Weekly Market Pulse: What Trump Bump?

I don’t spend a lot of time trying to predict the future, mostly because, as I pointed out just last week, I’m not very good at it. There’s no shame in that and it doesn’t impair my ability to invest; the gift of prophecy is not necessary. A couple of weeks ago, right before the election I speculated on what a Harris or Trump win might mean for the markets. As I pointed out last week, my expectation of a buy the rumor, sell the news effect on a Trump win turned out to be wrong. Stocks surged right after the election, based, according to numerous analyses I read, on expectations of all kinds of business friendly Trump policies. Maybe, but it turns out I did get something right in that pre-election missive:

In either case though, any movement seems likely to be short term.

In the first four trading days after the election, stocks rose strongly with small caps up 7.5% and the S&P 500 and Nasdaq 100 both up about 4%. In the next four trading days stocks gave back over half those gains; since the election small caps are now up 2.7%, the S&P 500 1.6% and the NASDAQ just 0.9%. I said before the election that markets didn’t appear to me to be moving based on any expectation of an election outcome but were instead moving based on the incoming information about the economy. And I think the same is true of the movements of the markets since the election, with some possible exceptions.

In thinking about the election it was our belief that the worst outcome for markets would be unified control by either party because it would produce a lot of uncertainty (we talked about this on our podcast before the election). When one party has control of Congress and the White House, they tend to act on that by trying to do big things in a hurry because they don’t know how long they’ll have the ability to enact their full agenda. That desire to try to do Big Things creates extreme uncertainty among businesses, who have to wait to find out what the new rules of the road are going to be. Will the new administration change the tax code? If so, how will they do that? Are there specific types of investments that will be favored or disfavored? What about the new administration’s attitude about mergers and antitrust? Will they have a big enough majority to do all those things they talked about during the campaign?

That degree of uncertainty is amplified in a Trump administration because, love him or hate him, I think everyone can agree that he is the most unpredictable President in history. That was on full display last week with some of his cabinet appointments and the uncertainty created by them. There was a lot of excitement immediately after the election about an easing of the antitrust enforcement of the Lina Khan led FTC but the appointment of Matt Gaetz as Attorney General – assuming he gets past the Senate – muddles that picture. His past statements about big tech, and antitrust more generally, align quite nicely with Khan (J.D. Vance has also expressed support for her agenda). The other big surprise was the appointment of Robert Kennedy, Jr. to head Health & Human Services, which sent most of the pharma stocks south, especially those involved in vaccine development.

Reacting to every pronouncement from the Trump administration is a recipe for churning your portfolio unnecessarily. We don’t know if RFK, Jr. will ever see the inside of the HHS building, much less what he would really do if does get there. The same is true of President Trump, who has been known to exaggerate on occasion. We don’t know what policies he will be able to enact or how they might be implemented. Rather than respond to every new development in the story line of the Trump Presidency take a step back and listen to the message of the market. Bonds and currencies, in particular, are extremely large and deep markets that provide a more sober view of the economic landscape than the stock market. As I said before the election, the market movements we saw were easily explained by ongoing economic developments and did not necessarily represent any expectation about the election.

Over the last two months the yield of the 10 year Treasury note is up 80 basis points with roughly half coming in the first month and half in the second. It has been a pretty steady march higher but we don’t know exactly why investors have been selling Treasuries. It could be that some of the sellers were focused on a Trump win but it could just as easily be the economic data that has been released during that time, which has largely been better than expected. The dollar started to rise at roughly the same time and is up 6.3% over those two months. Again, roughly half of the gain came in the first month and half in the second; a steady move higher. That could be the dollar anticipating higher tariffs under Trump or it could be, again, an economy performing better than expected. Tariffs would be expected to raise the value of the dollar to reduce the dollar price of imports – which is why they don’t work to reduce the trade deficit – but if that’s why the dollar is moving we would expect the biggest move to be against the Chinese Yuan. The Chinese currency is down over the last month by about 3% but it is also essentially unchanged since late 2022.

Of course, the Yuan isn’t free floating like the dollar or Euro or Yen so maybe that doesn’t mean anything. But we haven’t seen any big moves in the Brazilian Real or the Mexican Peso either so maybe we shouldn’t assume we know more than we actually do. A better approach is to do what we’ve always done – interpret the market signals and be humble about our ability to predict the future. The rise in the 10 year Treasury note yield, that started when the Fed cut rates by 50 basis points at the September meeting, is a mixture of higher inflation expectations and higher real growth expectations. The 10 year breakeven inflation rate has risen from 2.02% on 9/10 to 2.33% as of last Friday. That is a modest rise and could easily be attributed to the Fed’s rate cut. With inflation expectations up 31 basis points the rest of the move in the 10 year rate – a majority –can be attributed to higher real growth expectations. Is that due to Trump? That may matter as a point of politics but it doesn’t matter one bit to us as investors.

The movement of the stock market during that time reflects the move in bond yields. The S&P 500 is up a little over 4% since the September Fed rate cut, with most of that happening in the month after the cut; the gain over the last month is just 0.6%. That seems more likely to be related to the Fed action than the election but there is no way to know what motivated the buyers. After the growth scare of the summer, a rise in stocks based on rising growth expectations does make perfect sense. There are certainly investors and traders making moves based on their positive view of President Trump’s agenda. There are also some investors making moves based on their negative view of that agenda. Given a pretty evenly divided electorate it also makes sense that the end result is pretty neutral to the markets.

Politics has always been an emotional activity and it should not influence your investment portfolio; emotion is the enemy of investors. Warren Buffett has said to be greedy when everyone else is fearful and fearful when everyone else is greedy. That is good advice but if you read between the lines what he’s really saying is to be greedy when you are fearful and fearful when you are greedy. That would be very good advice for Republicans and Democrats alike right now.

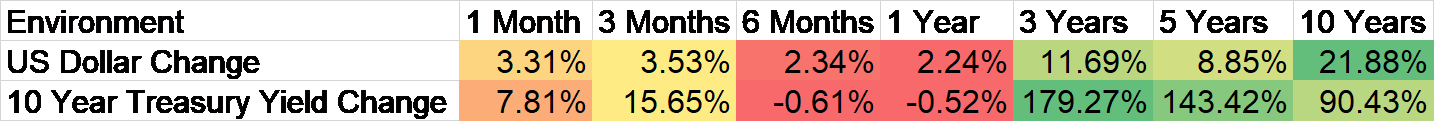

Environment

(Click on image to enlarge)

The dollar and interest rates continued to rise last week with the former up 1.6% and the latter up 12 basis points. There has been a lot of speculation that the dollar’s rise is predicated on the expected Trump tariffs and there is probably some truth to that. But I’d be careful about trading based on the textbook theory on currencies and tariffs. There has been a lot of talk out of the Trump camp about the dollar being overvalued and how a cheaper dollar would be positive forUS exports. While the dollar probably is somewhat overvalued, this is probably one of those instances where one should be careful what one wishes for. There aren’t a lot of us old geezers around that remember the ’87 crash but I sure do and it was obvious then and now that the trigger was James Baker’s cheering on of a cheaper dollar. When you tell the world you don’t care how much the dollar falls, as Baker did, they take you at your word.

From a technical perspective the dollar remains in the channel it has been in for most of the last two years but it is on the verge of breaking out higher. While a strong dollar is generally a positive – it reduces inflation and induces capital inflows – a too strong dollar introduces some negatives for the global economy. There is a lot of dollar debt in the world and a stronger dollar makes it harder to pay back. Certainly some of the recent surge has been from dollar debtors hedging their risk but that carries a cost and isn’t universal. If the dollar rises too much too fast, it will cause problems in countries and at companies with large dollar debts. And history tells us that those problems are unlikely to be contained outside the US. You may not remember the Asian crisis but it probably wouldn’t hurt to read up on it. Who would have thought that a crash of the Thai Baht would kick off a global crisis?

A breakout of the dollar would likely trigger some portfolio changes for us. In a rising dollar, rising rate environment the poorest performers are gold and bonds while small/mid cap stocks and commodities are outperformers.

(Click on image to enlarge)

The 10 year Treasury rate is also near a breakout higher but that wouldn’t require much change in our portfolios because our duration exposure is already below the strategic allocation.

(Click on image to enlarge)

It looks as if both of these major indicators are on the verge of a major change in trend but it hasn’t happened yet and it may not. It isn’t time to make changes yet.

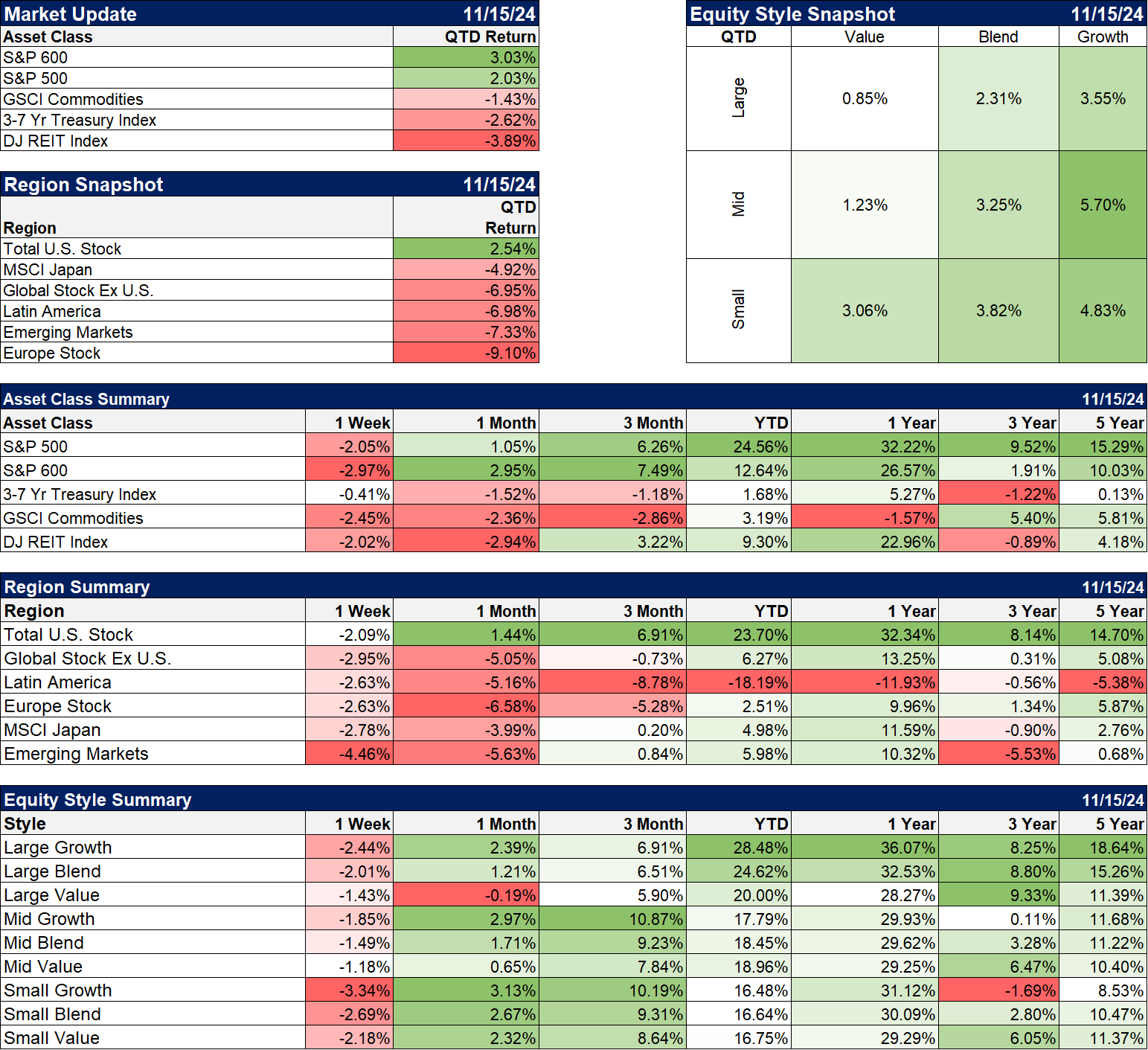

Markets

It was a pretty ugly week with all of our major asset classes down, led by small cap stocks. Value stocks did slightly better than growth but they were down too. REITs were down hard on higher interest rates but their short term uptrends are still intact.

The big losers on the week were non-US stocks and especially EM stocks which fell nearly 4.5%. That’s a dollar effect and some of these indexes are on the verge of breaking their uptrends. Gold, which was up nearly 35% through October 30th, is now up 23.8% YTD. It’s down 6.6% since the election and 4.4% in just the last week. That is a dollar effect of course, but it is also an indicator of higher growth expectations (higher real rates). That’s what a rising dollar, rising rate environment means – rising growth expectations domestically and relative to the rest of the world. That’s the exception I mentioned above; that does look like a Trump effect.

(Click on image to enlarge)

Sectors

Health care stocks managed to fall even more than EM stocks thanks to the Kennedy appointment at HHS. This could be a big opportunity if Kennedy can’t get through a confirmation hearing without saying something completely bonkers. If he does get through it you might look for an iron lung manufacturer. Financials and energy, two sectors expected to benefit from the new Trump administration, were the only ones higher last week. One thing I’d suggest for the next four years is not getting too comfortable with any group that Trump favors this week. It doesn’t take much to land on Trump’s naughty list.

(Click on image to enlarge)

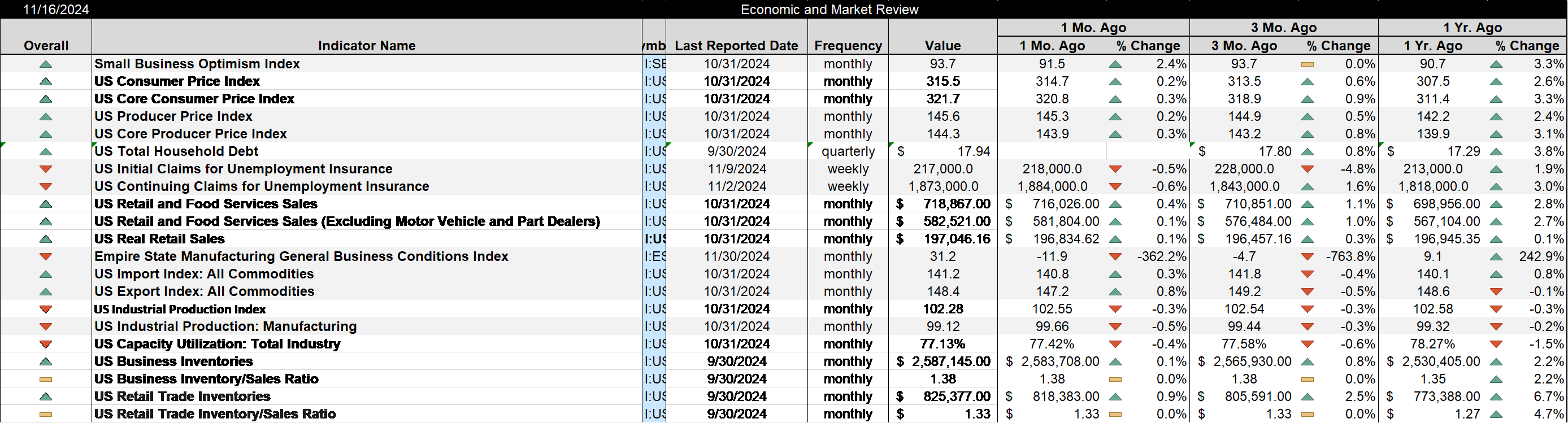

Economy/Market Indicators

Credit spreads are making new lows for the cycle and there is very little room for them to fall further. I don’t think it gets any better from here but spreads would have to widen considerably to cause any serious problems.

(Click on image to enlarge)

Economy/Economic Data

- The NFIB small business optimism index ticked higher and you can expect it to rise more in coming months. This survey is dominated by Republicans who will feel better after the election.

- Inflation was as expected but as expected is a stall. The rate of change for CPI and PPI has stopped falling at roughly 2.5% headline and 3.2% core. That isn’t terrible and history says markets can perform well in that environment but it isn’t what the Fed was hoping for. Expectations for a Fed rate cut in December are down to a little over 60% from nearly 90% a week ago.

- Unemployment claims continue at a low level which is a bit strange to me. In the past, hurricanes have triggered a rise in claims and we saw that with Helene but not Milton.

- Retail sales were up 0.4% but that had a lot to do with better auto sales. Gas prices have been a drag on the headline for some time so the retail sales picture has been somewhat distorted. But ex-gas stations, retail sales have been pretty darn good, up 0.4% month to month and 3.7% year over year. That is an acceleration from last month’s 3.0% yoy change.

- Import and export prices both rose more than expected but the year over year change is negligible.

- Industrial production was down 0.3% for the month and year over year. The effects of the Boeing strike and the hurricanes weighed on this report.

- The Empire State Manufacturing survey surged this month from a -11.9 last month to 31.2 this month. That was driven by new orders and shipments which both rose by over 30 points. I’ve been expecting an improvement in these regional Fed surveys as well as the national manufacturing PMIs. We’ll see if we get confirmation from other regions with reports from the Philly and KC Feds this week along with the S&P global PMIs.

(Click on image to enlarge)

More By This Author:

Weekly Market Pulse: Turn, Turn, Turn

Weekly Market Pulse: Election Anxiety

Weekly Market Pulse: Rose Colored Glasses?

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more