AgMaster Report - Tuesday, Dec. 19

JAN BEANS

(Click on image to enlarge)

We’re officially amidst the HOLIDAY DOLDRUMS – the 2-week year-end period encompassing Christmas & New Years! Volume is down & volatility could be high & new fundamentals are scarce! The above chart highlights that fact as the Dec has so far given us a tight trading range (1290-1340) which will probably continue thru month-end! The main features offsetting each other – giving us this range – are the weather in N & S Brazil versus an active export mkt! Rain in Brazil depresses the mkt but frequent 8am flash sales rally it – resulting in a stalemate! Helping the Bulls has been a 500 point plummet in the US Dollar & a $6 rally in Crude oil! S/A weather issues should ultimately rally beans sharply!

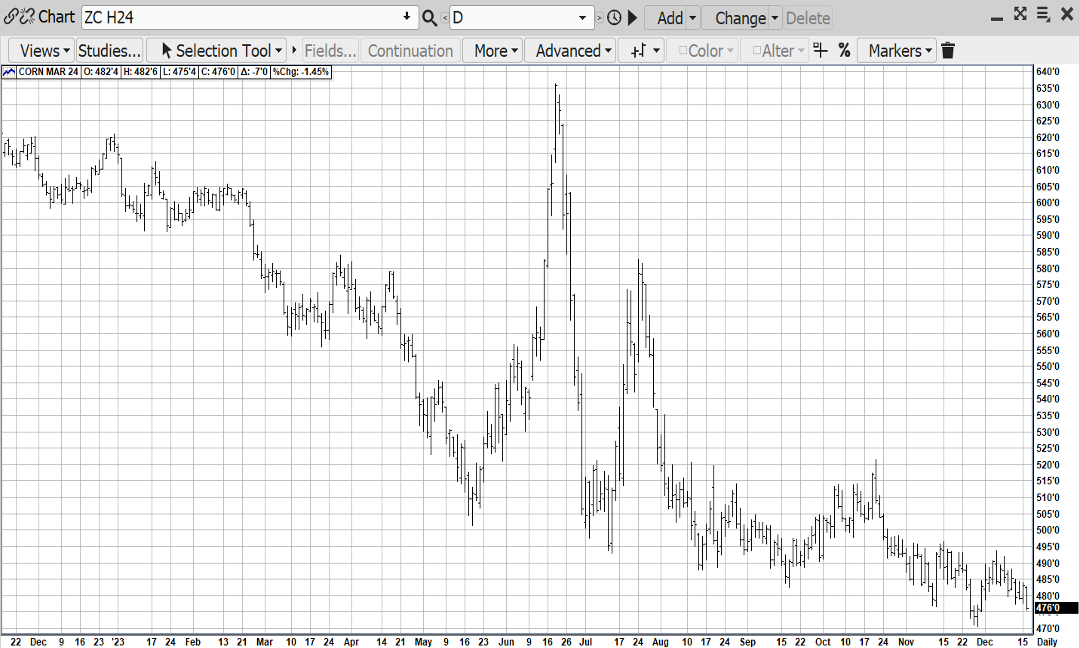

MAR CORN

(Click on image to enlarge)

For the past 5-months, Mar Corn has been confined to a 45 cent range (475-520) – with a substantial 15.1 BB harvest & ample supplies providing the headwinds & a falling US Dollar, a rallying crude & occasional exports have been the tailwinds! But with US Corn being the cheapest corn anywhere in the globe, very strong domestic demand & S/A weather issues, we feel the “arrows are pointing up” for corn – especially considering Mar Corn is a whopping $1.50 off its Summer highs! Indeed, we feel that low prices will eventually cure low prices!

MAR WHT

(Click on image to enlarge)

8 higher days in a row finally established a low in Mar Wht after a long, bearish slog in which a continuing inundation of Cheap Russian Wht into the Global mkt kept it “under wraps”for a long time! But finally, their supplies have dwindled & US Wht has become competitive on the world mkt – as evidenced a few wks back when China on 4 out of 5 days bought US Wht – announced by flash sales! The resulting 90 cent rally (560-650) finally stalled out as a reduction of Russian Export Duties, a recovery in the dollar, a resumption of Australian harvesting & rain in the US Southern Plains forced the mkt to correct! However, the trend is now up & as the mkt awaits more Chinese imports!

FEB CAT

(Click on image to enlarge)

It looks like “enough is enough” as a $33 break in Feb Cat (196-163) & an 80% reduction in the net long (119,000 to 22,000) were together enough to establish a low in Feb Cat on 12-7-23 at 162.50! At this extreme oversold point, exports started to come, shorts covered & bargain-hunters dived in! And with Friday offering 3 major meat reports at 2 pm – Cattle-on-Feed, Pig Crop & Cold Storage, more short-covering is likely! As well, 2024 production in the 1st three quarters is predicted to be 5-8% under this year! Finally, beef demand should hold up well into the Dec Holiday period!

FEB HOGS

(Click on image to enlarge)

After testing the contract lows last week, Feb Hogs rallied resoundingly $6 (66.50-72.50) – with such velocity that we feel that those lows are now established as seasonal lows!The mass China liquidation has waned & last week’s export sales were the highest since Nov 2! Much like Feb Cat, the lows seem to be in – with good enough demand thru year-end to support the mkt. As well, with the 3 major livestock reports due on Friday, the remaining shorts are getting out!

More By This Author:

AgMaster Report - Thursday, Dec. 14

AgMaster Report - Tuesday, Dec. 5

AgMaster Report - Thursday, Nov. 30