AgMaster Report - Tuesday, Oct. 3

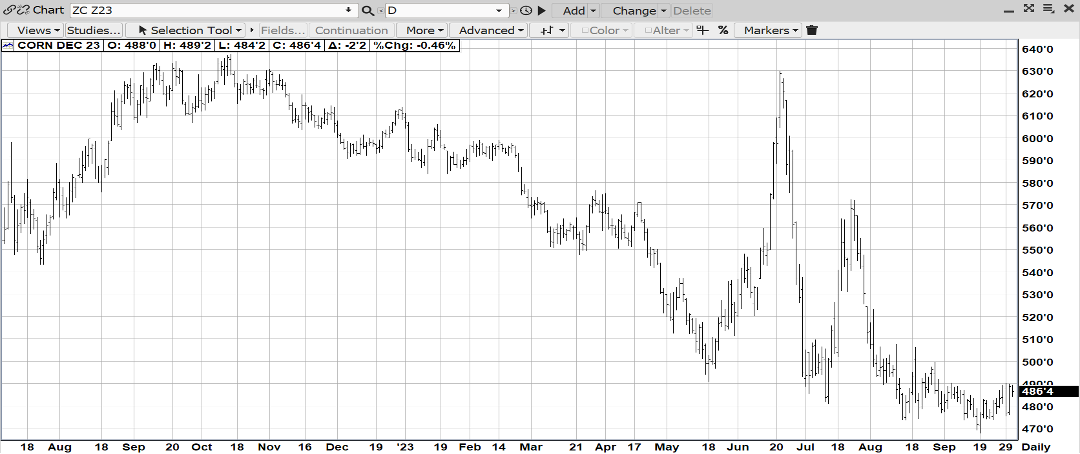

DEC CORN

(Click on image to enlarge)

The last 2 days, Dec Corn has shown bullish divergence against a host of negatives including harvest pressure, a strong dollar, a negative USDA Friday report & today a slumping bean mkt – indicating the mkt is saying ENOUGH IS ENOUGH! After congesting for 6 weeks in a tight range, Dec corn is hugging the top end with 75% of harvest ahead! Mexico has been a frequent buyer of our corn in the last 10 day – highlighted last Monday with a 1.6 MMT purchase! Domestic demand led by ethanol has been robust & the $1.50 drop in price since mid-Summer has made us competitive with South America! Yields are variable – the USDA is still estimating close to 174 b/a but our prediction is closer to 170 – based on early/late H & D!

NOV BEANS

(Click on image to enlarge)

Harvest pressure & the looming gov’t shutdown from last week have applied constant pressure to the bean complex despite frequent 8am flash sales & widespread reports of disappointing yields! The mkt is currently on a 60% correction! But the bullish anchor stabilizing beans is the 4 million acre reduction in 2023! That plus strong biodiesel demand & improving export demand will carve out a harvest low roughly 50% thru harvest! As well hot & dry conditions in Argentina & N Brazil – as they begin planting – could imply a smaller crop!

DEC WHT

(Click on image to enlarge)

How low can wheat go! Russia has brutalized the world wheat mkt with a continuing influx of cheap exports that has kept wht at bargain basement prices! But eventually “ low prices cure low prices”, & wht will finally carve out a season low – most probably aided by a post-harvest rally in Corn & beans! The technical action the last 3 days suggests a spike low has been established! The mkt plummeted 40 cents last Friday off a bearish Quarterly Stocks Report & a looming shutdown of the US Govt! But, there was no follow thru down as the mkt has nearly recovered all those losses! That mkt action plus corn’s hard rally yesterday speak well for lows being carved out!

OCT CAT

(Click on image to enlarge)

Traders have unsuccessfully been trying to pick a top in the “Raging Bull” that has been live cattle for a long time – and why not! How long will the consumer support record prices in the supermarket – with a shaky economy teetering on the edge of recession, being long past the peak demand grilling season & the relatively cheap alternative of much-lower priced pork! Low supply has been the upside driver but an economic downturn could seriously reduce demand – no matter the scant supplies! Today’s action has seen Oct Cat plummet to 4 week lows – is it a top or a correction? Consumer demand going forward will answer that question!

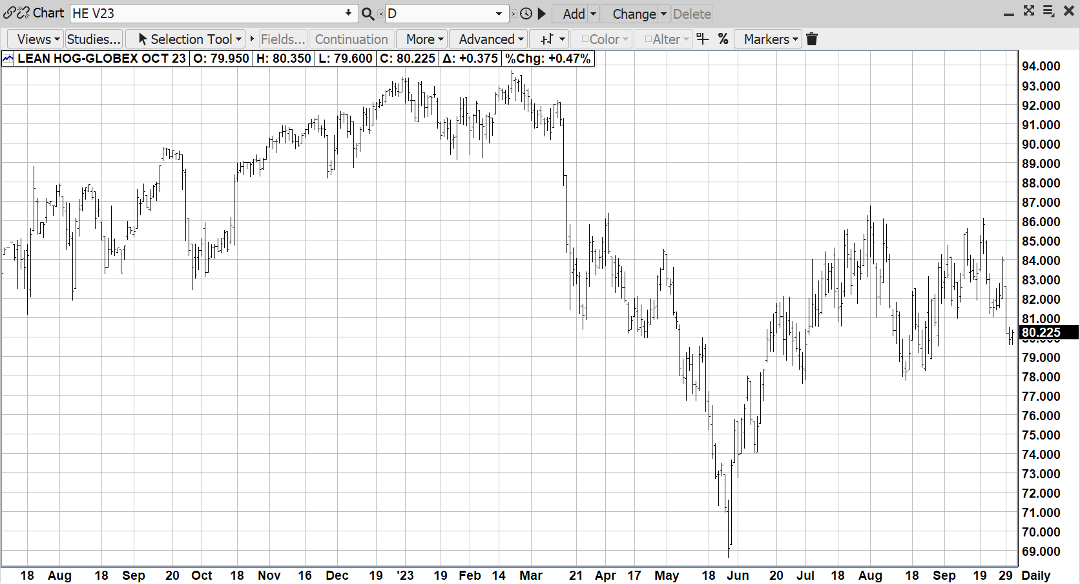

OCT HOGS

(Click on image to enlarge)

Oct Hogs have clearly lost ground in the past 2 weeks – burdened by implied heavy supplies form 2 recent USDA Reports – a Cold Storage Report & just last Thur a Quarterly Pig Crop Report that showed increases in nearly every weight category – plus a marked increase in pigs-per-litter – 7.4! And the demand for relatively inexpensive pork (compared to record high steaks) hasn’t been enough to offset the poundage increase! As a result, the mkt has slipped from the top end of it’s recent range (86-78) – closer to the bottom!

More By This Author:

AgMaster Report - Friday, Sep. 22

AgMaster Report - Wednesday, Sep. 6

AgMaster Report - Wednesday, Aug. 30