WTI Extends Gains After Bigger Than Expected Crude Draw; SPR Hits 1983 Lows.

Oil prices are higher for a third straight day ahead of this morning's official inventory data (following API's reported crude draw). Trading volumes remain dismally low.

API

- Crude -3.069mm (-167k exp)

- Cushing +840k

- Gasoline +4.510mm

- Distillates +830k

DOE

- Crude -5.895mm (-2.1mm exp)

- Cushing +853k

- Gasoline +2.53mm

- Distillates -242k

After last week's huge crude build, analysts expected a small draw this week (confirmed by API) but the official data showed a considerable crude drawdown of 5.895mm barrels. Inventories at Cushing rose 853k (2nd straight week) while Gasoline stocks rose for the 6th week in a row (distillates inventories drew down a small 242k barrels)

Source: Bloomberg

While the increase in refined-product stockpiles has muted fears of shortages on the East Coast this winter, it was mainly due to a decline in consumption, possibly a sign of slowing economic activity, which may ultimately pressure crack spreads further. Exports have been a critical component in lessening the pace of inventory additions, but as Bloomberg notes, may drop if a recession hits Latin America.

The SPR saw a 3.647mm barrel drain last week (so total Crude inventory draw was 9.5mm barrels), which pushed the SPR down to its lowest level since Dec 1983...

Source: Bloomberg

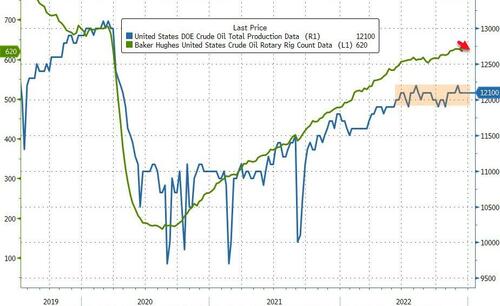

US Crude production was steady last week while rig counts begin to decline...

Source: Bloomberg

WTI hovered around $77.75 ahead of the official print this morning and extended gains after the crude draw...

"After an extended bout of long liquidation, and with positioning much more balanced, bullish sentiment is creeping back into oil traders' purview, primarily based on China's reversal of its zero-COVID policy," said Stephen Innes, managing director of SPI Asset Management, in emailed comments.

"And despite all the economic fear and recession hype, oil continues to find buyers on dips, proving itself as one of the most needful commodities in the world."

Crude is also finding underlying support from the Biden administration's plan, announced Friday, to buy 3 million barrels of crude in February to replenish the Strategic Petroleum Reserve.

More By This Author:

FedEx Misses On Revenue; Cuts Another Billion In Costs; Trims Outlook On "Continued Demand Weakness"

Kuroda-Nado Not Enough To Derail US Treasury Rally, BOJ Shift Sparks Japanese Banking Bonanza

These Are The World's Most Expensive Cities

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more