which in turn impacts the Prime Lending Rate. And that has influence over everything short-term like credit cards and home equity. It has absolutely no bearing on traditional fixed rate mortgages.

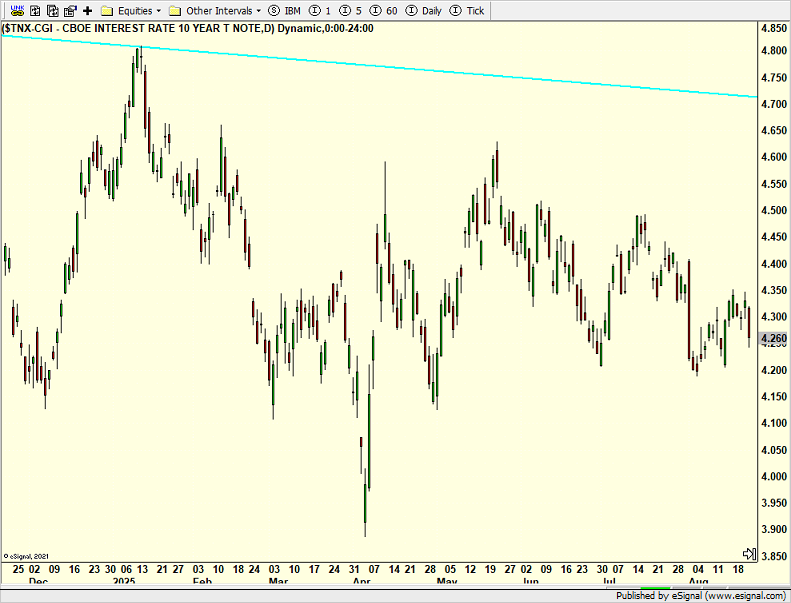

Looking at the 10-Year Note below, rates came down a bit but remain the range is laid out 9 months ago. I wonder aloud if Fed rate cuts might be met with higher longer-term rates which would really steepen the yield curve and juice the economy in 2026.

(Click on image to enlarge)

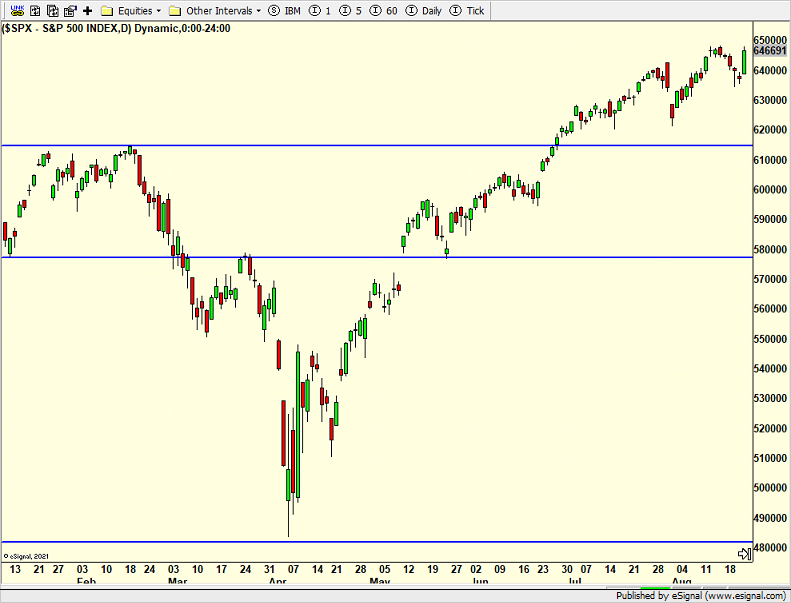

The stock market loved what it heard from Powell. All major stock market indices soared on Friday. The S&P 500 closed right at the old highs. Another move higher is likely.

(Click on image to enlarge)

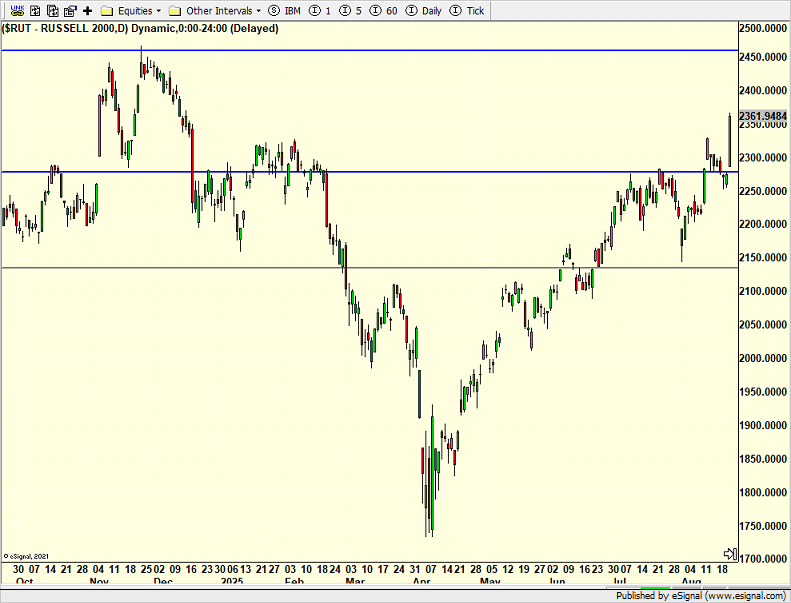

I have written much about the Russell 2000 and small caps all spring and summer. Don’t look now but the Russell below has really been surging all month. Friday’s action was super powerful.

(Click on image to enlarge)

And finally, the ratio of the Russell 2000 to the S&P 500 is below. This simply shows which index is leading. I have been showing this chart and its developing opportunity since spring. Small caps are clearly leading over large caps. What we do not know is if this is yet another fleeting surge or if it has staying power. Right now, I favor the latter, but I am anything but married to it. We have had our small cap positions in place for months, but I won’t hesitate to jettison them at a moment’s notice.

(Click on image to enlarge)

Friday’s Powell-induced rally was powerful and impressive. There should be more to come. The more I hear about the negative seasonals in September and how investors are buying options to guard against the downside, the more stocks should rally.

On Friday we bought PCY, EMB, GO and VNM. We sold EWY, some CELH and some SSO.

More By This Author:

Berkshire Looking Better – Nasdaq 100 Dipping To BuyVolatility About To Spike With Fed Meeting?

Inflation Soars At The Producer Level – Stocks & Bonds Don’t Crash

Disclosure: Please see HC's full disclosure here.