A Rebound In Lumber Prices?

Reader JohnH points us to an article entitled “Lumber prices have fallen, but the stage is set for a potential 65% rally through the end of the year, an expert says”. What do markets say about this?

Photo by Nicola Pavan on Unsplash

(Click on image to enlarge)

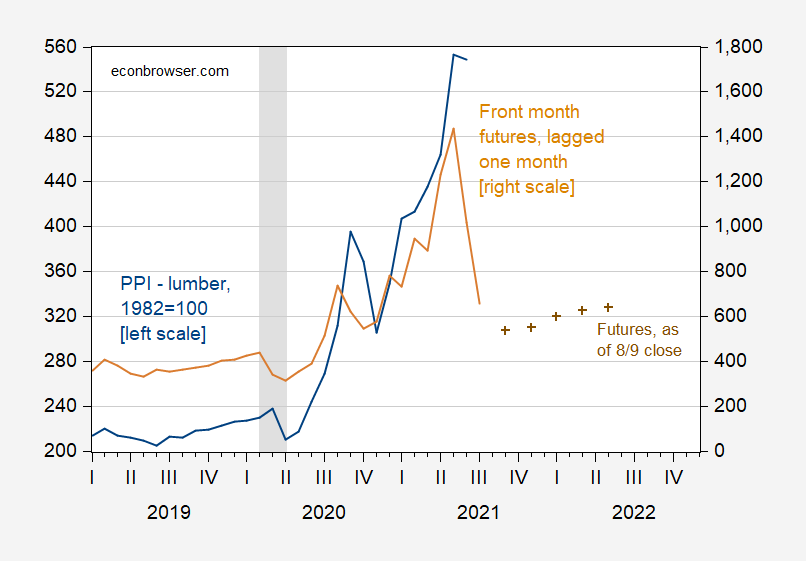

Figure 1: PPI for lumber and softwood (blue, left scale), and front-month futures, lagged one month (brown, right scale), futures as of 8/9/2021 close (dark brown +). NBER recession dates are shaded gray. Source: BLS via FRED, macrotrends.com, ino.com, NBER and author’s calculations.

The futures prices are rising gradually (but they usually are, i.e., commodity futures are usually in contango due to storage costs).

Now, it would be wrong to interpret the futures as one-for-one predictors. A one percentage point basis — futures price change relative to current spot price — is associated with about a 0.55 percentage point change in actual lumber price for futures maturing 2 months hence, as reported by Mehrotra and Carter (2017). The coefficient goes up to 0.67, 0.71, and 0.77 as horizons go from 4 to 8 months.

If indeed the possibility of passage of the infrastructure bill was going to spark the rally as speculated on in the article, then I would’ve expected the futures contracts for say January 2022 to rise last week as the likelihood of passage rose markedly (at least according to PredictIt). They didn’t.

So, the market doesn’t seem to be betting on a 65% rally. But of course, anything can happen, and nothing guarantees the markets will be right. After all, they probably missed the recent spike. (And futures are often very wrong, consistently so for gold and silver for instance). Still, count me skeptical for the 65% rebound.

(July PPI data come out on August 12.)

Disclosure: None.