Business Cycle Implications From The ADP Release

Image Source: Pixabay

My nowcast of BLS private nonfarm payroll employment was for a decreaes of 78K, but with a very wide prediction interval. This is an aggregate number; however, we can infer certain trends from the disaggregate (by firm size) numbers from ADP.

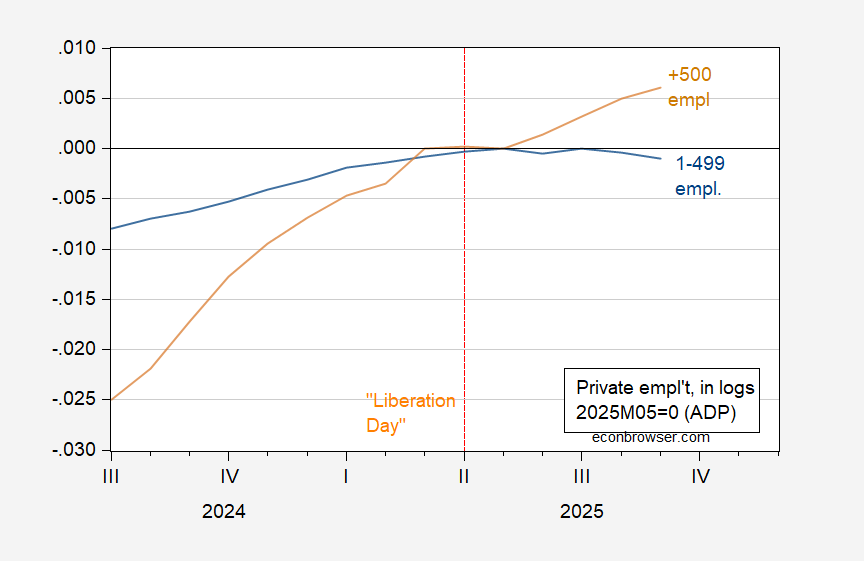

The financial accelerator approach (e.g., BBG, 1996) implies that smaller firms (with less collateral) will evidence a slowdown sooner than larger firms. Using the 500 employee cutoff, can we see the differential trends in the data?

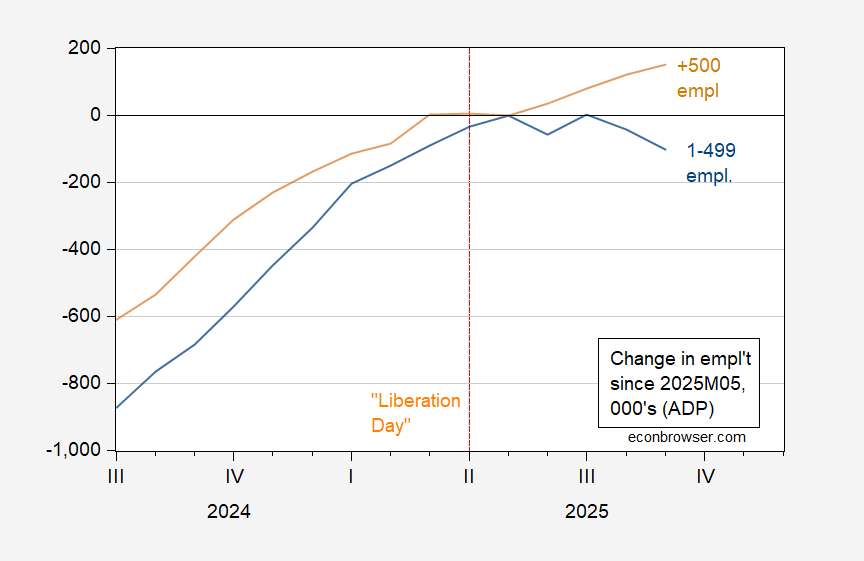

Figure 1: Change in employment from May 2025 in firms with less than 500 employees (blue), in firms with 500 and more employees (tan), both in 000’s, s.a. Source: ADP via FRED, and author’s calculations.

Figure 2: Employment in firms with less than 500 employees (blue), in firms with 500 and more employees (tan), in logs 2025M05=0. Source: ADP via FRED, and author’s calculations.

Private employment in firms with 1-499 employees constitutes about 80% of employment.

Seen either way, employment growth has essentially disappeared for “small” firms.

More By This Author:

FT-Booth GDP Forecast For 2025: 1.6%

Nowcasting Private NFP For September

September Private Nonfarm Payroll Employment According To ADP