FAN: Profit As Wind Power Makes Great Strides In The Renewables Space

Image Source: Unsplash

People ask me all the time if internal combustion engines are going away. I don't think so, and Warren Buffett doesn't either — at least not any time soon. But as the energy industry increasingly focuses on renewables, the First Trust Global Wind Energy ETF (FAN) looks more and more attractive, advises Tony Sagami, editor of Weiss Ratings Daily.

Warren Buffett's Berkshire Hathaway (BRK-A) recently purchased 3.7 million shares of Occidental Petroleum (OXY) for $216 million. That's not his first purchase of OXY stock, either. Berkshire Hathaway owns 211.7 million shares, worth about $12.6 billion, and OXY is its seventh largest holding.

I'm only half as smart — maybe less — as Buffett, but he clearly believes the fossil fuel business has a bright, prosperous future. Yet that does not mean you should load up on fossil fuel stocks. In fact, I think there is even more opportunity in renewable energy stocks.

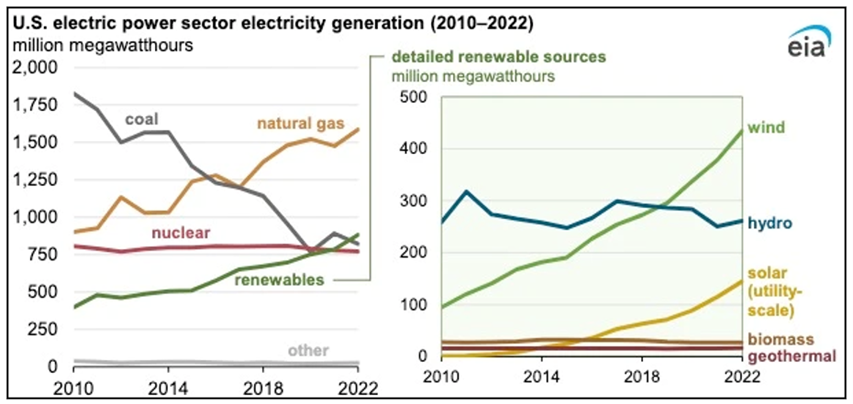

According to the U.S. Energy Information Administration, the amount of renewable power generation — wind, solar, hydro, biomass, and geothermal — exceeded nuclear and coal-fired generation in 2022 for the first time ever.

U.S. power stations produced 4,090 million megawatt-hours of power in 2022. Of that, natural gas is the largest source of electricity generation in the U.S. and has grown from 37% in 2021 to 39% in 2022.

The renewable growth came from wind and solar, which increased from 12% in 2021 to 14% in 2022. Between solar and wind, however, the most growth is in wind. According to the EIA, solar capacity increased from 61 gigawatts in 2021 to 71 GW in 2022, while wind capacity grew from 133 GW in 2021 to 141 GW in 2022.

The EIA forecasts that both wind and solar will grow by 1% in 2023. But as the chart above shows, wind is beating solar by a wide margin. And if you want to add wind power to your portfolio, take a look at FAN or a similar ETF, the Global X Wind Energy ETF (WNDY).

My recommended action would be to consider buying FAN.

About the Author

Tony Sagami is the editor of Weiss Ratings LLC's Weiss Ultimate Portfolio and is one of the early pioneers in the application of technical and quantitative analysis to mutual funds and stocks. At the heart of his investment system are two obscure but effective mathematical models developed by two Nobel prize-winning University of Chicago mathematicians that help deliver consistent results with a very low risk.

Mr. Sagami is best known for his "Sell Tech Stocks Now!" call in October of 2000.

More By This Author:

Gold: The $2,000 Level Is Acting Like A MagnetARE: A Life Sciences REIT Worth Buying Amid Market Flight

Investing Ideas Can Come From Anywhere - Consider My Lions Gate Story

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.