Weekly Market Pulse: Is The Honeymoon Over Already?

Image Source: Pixabay

President Trump’s first week on the job was a good one for markets. The S&P 500 was up 1.75%, with tech stocks taking the lead as the President welcomed a group of leading technology CEOs to D.C. to announce big investments in AI. Well, not so much to announce as to re-announce, since finding something new in the press release was pretty hard. Apparently there was a pool of people on planet earth who hadn’t heard that companies are investing insane amounts of capital in AI with little or no inkling as to how it will all pay off. I’m sure Larry Ellison thanks everyone for tuning in and boosting his already huge net worth ($228 billion, give or take a few billion). He co-founded Oracle whose stock managed to add 14% on the week because the company joined the Stargate project, which I guess was news of a sort, although I’m a tad skeptical it was worth the $60 billion gain in Oracle’s market cap.

What the announcement really revealed were the rivalries in Silicon Valley. Elon Musk, feeling a bit left out, vented on X that the companies didn’t have the money they were promising to invest to which Sam Altman responded that uh-huh, yes we do. There may have been a neener, neener in there too. Microsoft was prominent by its physical absence and a very carefully worded press release. If that sounds a lot like a reality TV show I think that’s because it is. I am not much of a TV watcher and the only reality TV I ever consumed was a few seasons of Deadliest Catch. I find the whole genre voyeuristic and tawdry; I’ve got better things to do, which is a low hurdle indeed. So, I could be wrong. Unfortunately, much of what passes for politics these days – from either side of the widening aisle – is of this who did what to whom type of tattletale entertainment. Politics has become just another way to gather an audience that can be fleeced by the Sultans of Silicon Valley with the dopamine inducing tools they’ve spent the last 25 years perfecting and embedding in social media. If you think Tik-Tok should be banned because of the information they gather on US citizens, you should be really steamed about what Google, X and Meta have been doing for a lot longer than Tik-Tok. AI, by the way, isn’t going to care one whit about your privacy.

While there was a lot of focus in D.C. on the things that President Trump did in his first week in office, markets were driven by the things he didn’t do. The big movers last week were the dollar (down nearly 2%), gold (up 2.6%) and non-US stocks. The EAFE index was up 3.2%, emerging market stocks rose 2% and Chinese stocks were up 2.6%. All of these moves were in response to the dog that didn’t bark – the tariffs that were not imposed. The calm in US markets was driven by the same lack of tariff action. With President Trump threatening to impose 25% tariffs on Mexico and Canada – and for some reason only 10% on China – the calm will likely only last as long as the tariff moratorium.

I have some guesses about what President Trump is trying to accomplish with his public remarks on tariffs but I don’t really know anything. I don’t even know if those closest to him know what he’s going to do. I can look at our trade with Mexico and Canada and quickly figure out that if he really imposes 25% tariffs on everything we import from those two countries, the results won’t be favorable for anyone, the US included. With more than half of Mexico’s foreign investment coming from US companies and a large part of the trade involving subsidiaries of US companies, the US has a lot to lose from 25% tariffs. Yes, it would hurt Mexico but at what cost? For that reason, I don’t expect him to do this unless he also exempts a large portion of the trade between the two countries. The same is true of Canada and the crude oil we import from the western provinces. US refineries need that sour crude to provide gasoline to large parts of the US. Or does he plan to cut a deal with Venezuela to import more sour crude from there? As I said, I don’t have a clue what he’s really thinking and I sure don’t know what he’s going to do.

I can, however, read a calendar and February 1st, the day he promised to impose those tariffs on Mexico and Canada, is this Saturday. Since the election, and especially last week, investors have been acting as if President Trump will do all the things markets like but none of the things they don’t. This may be the last week that is a viable position. Will he impose big tariffs on our neighbors? We find out Saturday.

We also have an FOMC meeting this week and the Fed is widely expected to leave the Fed Funds rate unchanged. Last week, President Trump said he wants oil prices and interest rates to come down but he doesn’t have a lot of control over either. He will almost certainly criticize the Fed decision this week but considering how long term interest rates have acted since the Fed’s first cut in September (rising), he probably ought to thank them. The Fed influences short term rates but long term rates are determined by the market and another Fed cut right now would, more than likely, send them higher still. I think the only way the Fed meeting this week would move the market would be if President Trump announces that he has decided to fire Jerome Powell. And I can’t rule that out.

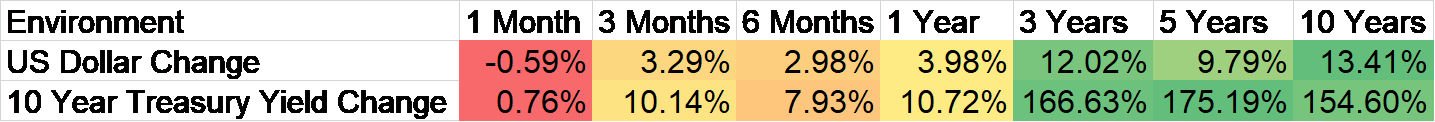

Environment

(Click on image to enlarge)

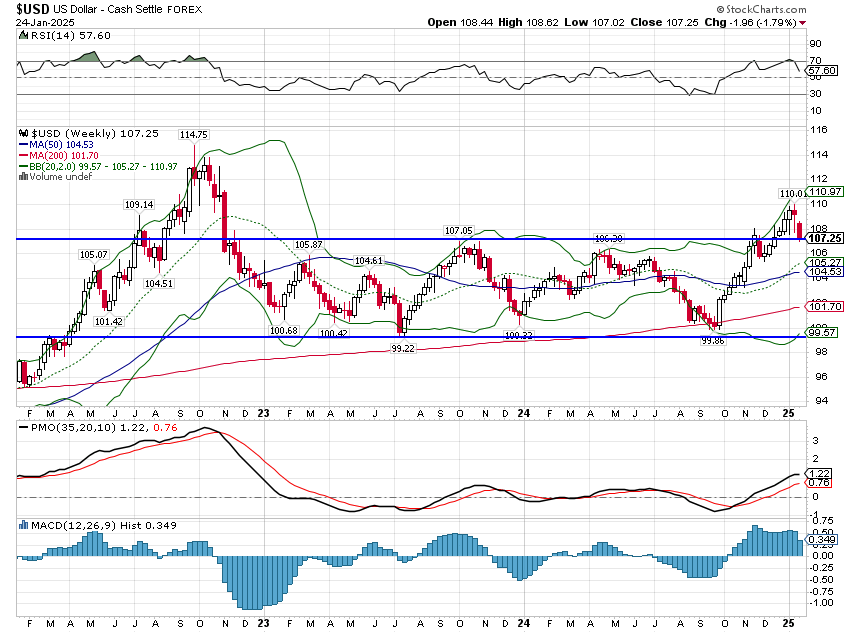

The dollar fell last week but is still in a short term uptrend. On an intermediate term basis the buck is trendless but since 2011 and especially since 2014, the dollar is in an uptrend. Over the really, really long term, the dollar is the same today as it was in the late 80s.

The events of the next couple of weeks will determine the short term course of the dollar but thinking longer term it seems likely to fall. The dollar is overvalued (my guess is about 20%) but that has been true for some time; as with stocks, valuation is a lousy timing tool. But with a President who has made it known he wants a weaker dollar, we’re likely to get it.

For now, we continue to be mostly neutral to the dollar in our portfolio positioning. If it does get in a downtrend, the usual suspects will likely outperform. That includes gold, commodities and non-US stocks.

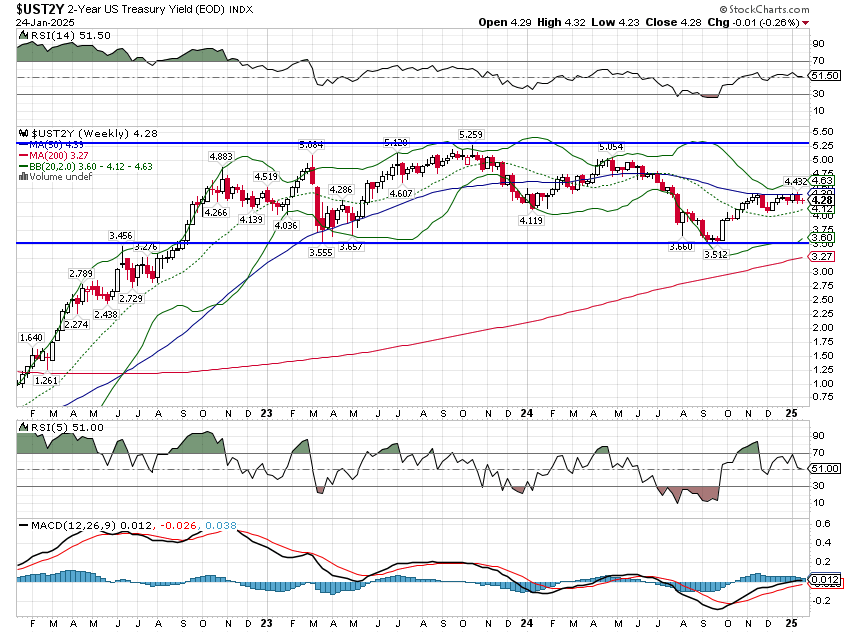

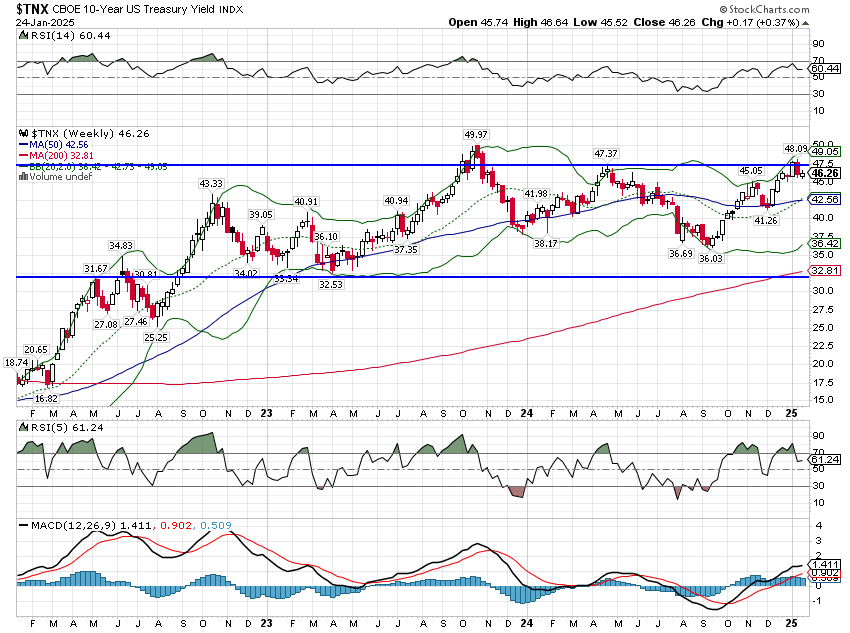

(Click on image to enlarge)

Interest rates didn’t move much last week with the 10 year up a couple of basis points and the 2 year down a couple. The 10 year rate remains in the trading range that has defined it since the fall of 2022 – the intermediate term trend is no trend at all. The short term trend for long term rates is up. The 2 year Treasury yield is also in a short term uptrend but it is very weak and nowhere near the 2023 highs. As with the dollar, we remain fairly neutral to rates with a slight lean toward shorter maturities.

(Click on image to enlarge)

(Click on image to enlarge)

Markets

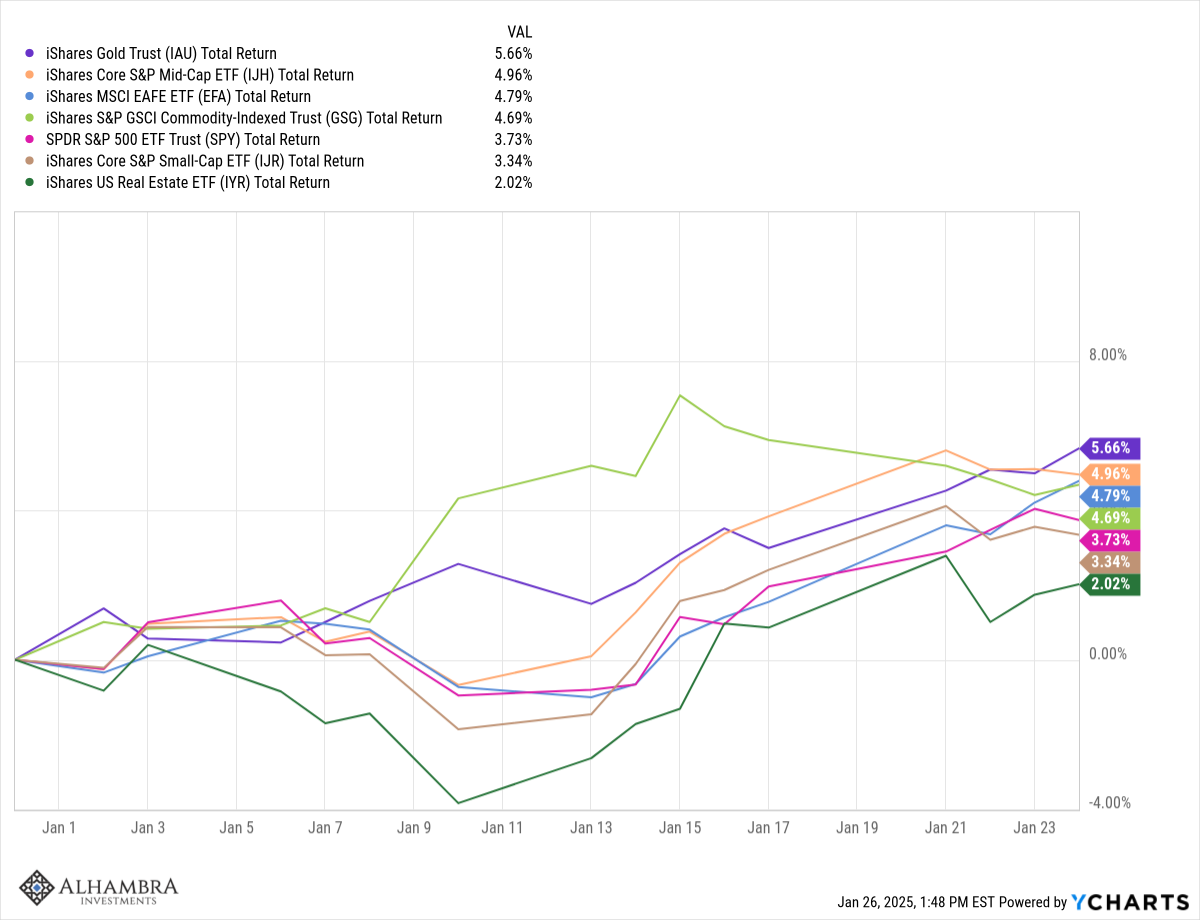

Markets are off to a good start this year but the S&P 500 has lagged. Gold, US Mid-cap stocks, Non-US stocks (EAFE) and general commodities have all outperformed the S&P 500 ytd.

(Click on image to enlarge)

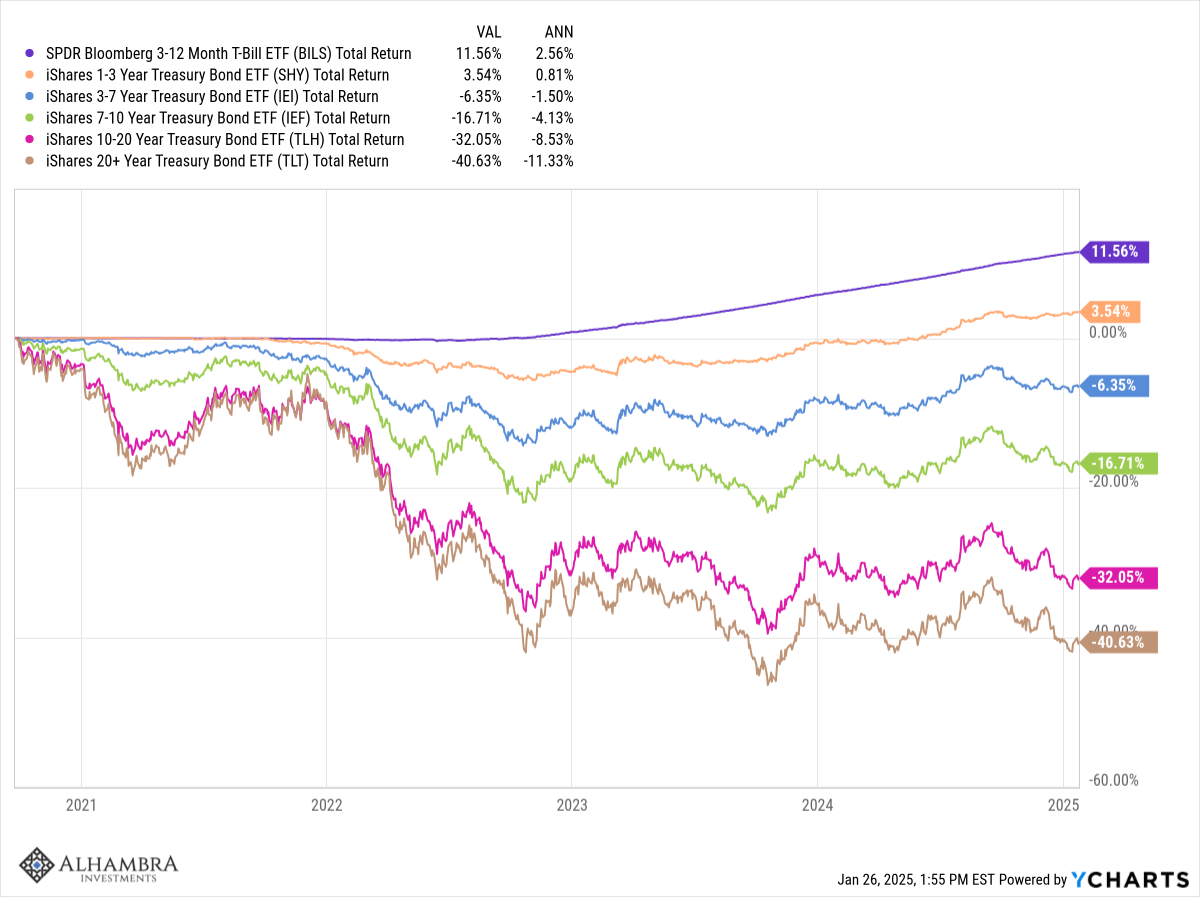

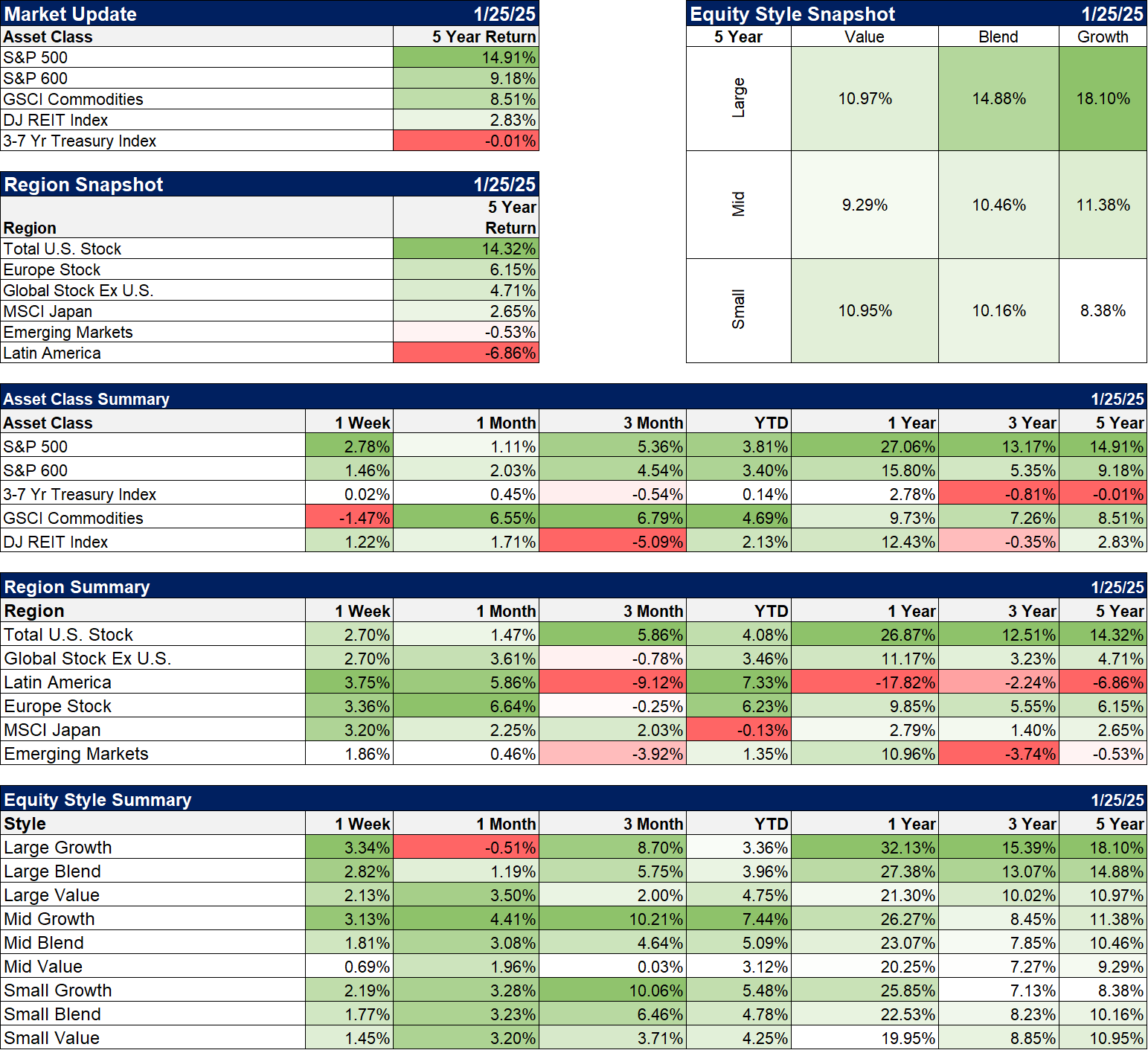

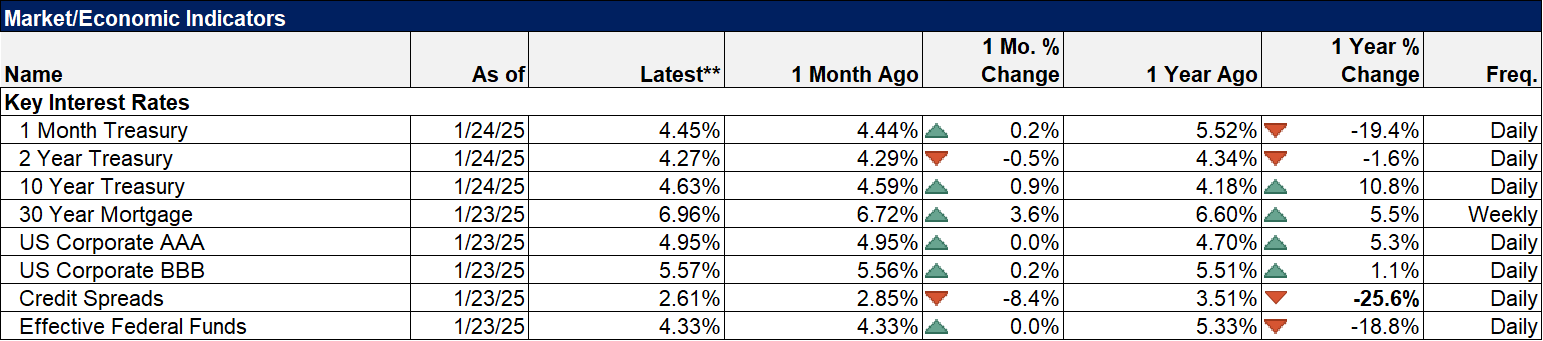

The returns in the charts below highlight 5 year performance. The most interesting part is probably that intermediate term Treasuries have provided no return at all over the last 5 years. What that means is that, for a diversified investor, your choice of what stocks to include in your portfolio is what mattered most. For the standard 60/40 investor (60% stocks/40% bonds), if you attempted to diversify away from the S&P 500, you underperformed. For multi-asset class investors, some of the lack of return from bonds could have been mitigated with other diversifying assets like gold but still, if you didn’t choose US Large cap stocks for the stock portion of your portfolio, you got the same result as the 60/40 investor – you underperformed.

Your choice of bond allocation mattered too by the way – you could have done worse than intermediate term bonds. A lot worse. The 20+ year Treasury ETF has lost 11.3% per year over the last 5 years. Short maturities did make money, the shorter the better.

One other result of the outperformance of the S&P 500 is that it is overvalued by almost any measure. In fact, using a variety of methodologies, valuation is currently in the 10th decile, meaning it has traded at a cheaper valuation 90% of the time since WWII. Furthermore, it first entered the 10th decile in 2016 – the 10th decile consists mostly of the last 10 years. The equity risk premium, using the 10 year Treasury yield versus the S&P 500 earnings yield is in the ninth decile and negative to boot. Even if you don’t put a lot of stock in that measure – and I don’t – it is at an extreme and extremes are extremes for a reason – they don’t happen often or last long.

There will come a time when it will pay – likely very handsomely – to own something other than US large cap growth stocks but I can’t tell you when that will be. The best indicator to watch for that is probably the dollar by the way.

5 year fixed income returns

(Click on image to enlarge)

(Click on image to enlarge)

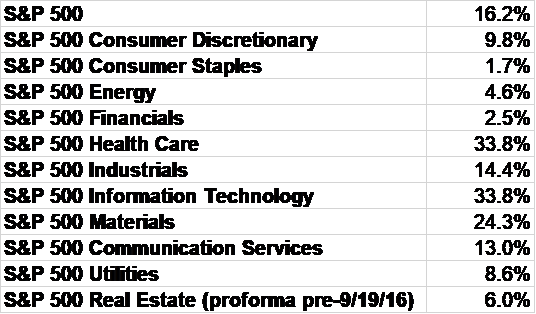

Sectors

Communications services and tech led last week but industrials also turned in a good week.

Earnings season has gotten off to a good start, especially for financials where 90% of companies reporting have beaten expectations. Overall, with just 74 of the companies in the S&P reporting, 81% have beaten expectations.

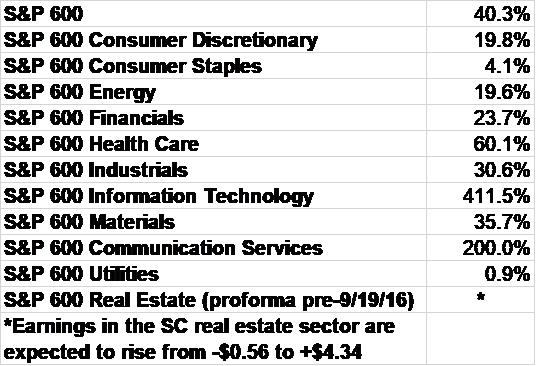

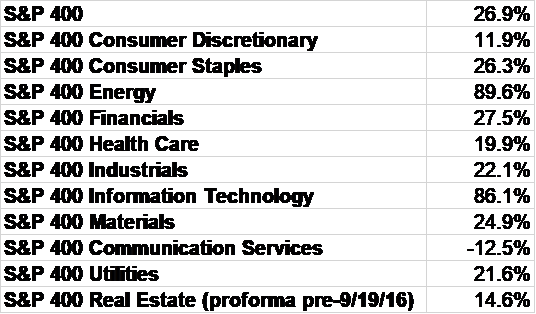

Earnings growth is not uniform across sectors – obviously – but it also isn’t uniform across size (midcap and small cap). Here’s expected earnings growth for each sector for the S&P 500,400 and 600.

(Click on image to enlarge)

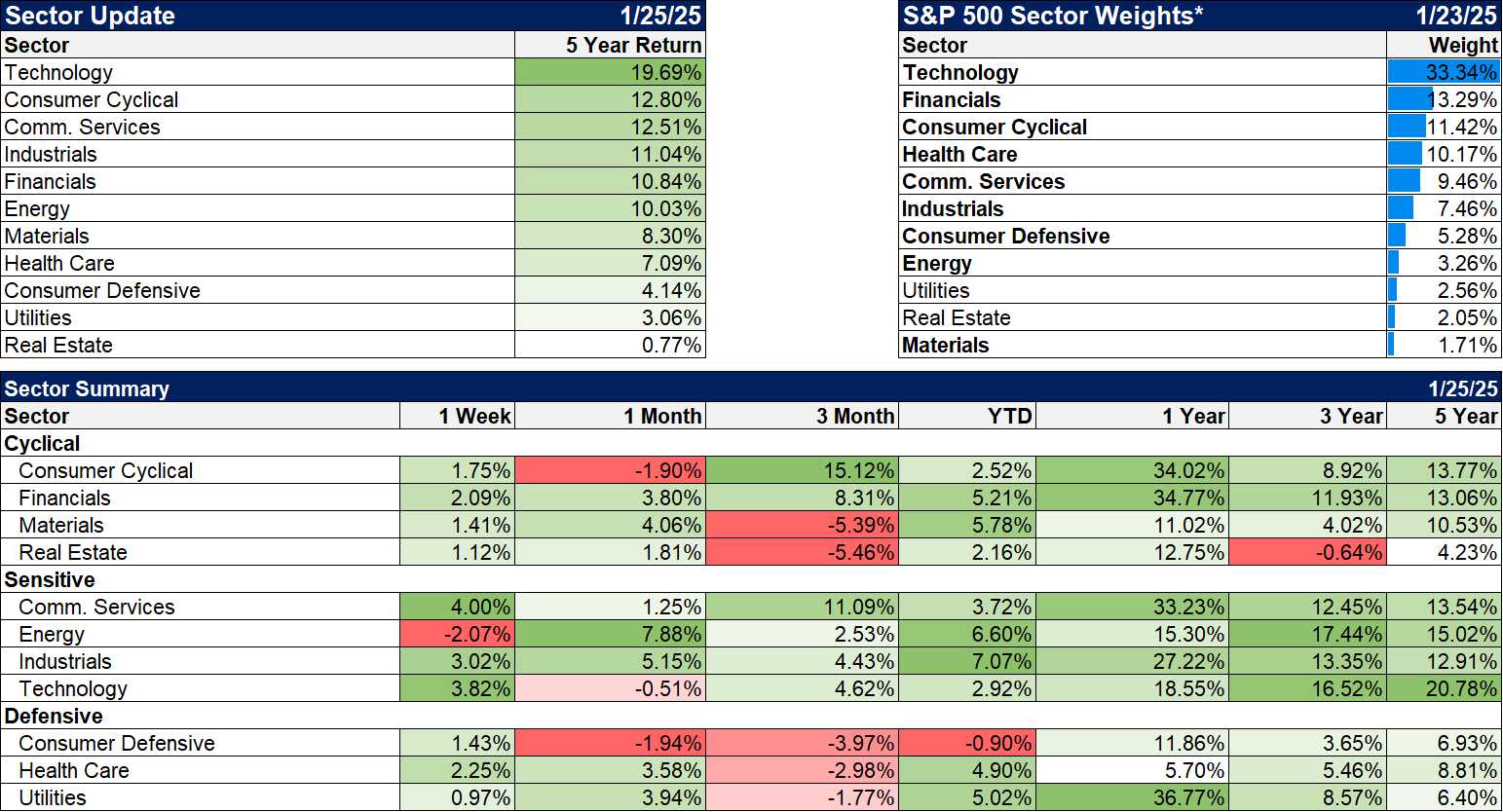

Economy/Market Indicators

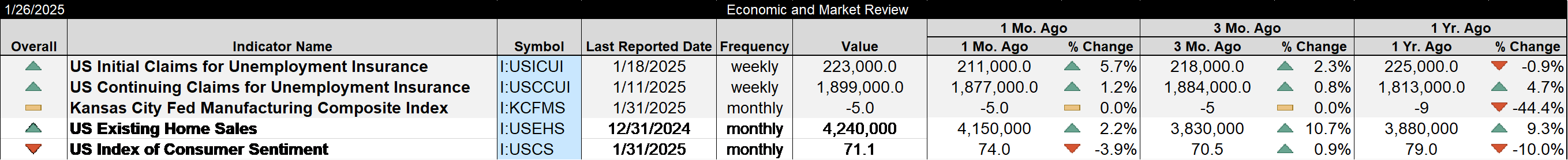

Almost no change from last week.

(Click on image to enlarge)

Economy/Economic Data

Not much in the way of data last week. The most interesting were the U of Michigan consumer sentiment poll and the Conference Board’s LEI.

The consumer sentiment poll continues to be affected by politics. It fell in the latest reading from 74 to 71.1 solely because Democrats, and to a lesser degree independents, lowered their assessment of current conditions and expectations. The latter has dropped from 100 last March to 48.9 in January 2025 for Democrats. Both of those have risen for Republicans who apparently think the economy is better already even though Trump just took office last week.

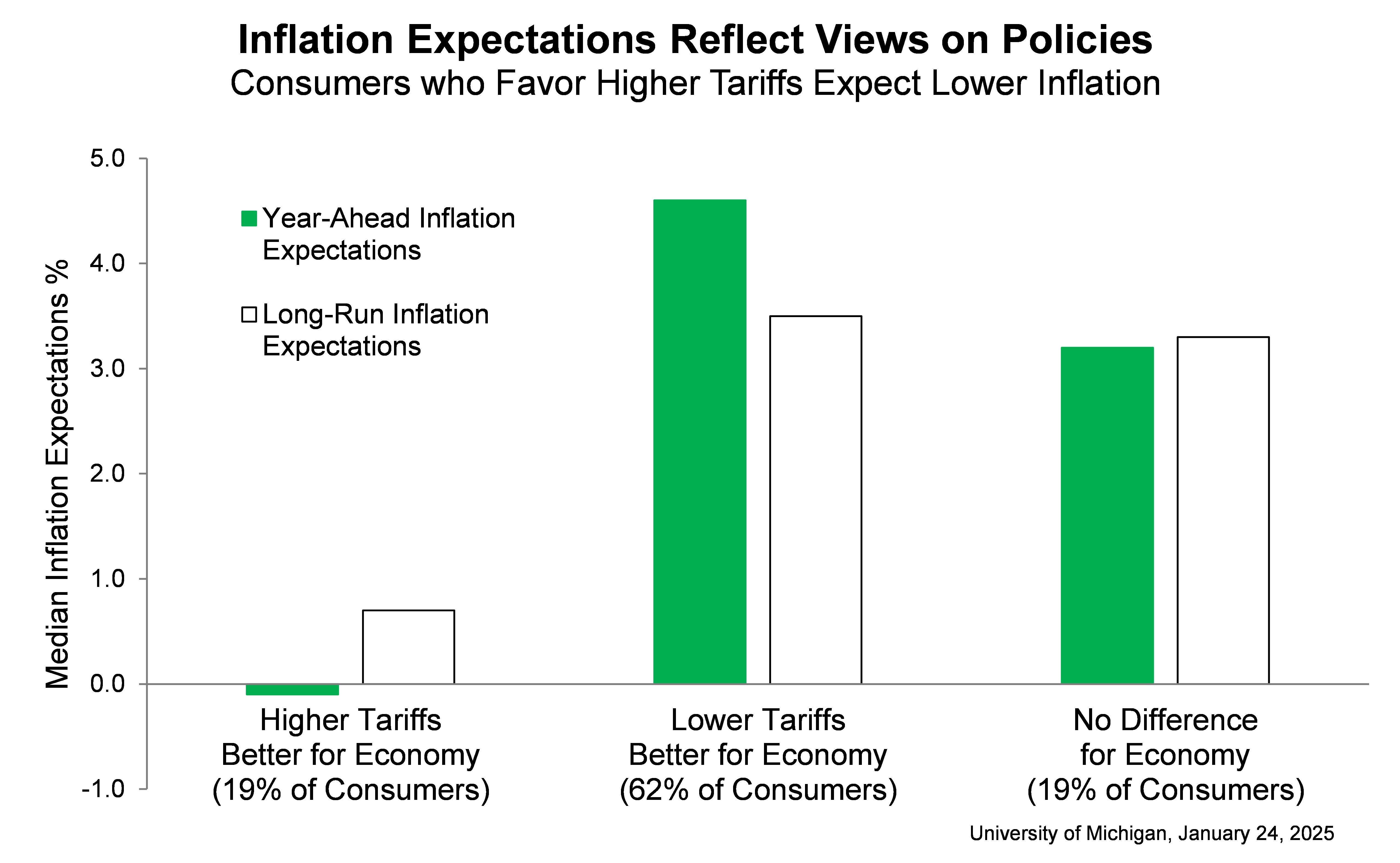

The consumer sentiment poll has also been asking questions about tariffs and have gotten some interesting results. For those who believe tariffs are better for the economy their expectations are that prices will fall over the next year and average under 1% over the long run. Those are some magic tariffs.

The Conference Board’s Leading Economic Indicators fell in December by 0.1 after advancing 0.4 in November. The rate of change is less negative than it has been over the last six months though and the index is no longer signaling a risk of recession. The LEI has been pointing to recession most of the time since 2022 so that is certainly a relief (sarcasm alert).

We’ll get a lot more data next week with reports on:

- New Home Sales

- CFNAI

- Durable Goods orders

- Case Shiller home prices

- Richmond Fed survey

- Trade balance

- Q4 GDP growth

- Personal income and spending and the PCE inflation index

(Click on image to enlarge)

More By This Author:

Weekly Market Pulse: Tariffs Aren’t The AnswerWeekly Market Pulse: Good News Is Good News

Weekly Market Pulse: The Times Are Still A-Changin’

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more