Yields Slide After Stellar 20Y Treasury Auction

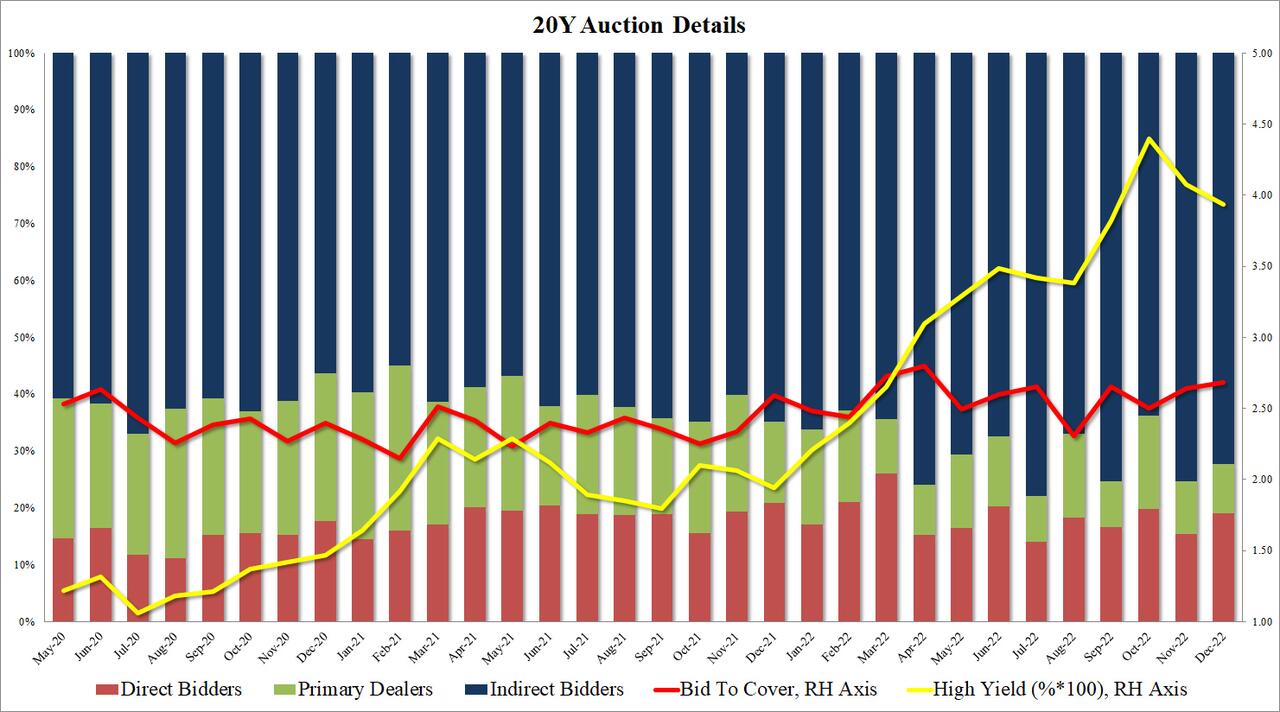

After several disappointing coupon auctions to start the month of December many of which tailed and pushed yields wider, moments ago the Treasury placed the final 20Y auction for 2022 when it sold $12 billion in 19-year 11-month (Cusip TM0) reopening. The auction was a blowout: the high yield of 3.935% was the first auction to price below 4.00% since September, it was well below November's 4.101% and also stopped through the 3.948% When Issued by 1.3bps, which while less than half of last month's 2.9bps stop through was still the 10th stop through in the past 13 auctions.

The Bid to Cover of 2.68 was not only above last month's 2.64 and above the 6-auction average 2.56 but was also the 3rd highest on record.

The internals were also impressive, with Indirects, i.e., foreign buyers awarded 72.3% of the auction and with Directs taking down 19.0%, Dealers were left holding on to 8.7%, tied for the 3rd lowest on record.

(Click on image to enlarge)

Overall this was a stellar auction, and the market agreed with yields dropping across the curve and certainly at the 10Y point, where they dropped from just shy of 3.70% ahead of the auction to down on the day.

(Click on image to enlarge)

More By This Author:

WTI Extends Gains After Bigger Than Expected Crude Draw; SPR Hits 1983 Lows.

FedEx Misses On Revenue; Cuts Another Billion In Costs; Trims Outlook On "Continued Demand Weakness"

Kuroda-Nado Not Enough To Derail US Treasury Rally, BOJ Shift Sparks Japanese Banking Bonanza

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more