Business Cycle Indicators As Of Mid-October 2022

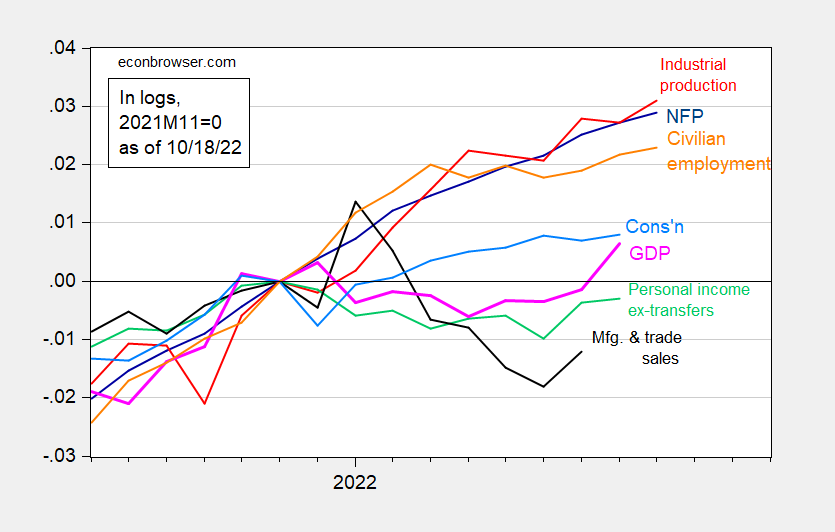

Industrial and manufacturing production both at 0.4% m/m growth, above consensus (0.1% and 0.2%, respectively) in September, showing resumed growth. This is the picture of key macro indicators followed by the NBER Business Cycle Dating Committee, plus IHS-Markit monthly GDP.

Figure 1: Nonfarm payroll employment, NFP (dark blue), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2021M11=0. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (10/4/2022 release), and author’s calculations.

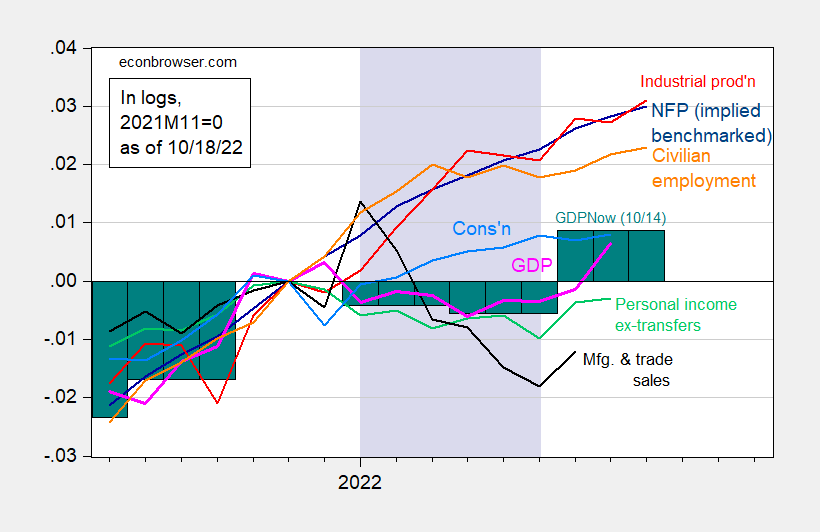

GDP as reported in the annual benchmark revision reported at end-2022 (which revised the series up through 2022Q1) shows two quarters of decline. However, as noted elsewhere, this is not the official definition of a recession in the United States; rather that determination is made by the NBER’s Business Cycle Dating Committee, based upon a wide variety of indicators, and only secondarily on (oft-revised) GDP. Here is the corresponding picture, showing official GDP (through Q2), and the implied level of GDP from the Atlanta Fed’s GDPNow nowcast (10/14/2022).

Figure 2: Nonfarm payroll employment as implied by annual benchmark revisions (dark blue), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), official GDP through Q2, and GDPNow for Q3 (teal bars), all log normalized to 2021M11=0. Lilac shading denotes dates associated with a hypothetical recession in H1. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (10/4/2022 release), GDPNow (10/14/22 release), and author’s calculations.

Note the continued growth in the labor series even during the slowdown in official GDP during H1, which some observers have tagged as a recessionary period. Consumption and industrial production also increased (by about 1% and 2% respectively) over this period. Hence, I remain skeptical of the comments that we were in a recession in 2022H1.

Of course, this is a backward looking assessment. A high frequency assessment is here (albeit looking at y/y growth to last week). Looking forward, lots of economists see a recession.

More By This Author:

Weekly Macroeconomic Activity Thru October 8

Weekly Macro Indicators Through October 1

The Employment Report And Business Cycle Indicators