An Unprecedented Moment For A New Crypto Commodity

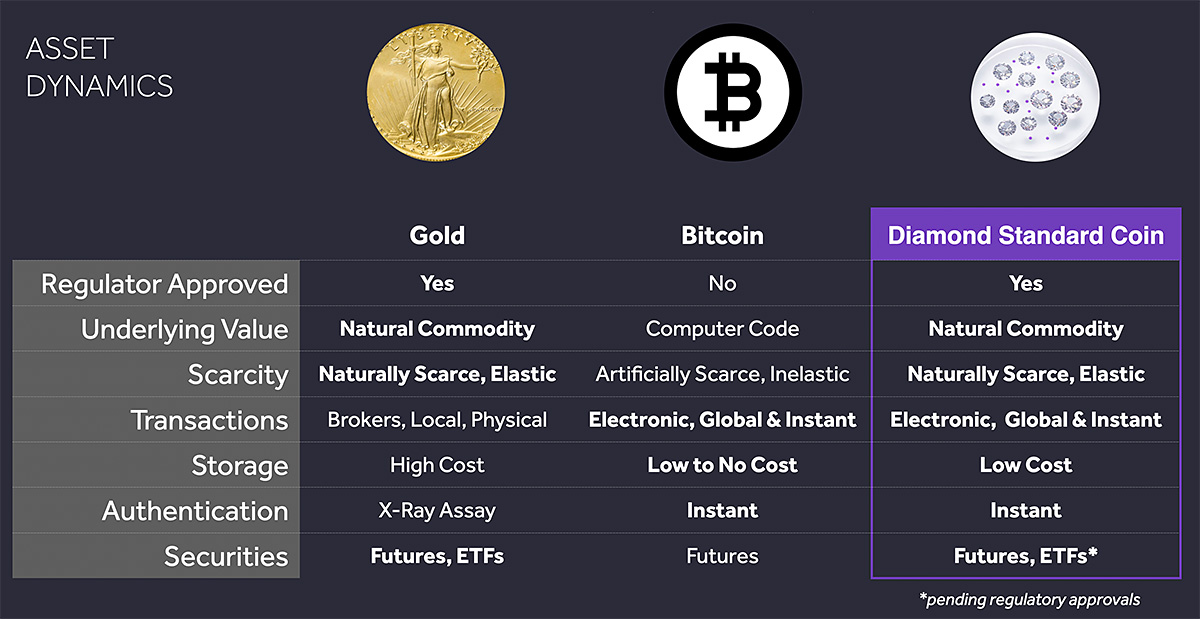

In the previous parts of our “Why Diamonds?” series, we explained that as an uncorrelated and under-allocated asset, diamonds can play an important role in investor portfolios. In this final installment, we describe how the unique characteristics of diamonds combined with the emergence of blockchain and cryptocurrencies have created an unprecedented moment for creating superior value. Diamonds are the ultimate hard asset and are the most valuable and dense commodity on earth.

As a result of the Coronavirus, markets are volatile and governments are printing unlimited money. Hard assets are a hedge against volatility and currency inflation. Gold can’t go bankrupt. Diamonds are the ideal hedge. The supply is sufficient for institutional use, with an estimated $1.2 trillion worth above ground, more than silver and platinum combined. Their value to weight is extremely high, so storage costs are low.

Diamonds: The Previously Inaccessible Commodity

For decades, investors turned to diamonds for their long-term value. Diamonds are also extremely attractive — and not just because they are ‘forever’ beautiful.

Consider a few key facts:

Permanent natural resource: supply-constrained with historic global demand.

Extreme value concentration: density of approximately $400,000 per ounce.

Stable asset class: $1.2 trillion above-ground and $30 billion per year production.

Low stock-to-flow ratio: similar to gold at approximately 2.5% stock-to-flow ratio.

Significant consumer and business needs: Global supply and demand for jewelry and industrial.

Tangible: Delivery or Custody

Diamond Standard has established the first regulated diamond commodity. Each beautiful Coin is designed to have the same value, containing a statistically calibrated set of diamonds encased in transparent resin, and a military-grade wireless encryption chip. The chip stores a digital token that allows owners to instantly authenticate, audit, and trade the Coin electronically, using blockchain technology. Leading regulators, banks, exchanges, hedge funds, and asset managers have agreed that this new commodity is fair and consistent. Hundreds of investors have placed reservations.

The physical commodity features digital audit, authentication, and secure and efficient blockchain transaction technology, using an embedded wireless encryption chip. A commodity designation enables the use of diamonds by investors and asset managers, providing standardization, price discovery, daily fixed price, low transaction friction, and liquidity. Diamond liquidity and price discovery will be further enhanced by forthcoming futures, options, and a physical commodity ETF.

The Gemological Institute of America (GIA) and the International Gemological Institute (IGI) independently grade and inspect every diamond incorporated in Diamond Standard commodities. IGI, a subsidiary of Fosun, inspects and transports the diamonds to New York City from eight global intake locations, where the Coins are assembled inside a gemological lab. Diamond Standard’s internal auditor is Deloitte.

More By This Author:

An Under-Allocated Investment With Pent-Up Demand

CSAN: This Brazilian Stock Is A Once-In-A-Lifetime Profit Opportunity

Latin American Markets May Be A Mess, But This Stock Is Irresistible

Disclosure: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more