AgMaster Report - Tuesday, Oct. 24

DEC CORN

(Click on image to enlarge)

After congesting for over 2 months in 470-500 trading range, Dec Corn decisively breached the $5.00 level last Thur & Fri – but was unable to close above it! The charts have confirmed what the fundamentals have been telling us for a while – the HARVEST LOW ARE IN!Being ½ way thru harvest – with the farmer not selling – and exports starting to flow, South America behind in planting due to “hot & dry”, domestic demand very strong & the cash basis improving, it’s “all systems go”! However, in the past 2 days, geopolitical issues have intervened to stymie the rally – the Israel-Hamas War, the Russian-Ukraine conflict & the election of a new President in Argentina! The key to these seasonal lows is the price level – a full $1.50 off the summer highs – cheap enough to make us competitive with S/A!

NOV BEANS

(Click on image to enlarge)

Much like Dec Corn, Nov Beans, after a stirring 70-cent rally (1250-1320) since the Oct WASDE on Oct 12, ran into some headwinds late Thur & Fri in the form of both geopolitical & crop issues from both hemispheres! The two wars – Israel/Hamas & Russia/Ukraine & the Argentine Presidential election seemed to pressure the mkt today – along with general harvest progress in the US & some needed moisture in South America! On the “bull side”, 10am export inspections were 2.458 MMT (lw-2.039)! Alsosimilar to Dec Corn, Nov Beans are $1.50 off their summer highs – making them competitive on the global mkt & producers are opting to hold rather than sell! Also, the November WADSE is predicted to show another decrease in both production & yield! Finally, acreage is forecast to be down 3-4 million acres! Breaks should be supported!

DEC WHT

(Click on image to enlarge)

The much-maligned, bargain basement Wht mkt has finally scored seasonal lows – as of the Oct WADSE Report ON 10-12-23 which reflected bearish stocks but still resulted in a 10-cent higher close – classic “bullish divergence”! Many factors are at work here including a “cheap prices cure cheap prices” mentality, China’s purchase of our wht & drought issues in the upcoming Australian & Argentine Wht crops! Technically, since the report, Dec Wht has exhibited a pattern of higher highs & higher lows! Also, “spillover support” from post-harvest rallies in corn & beans will lend support!

DEC CAT

(Click on image to enlarge)

Wow! Carry positions into the gov’t reports at your own risk! After months of speculation & amazement at Dec Cat’s ability to hold at or near record levels – despite a faltering economy & much cheaper pork offerings, the mkt succumbed BIG-TIME to a “bearish surprise” of a October Cattle-On-Feed last Friday at 2 pm – which reflected higher #’s across the board – COF – 101 (99)PLACEMENTS – 106 (101) & MKT -89 (90.4)! Currently, Dec Cat is down $6.32 (limit – $6.75) – breaching a 3 ½ month low at $1.82!

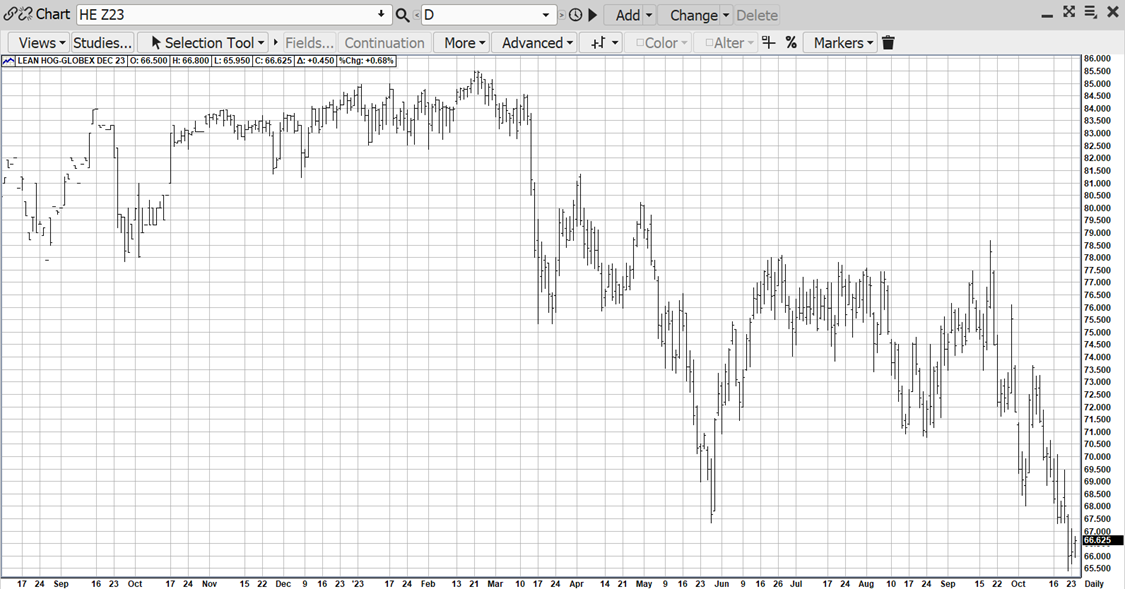

DEC HOGS

(Click on image to enlarge)

Sometimes, what a mkt doesn’t do under certain circumstances – says a lot more than what it does do! CASE IN POINT – Dec Hogs – holding steady or higher while Dec Cat plummeted after a bearish COF Report last Friday at 2pm! It speaks to the extreme discount to cash that Dec hog currently holds – $11 (avg-7) & its oversold condition after a $10 drop in just 3 months! Quite possibly, all the negative hog fundamentals (too much supply, lackluster demand & slack exports) have been fully dialed – & Dec Hogs are finally carving out seasonal lows! It certainly wouldn’t be a “shocker” after its $20 plummet from its Feb Highs!

More By This Author:

AgMaster Report - Tuesday, Oct. 3

AgMaster Report - Friday, Sep. 22

AgMaster Report - Wednesday, Sep. 6