U.S. Stocks - Micron Technology Inc

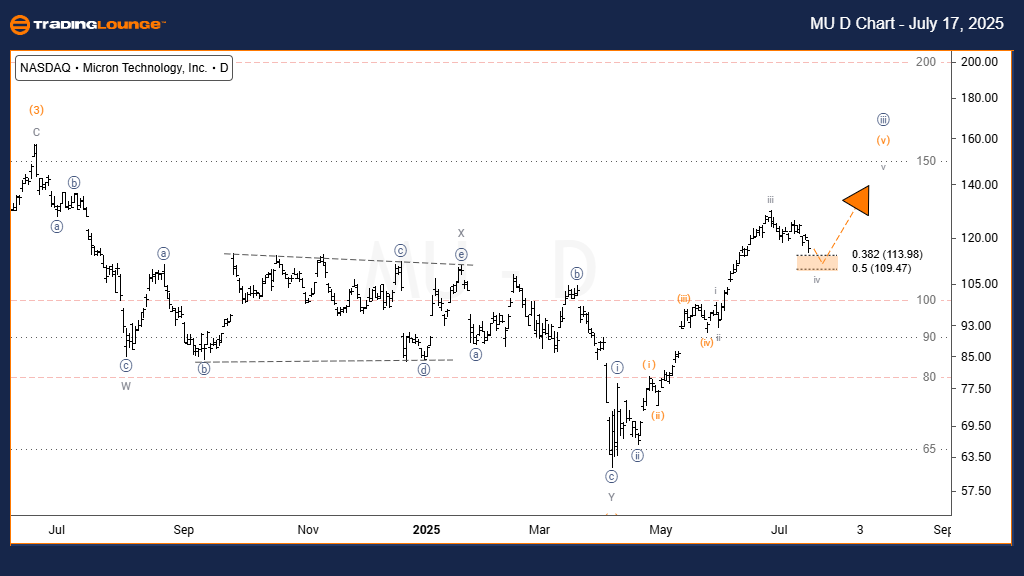

Micron Technology Inc (MU) – Elliott Wave Analysis (Daily Chart)

Technical Analysis Overview – Trading Lounge

Function: Trend

Mode: Motive

Structure: Impulsive

Position: Wave (v) of {v}

Direction: Uptrend

Details: Price expected to move toward wave (v) once wave iv finishes

On the daily chart, Micron Technology Inc (MU) continues to move within a clear impulsive structure. The stock has completed wave iii of (v) and is currently retracing through wave iv. This correction is projected to reach the 38.2%–50% Fibonacci retracement zone of wave iii.

Once wave iv concludes, the analysis anticipates a strong rally in wave v of (v), marking the end of the broader wave (v) of {iii} cycle. Traders should monitor the retracement levels closely for potential bullish setups as the stock prepares for the final upward leg of this impulse.

Micron Technology Inc (MU) – Elliott Wave Analysis (Weekly Chart)

Technical Analysis Overview – Trading Lounge

Function: Trend

Mode: Motive

Structure: Impulsive

Position: Wave (5) of {5}

Direction: Uptrend

Details: Price is in wave (5) of {5}, targeting the upper boundary of the parallel channel

On the weekly chart, Micron Technology Inc (MU) is moving inside a strong uptrend and confined within a well-defined parallel channel. After completing wave {4} as a double zigzag correction, the stock entered wave {5}, which is unfolding as an impulsive sequence.

Wave (5) is currently developing and expected to rise toward the channel's upper resistance, a probable target for the final move. Any interim pullbacks are likely to present favorable entry opportunities before the wave structure reaches exhaustion. The chart supports continued bullish action as long as the wave progression holds.

Technical Analyst: Dhiren Pahuja

More By This Author:

Unlocking ASX Trading Success: Amcor

Elliott Wave Technical Analysis: British Pound/U.S. Dollar - Thursday, July 17

Bitcoin Crypto Price News Today - Thursday, July 17

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more