Chainlink /U.S. Dollar Crypto Price News Today

LINKUSD Daily Chart – Elliott Wave Count

Elliott Wave Analysis | TradingLounge

- FUNCTION: Trend

- MODE: Motive

- STRUCTURE: Impulse

- POSITION: Wave (3) of ((1))

- DIRECTION: Uptrend continuation

Details:

- Wave I concluded at 17.965 USD

- Wave II completed at 10.87 USD

- The market is now in wave (3) of III

- Wave (3) has a 1.618 Fibonacci extension target of 18.94 USD

- The next significant resistance lies at 20.00–22.00 USD

Trading Strategies

- For Swing Traders:

-

- If the price remains within the upward channel and stays above 13.50 USD, the uptrend remains valid.

- A strong wave (3) may propel the price beyond the 2000 Fib Extension level.

- Invalid Scenario (W.C. Invalid):

-

- If price drops below 13.50 USD, this impulse wave count becomes invalid.

- If price drops below 13.50 USD, this impulse wave count becomes invalid.

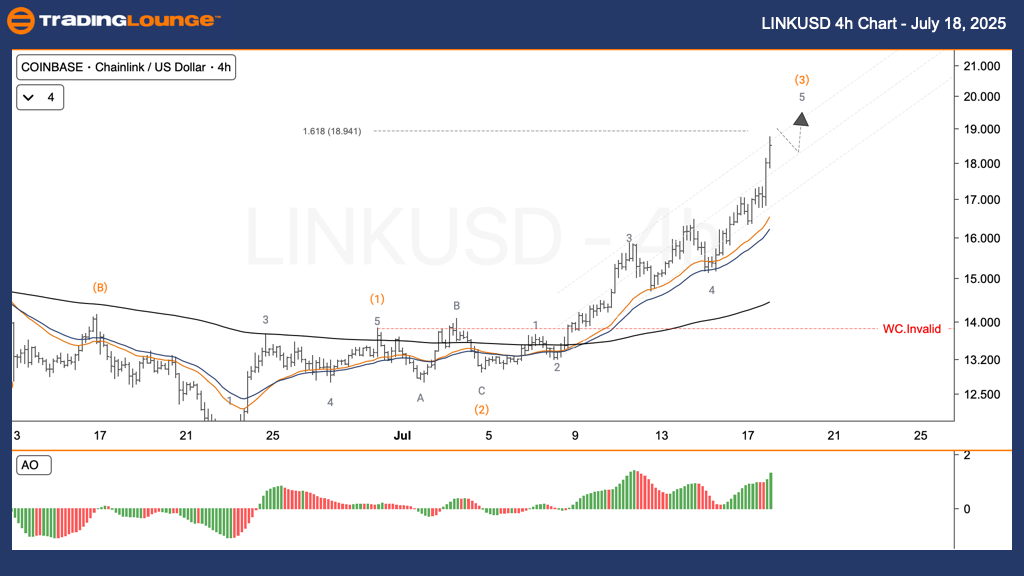

LINKUSD 4H Chart – Elliott Wave Count

Elliott Wave Analysis | TradingLounge

- FUNCTION: Trend

- MODE: Motive

- STRUCTURE: Impulse

- POSITION: Wave (3) of ((1))

- DIRECTION: Uptrend continuation

Details:

- Wave I finished at 17.965 USD

- Wave II ended at 10.87 USD

- The market is currently developing wave (3) of III

- 1.618 Fibonacci extension target for wave (3): 18.94 USD

- Psychological resistance area: 20.00–22.00 USD

Trading Strategies

- For Swing Traders:

-

- As long as price remains above the invalidation level of 13.50 USD, the uptrend remains in place.

- A strong wave (3) move can push prices towards the 2000 Fib extension zone.

- Invalid Scenario (W.C. Invalid):

-

- A price move below 13.50 USD would invalidate the current impulse wave structure.

Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Unlocking ASX Trading Success: Amcor

U.S. Stocks - Micron Technology Inc

Elliott Wave Technical Analysis: British Pound/U.S. Dollar - Thursday, July 17

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!