A Solid Gold Stock That Will Benefit As Precious Metals Keep Climbing

Everything I see points towards higher prices, and higher inflation will likely bring more deeply negative real yields. THAT is a situation that is very bullish for gold, and one of my favorite mining stocks, Alamos Gold Inc. (AGI), writes Omar Ayales, editor of Gold Charts R US.

Strong labor and employment data out of the U.S. continues to support a strong consumer in a consumer-based economy. Remember that consumption expenditures by households in the U.S. accounts for two thirds of the U.S. gross domestic product (GDP).

This means most of the U.S. economy operates mainly on the trade of goods and services. A stronger for longer U.S. consumer will likely keep pressure on supply chains globally, putting upside pressure on prices across the board.

That is one of the strong elements fueling the inflation for longer narrative. There are other elements fueling the narrative too. They include the re-opening of China after being shut off from the world for nearly three years, the process of de-globalization and global fragmentation, and stiffer competition for resources and energy globally, among others.

That means the rate of inflation will likely continue to outperform the rate of interest, which translates into erosion of purchase capacity. This is bullish for gold because all of a sudden, sovereign Treasuries, like U.S. Treasury bonds, that compete with gold as a store of value lose one of their most valuable advantages: yield. Once the real yield goes negative, capital is punished and will tend to flee fixed income assets and go to assets that fluctuate closer to the rate of inflation, such as gold.

Gold recently broke above the $2,000 level, confirming the start of a bullish cycle called a ‘C’ rise. That rise could see gold break to new all-time (nominal) highs over the next several months. We bought early thanks to our indicators and are enjoying the up move now.

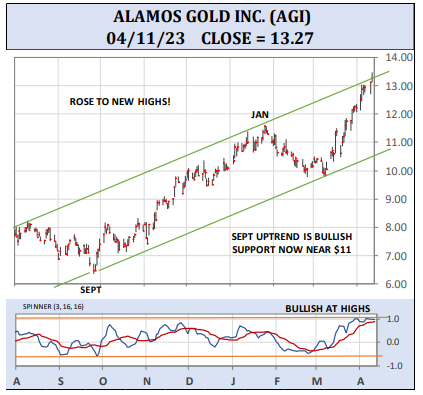

As for AGI, it rose to the top side of the September up channel above $13 showing impressive strength. AGI will remain uptrending as long as it holds above the uptrend.

Keep in mind the leading indicator below is at a high level, showing AGI is overbought short term and it could now pull back, possibly to the September uptrend near $11. I’m keeping my positions, not selling. I’ll buy more on a dip below $12.

(Click on image to enlarge)

Recommended Action: Buy AGI on a dip below $12.

More By This Author:

Cleveland-Cliffs: A Steel Producer To Target In This Resilient MarketFAN: Profit As Wind Power Makes Great Strides In The Renewables Space

Gold: The $2,000 Level Is Acting Like A Magnet

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.