“When Rates Fall, Castles Rise” Stock Market (And Sentiment Results)…

Key Market Outlook(s) and Pick(s)

On Friday, I joined Stuart Varney on Fox Business “Varney & Co” to discuss markets, outlook, earnings, and more. Thanks to Stuart, Peyton Jennings, and Christian Dagger for having me on:

On Wednesday, I joined Stuart Varney on Fox Business “Varney & Co” to discuss markets, outlook, earnings, the Mag 7, Netflix, and more. Thanks to Stuart, Peyton Jennings, and Christian Dagger for having me on:

Crown Castle Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

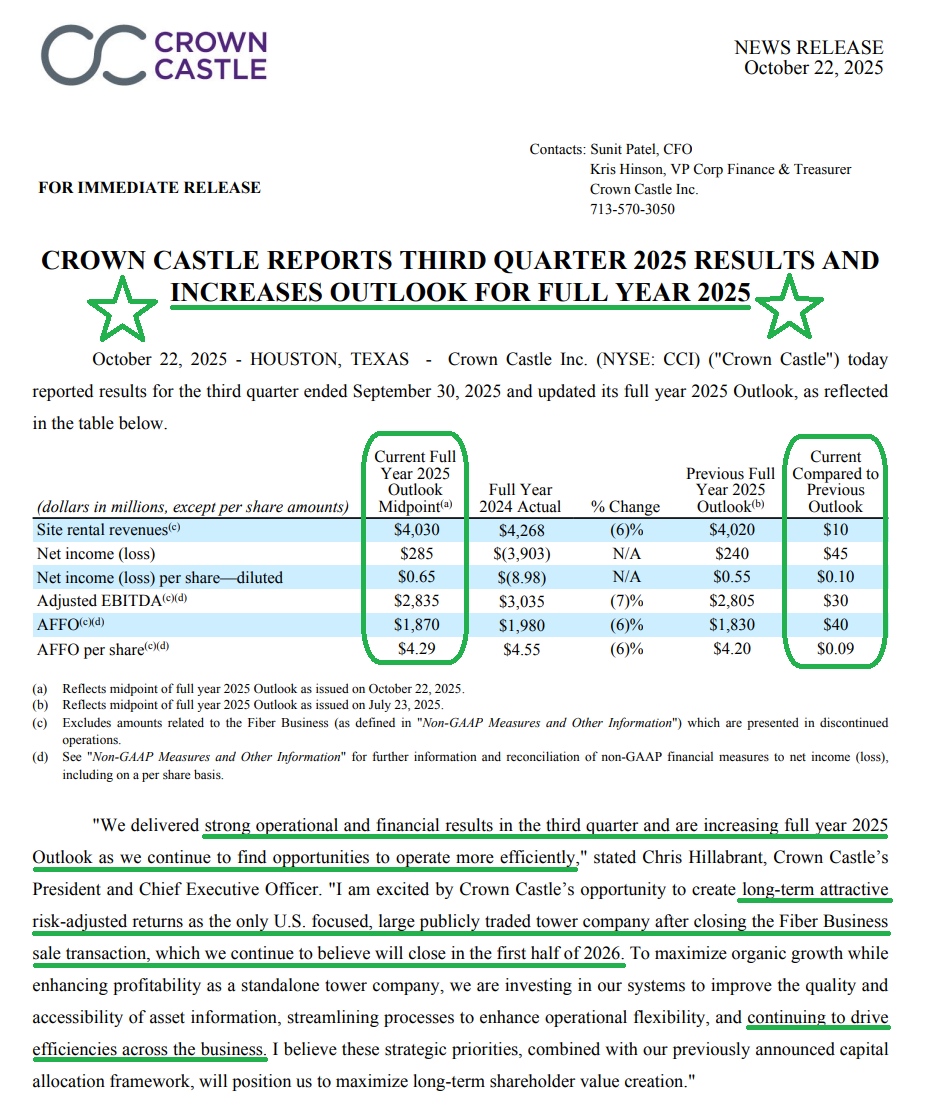

Crown Castle kicked off our Q3 earnings season on the right foot, delivering another solid quarter and raising full-year guidance as the recovery story takes hold.

Like all REITs, the name of the game with Crown Castle is interest rates. When the 10-year yield moves lower, REITs tend to catch a bid, and CCI is no exception. While the chart below is slightly dated, it does a good job painting the picture of this relationship:

That’s because when bonds rise (yields fall), companies like CCI get a twofer of cheaper financing and stronger demand for yield.

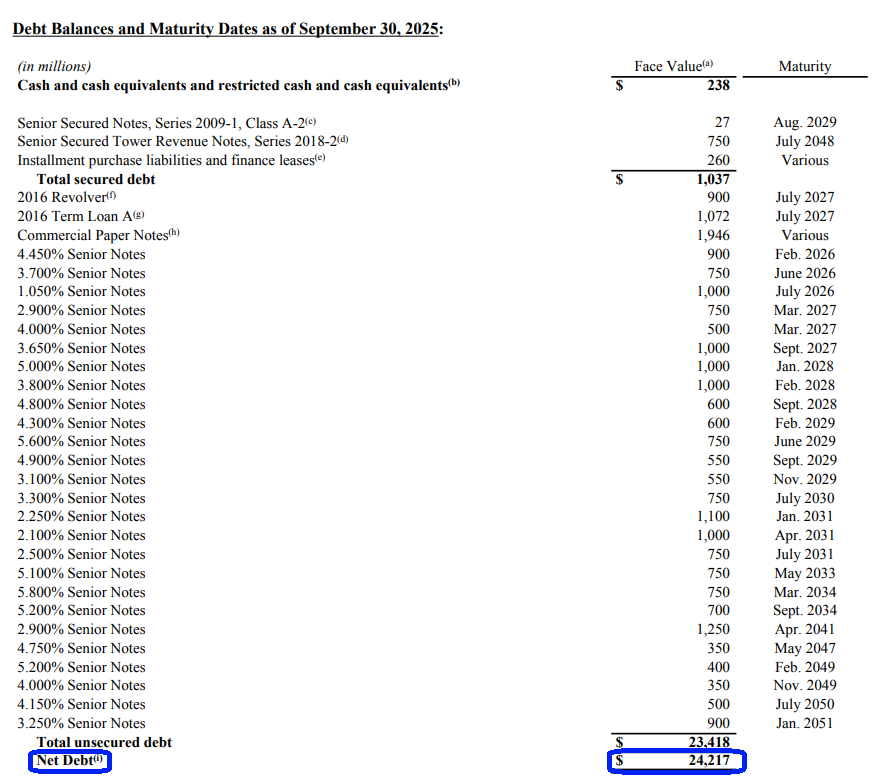

It’s no secret that REITs tend to carry a lot of debt on the balance sheet, relying on borrowing to finance acquisitions and development. In the case of CCI, this leverage is to the tune of ~$24 billion in net debt (86% fixed rate) and results in annual interest expense of just under $1 billion. Lower rates open the door to refinancing at more favorable terms, reducing the interest burden while also serving as a shot in the arm for highly levered carriers to boost capex, resulting in better client activity and a win-win for CCI.

Meanwhile, close to $7.5 trillion remains parked on the sidelines collecting 4% yields, risk-free, a key reason dividend yield has been neglected. But as we say, money eventually finds its way to where it’s treated best. As rates come down and investors are forced to search for yield elsewhere, they’ll be tripping over themselves to get exposure to high-quality names like CCI, with a 4.31% dividend and room for MATERIAL price appreciation from here.

Of course, this dynamic is a double-edged sword for REITs, and we’ve seen the flip side of this playbook over the past few years. When rates move higher, borrowing costs rise and fixed income becomes more attractive, leaving REITs on the short end of the stick.

The GOOD NEWS is that this dislocation gave us the opportunity to buy what we would consider a “straw hat in the winter,” picking up a high-quality leader like CCI after it had been cut in half right before what appears to be the early innings of a Fed easing cycle.

With the 10-year yield back to having a 3-handle, investors are slowly beginning to wake up to the opportunity. We’ve been making the case for a lower 10-year for some time and still see a path lower from here. Whether it’s the removal of the Supplementary Leverage Ratio (SLR), the Genius Act and stablecoins potentially creating $2 trillion in Treasury demand, or reduced issuance on stronger tax receipts, there are multiple arrows in the quiver supporting that view.

Here’s a link to our prior article where we made this case in detail:

In the meantime, while waiting for this dynamic to play out, CCI has done shareholders a favor by removing two of the big overhangs that had been weighing on the stock: announcing a new CEO and the sale of its Fiber business.

Leadership at CCI had been a revolving door with three CEOs since 2024. The appointment of new President and CEO Chris Hillabrant in August removes a layer of uncertainty and is welcome news for shareholders. With more than three decades of experience in the global tower industry, Hillabrant is a proven winner and exactly what CCI needed.

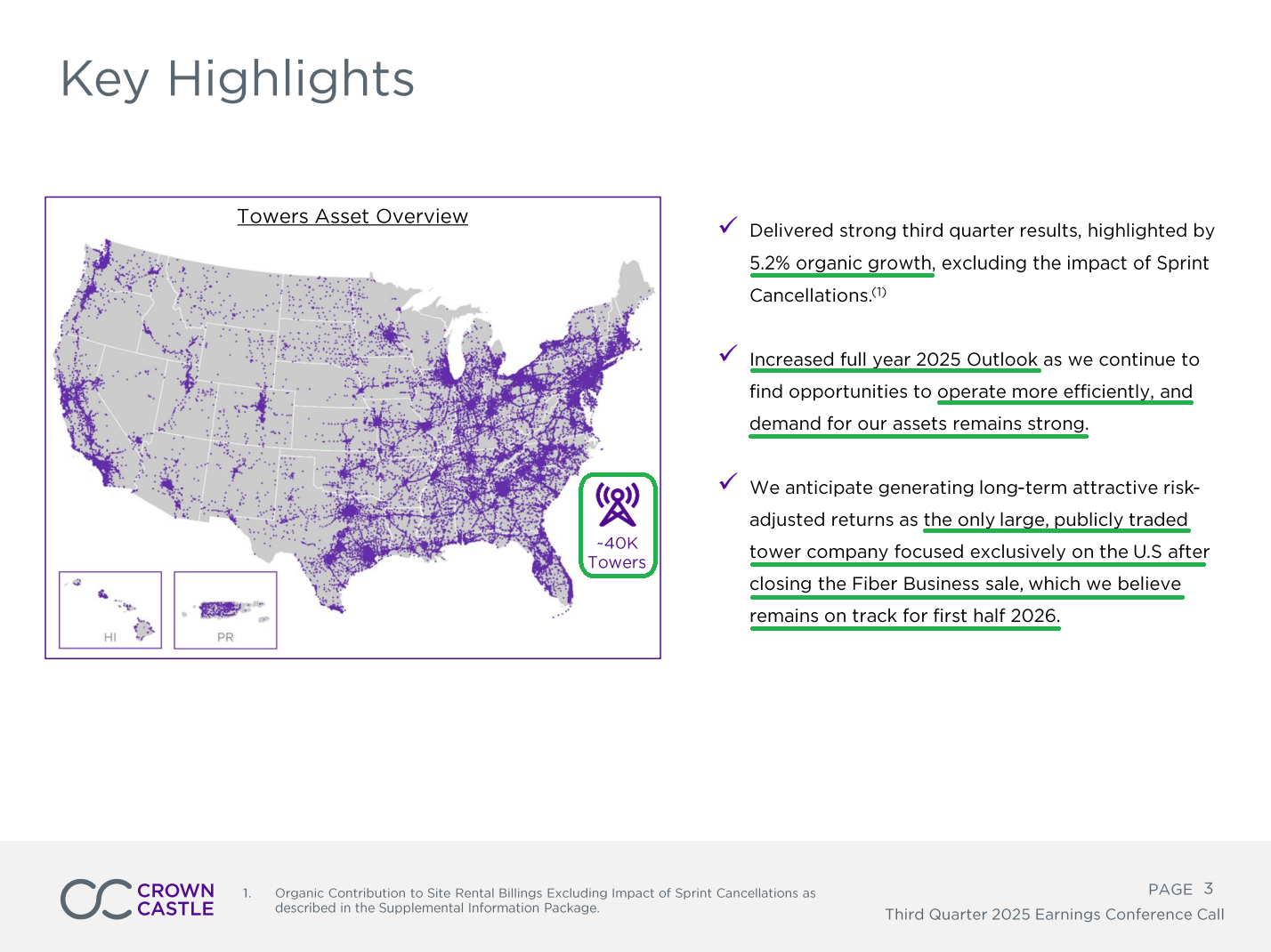

On top of that, CCI agreed to sell the long-struggling Fiber segment for $8.5 billion. The capital-intensive segment had been a major drag on results for over a decade, consistently accounting for ~90% of total capex while generating less than one-fourth of operating profit, a good formula for destroying shareholder value.

The transaction remains on track to close in the first half of 2026, leaving CCI as a higher-margin, leaner business and the only publicly traded pure-play U.S. tower company. Management plans to use ~$6 billion of the proceeds to pay down debt and allocate the rest to what they should have been doing all along: share repurchases.

So with rates coming down and the two big overhangs now removed, Crown Castle’s recovery is well underway. From here, it comes down to how well Chris Hillabrant executes. If history is any guide, we can expect great things. In the meantime, we’re happy to collect the dividend and watch the story play out.

Q3 Earnings Breakdown

10 Key Points

1) The $8.5 billion sale of the small cell and fiber solutions business remains management’s top priority and is on track to close in the first half of 2026, positioning CCI as the only publicly traded pure-play tower company focused exclusively on the US market.

2) Organic revenue growth excluding the Sprint churn totaled 5.2% for the quarter, well ahead of the 4.7% full-year guidance. Management continues to expect the Sprint cancellation churn, which represented a $51 million headwind during the quarter, to lapse by the end of 2025.

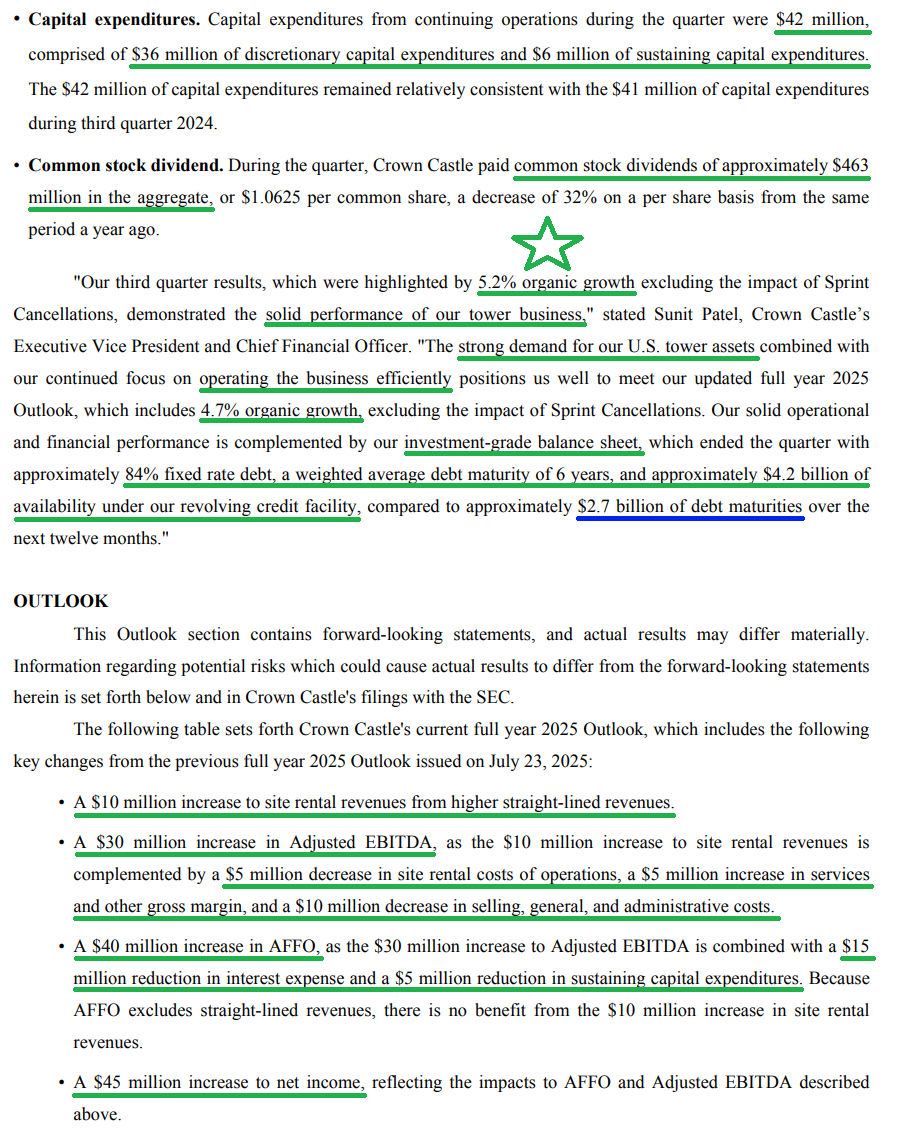

3) Management believes the tower business is “entering a period of significant opportunity,” supported by sustained mobile data growth and rising customer demand. In 2024, mobile data usage increased by more than 30% for the third consecutive year, which remains the best long-term indicator of demand for tower assets as continued investment is needed to support higher levels of mobile data traffic.

4) Capital expenditures totaled just $42 million for the quarter, including $36 million in discretionary and $6 million in maintenance capex. Management also lowered full-year discretionary capex guidance to $155 million, down $30 million from the prior outlook. This is a welcome change in strategy from the $1.1 billion spent on discretionary capex in 2024, which was largely tied to the capital intensive, loss generating Fiber business.

5) Capital allocation priorities following the Fiber sale remain unchanged. Reducing $6 billion of debt is the top priority. Any remaining cash flow will be directed toward share repurchases. After the sale, management expects to grow the dividend in line with AFFO while maintaining a payout ratio between 75% and 80%.

6) Following the sale of the fiber business, management continues to anticipate significant operational efficiencies, simplifying the company from three operating segments down to one focused business. Some of these benefits are already being realized, with $15 million of the $40 million increase to full-year AFFO guidance driven by lower expenses.

7) Management also highlighted that spectrum acquisitions often create meaningful growth opportunities for tower operators. Over the past year, each major mobile network operator has acquired additional spectrum, despite collectively securing 700 megahertz less than five years ago — the same amount obtained in the prior 40 years combined. Looking ahead, the FCC plans to auction at least another 800 megahertz of spectrum beginning in 2027, which will be a material tailwind for CCI.

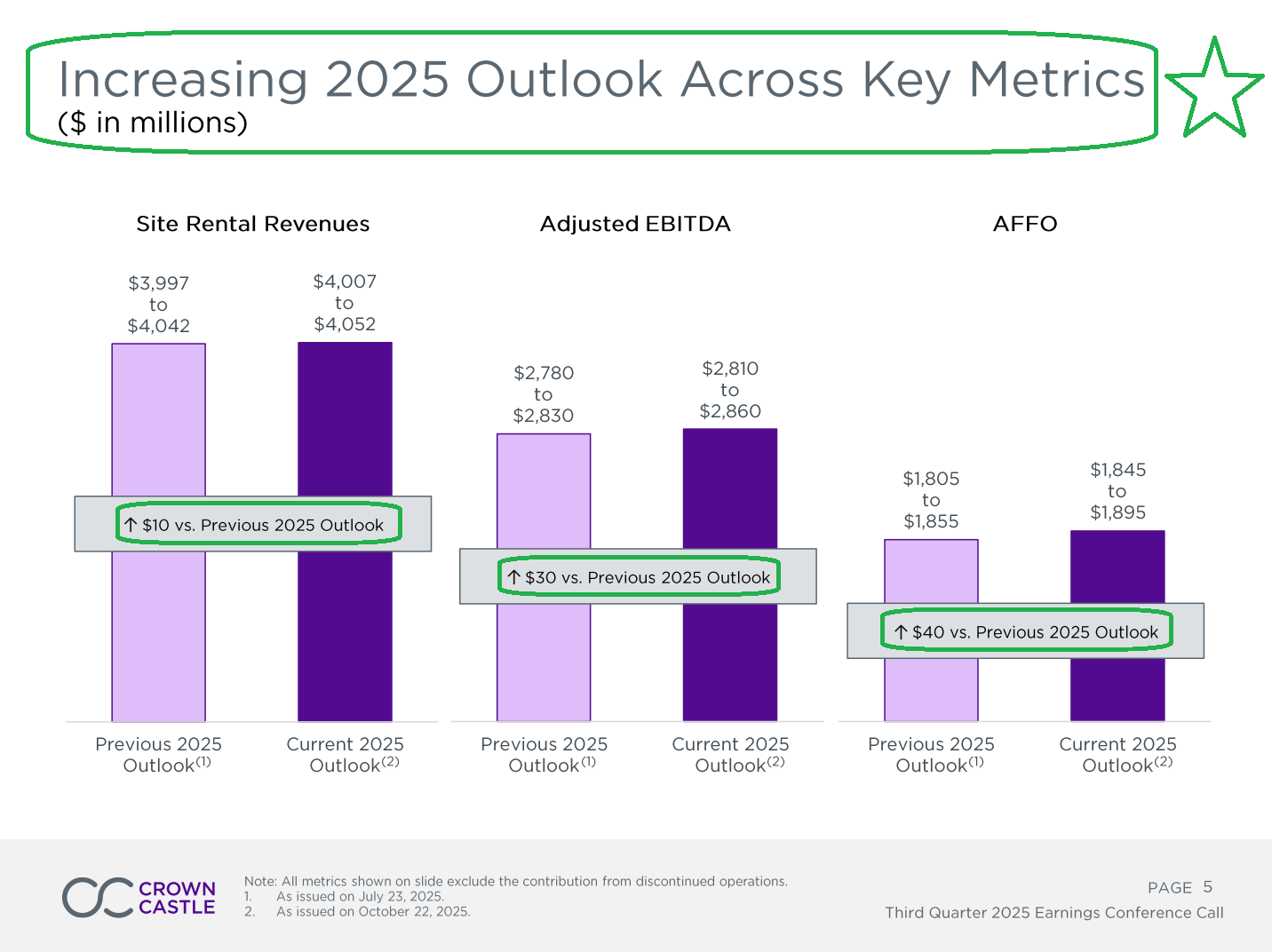

8) Management raised full-year guidance across the board from the previous outlook, with the midpoint of site rental revenues increasing to ~$4.03 billion (+$10 million), adjusted EBITDA to ~$2.84 billion (+$30 million), and AFFO to ~$1.87 billion (+$40 million).

9) Management remains committed to maintaining an investment-grade balance sheet, ending the quarter with 84% of debt fixed, a weighted average debt maturity of ~6 years, and ~$4.2 billion of available liquidity under the revolving credit facility, compared to $2.7 billion of maturities over the next twelve months.

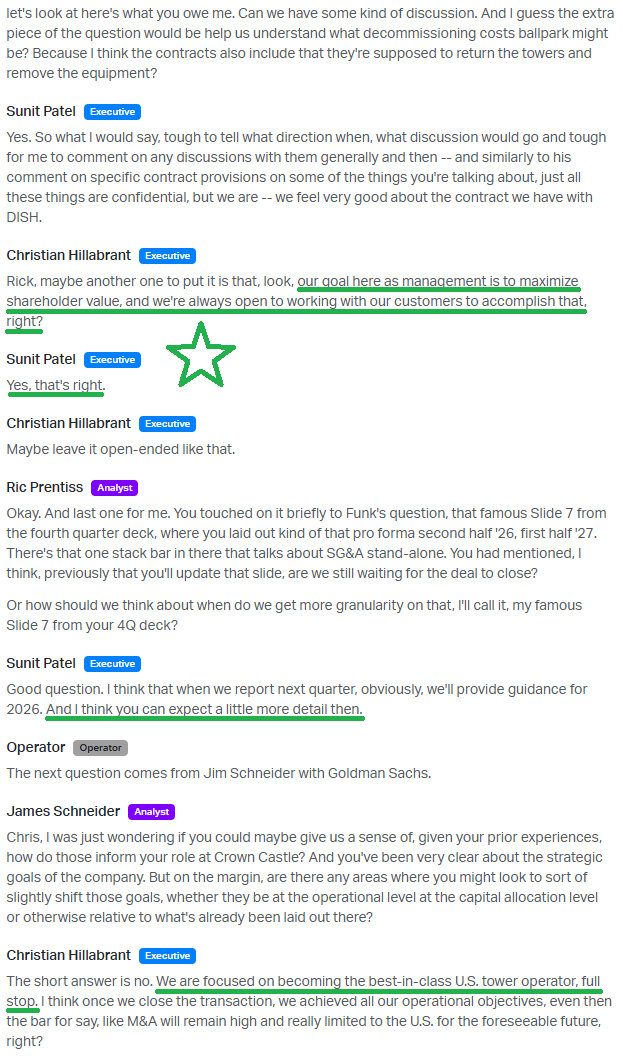

10) Crown Castle maintains a long-term agreement in place through 2036 with EchoStar and continues to expect full payment under the terms of that contract. In light of EchoStar’s agreement to sell spectrum assets to both AT&T and SpaceX, management noted that they remain open to working with all parties in ways that maximize shareholder value.

Earnings Call Highlights

General Market

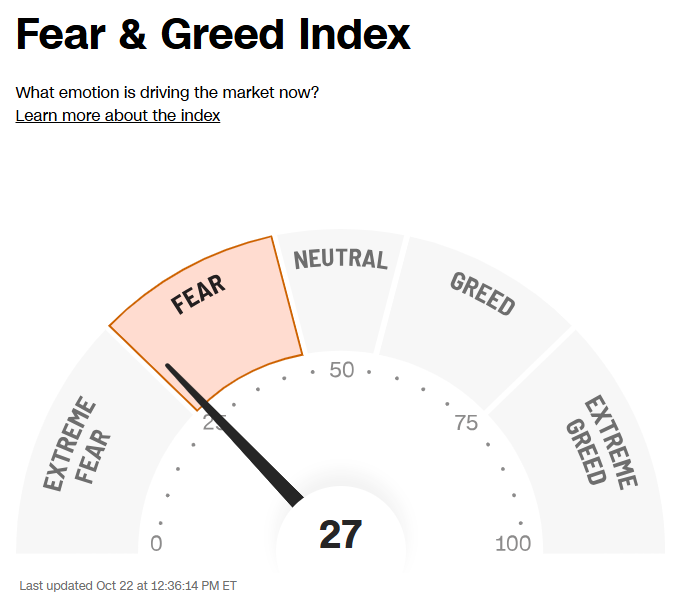

The CNN “Fear and Greed Index” ticked down to 27 this week from 36 last week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 84.87% this week from 84.57% equity exposure last week.

Our podcast|videocast will be out sometime today. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms

More By This Author:

“Back In Style” Stock Market (And Sentiment Results)…

“Breaking The Ice” Stock Market (And Sentiment Results)…

“Foundation For A Comeback” Stock Market (And Sentiment Results)

Long all mentioned tickers.

Disclaimer: Not investment advice. For educational purposes only: Learn more at more