Weekly Market Pulse: A Positive Feedback Loop?

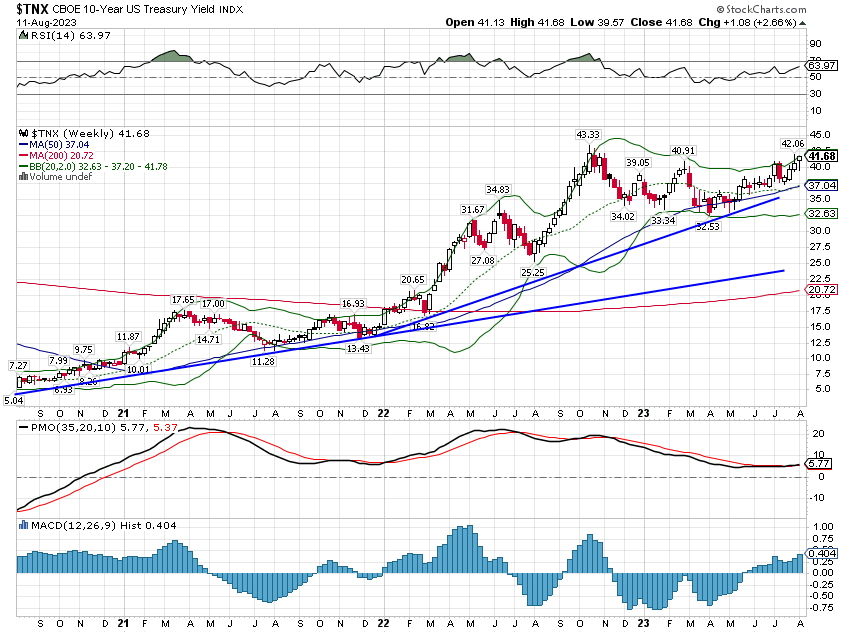

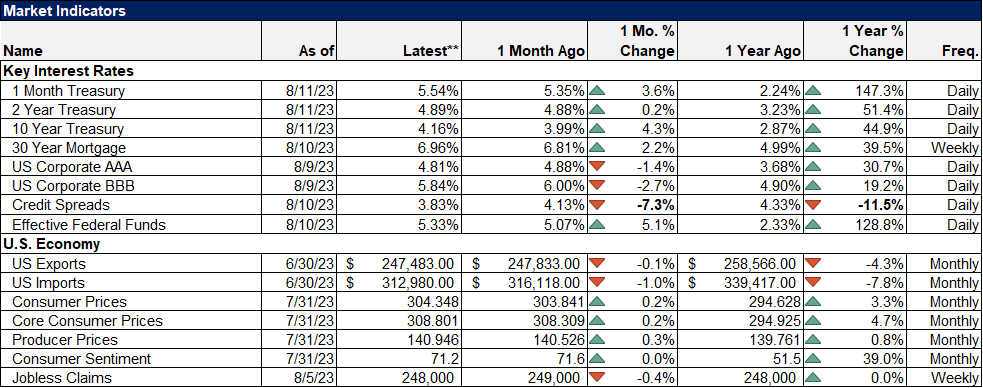

The 10-year Treasury yield has been in an uptrend since the summer of 2021 which is obvious to anyone who can see. It has stalled a couple of times and moved sideways – consolidated in Wall Street technical speak – but the trend is obvious (see below). It seems only a matter of time before we break above the high for this cycle of 4.3% set last October. Meanwhile, in the market that no one watches, the 10 year rate has already hit a new high for this cycle.

That is the TIPS market, the inflation protected bond market. These instruments are fairly new, only coming into existence in the US back at the turn of the century. They may be the most useful – and least watched – market indicator available to investors. These bonds didn’t exist in most of the previous business cycles that we study for clues about the future so we don’t know how they would have acted in, for instance, the inflationary 70s. But we can make a pretty good guess.

TIPS tell us about the demand for inflation protection. When yields are falling, demand for inflation protection is rising. That’s why gold prices are inversely correlated with TIPS yields. When investors are worried about inflation they buy TIPS, which provide direct protection from inflation, and they buy gold which has a long history of providing protection from money debasement (which is what inflation really is).

When TIPS yields are rising, the demand for inflation protection is falling. And when they aren’t worried about inflation, investors find more productive things to do with their money. They invest in the real economy which might take the form of starting a new company or investing in a startup. Or it might take the form of savings; when the economy is good both consumption and savings tend to rise. Savings is then turned to investment through intermediaries. Investment in the real economy should show up as increased productivity somewhere down the road. And productivity is directly related to economic growth.

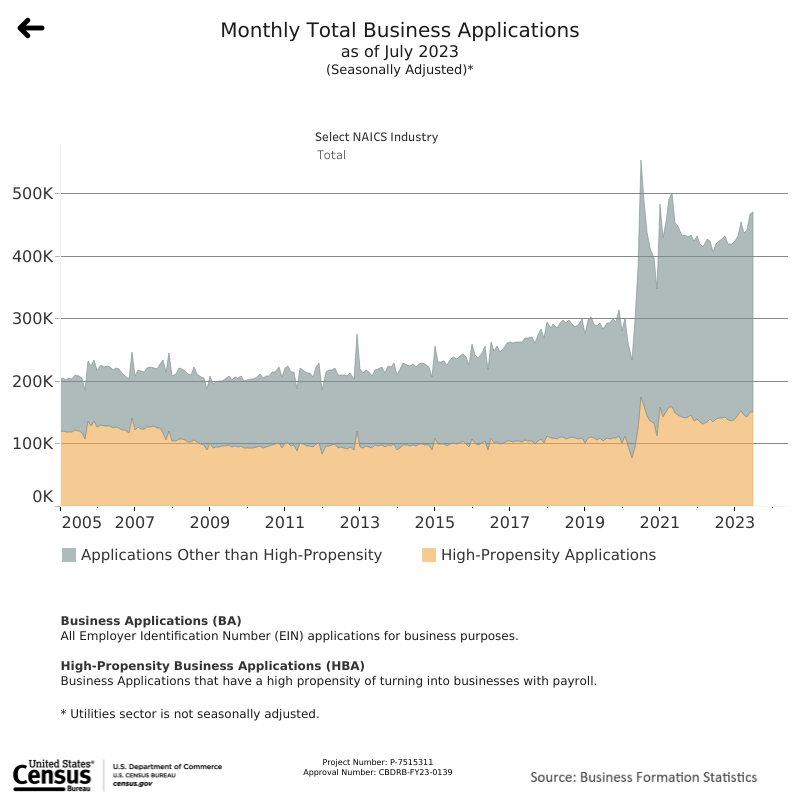

We can see some of this phenomenon in the formation of new companies. New business applications rose dramatically during COVID but after peaking at over 500k in May of 2021, applications fell 18.8% to just over 400k in June of last year. Since then applications have risen by 15.5% to 469k. Maybe it is just coincidence but inflation also peaked in June of last year. More importantly, it was also just a few months after inflation expectations peaked.

If real interest rates reflect investment demand in the real economy – and that’s pretty standard theory – then rising real rates is obviously a positive sign for the future. The US economy suffered through years of weak growth after 2008 and we had the TIPS rates to go along with it. The 10 year TIPS yield today is higher than it was for the entire time from the end of the Great Recession (June of 2009) until September of last year. 10 year TIPS yielded less than 1% for most of that time but is now approaching 2%.

The 10 year TIPS yield today is consistent with the rates that prevailed prior to the 2008 crisis and I think that means that we are finally putting that episode behind us. It has taken a decade and half but we are finally returning to “normal”. There are still plenty of problems in the economy from high government spending (industrial policy makes a comeback among other things) to protectionism to a broken immigration system but the rise in real yields is tangible evidence of a confidence in the future we haven’t seen in a long time.

Higher interest rates, real and nominal, are not all good news but they do represent a return to a more normal set of economic circumstances. Higher rates should, in time, also reduce the speculation that has run rampant through the economy during the post financial crisis period. Real interest rates are critical to all kinds of economic decisions and the price one pays for stocks is no different. Valuations should moderate with higher real rates as capital is diverted to more useful real purposes.

Everything is not wonderful and we’ll still probably have a recession fairly soon, although I can’t define soon. The market currently doesn’t see rate cuts until next year which would seem to indicate that recession is still quite a ways off. But I’ve been doing this long enough to know that can change very quickly so one shouldn’t get too comfortable. Recession will come eventually but higher rates will also make it easier to deal with when it does. That isn’t, by the way, because the Fed will have more room to cut rates which is a ridiculous reason to want higher rates. No, recession will be easier because the real economy is better prepared for it, bolstered by a higher rate of investment.

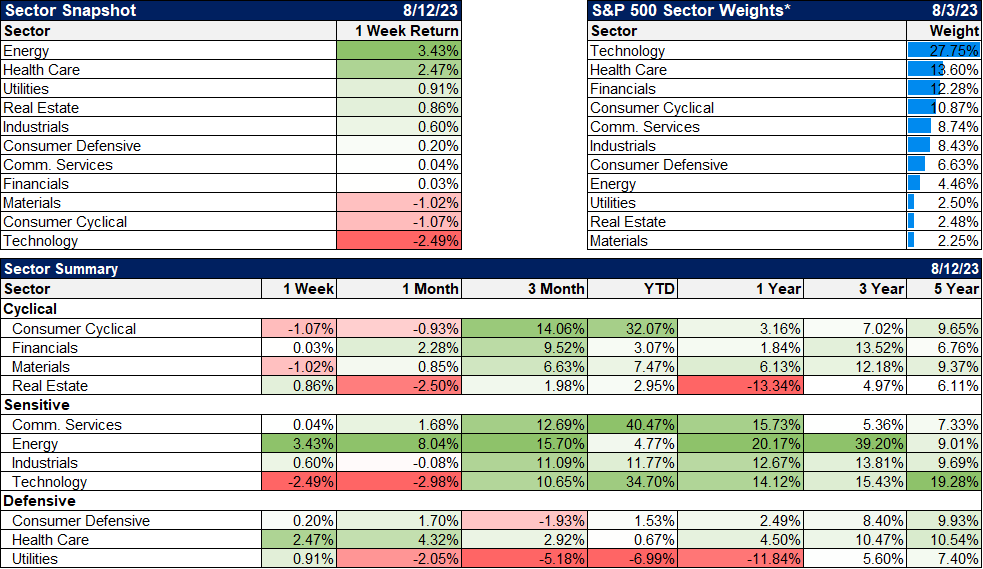

Environment

The trend for the 10 year Treasury yield is, you guessed it, up. This trend is obvious and persistent; it has been in place since August of 2020. Yes, it has had some periods where the short term trend shifted to down but if you try to respond to every change in the short term trend, you are going to be very busy. You’re also going to get whipsawed a lot and the odds of making any money trying to do that are basically nil. Longer term trends change more reluctantly and give you time to assess the fundamental reason behind any shift.

(Click on image to enlarge)

Where might the uptrend go? Technical analysis isn’t magic. Resistance and support are nothing more than levels where sellers and buyers emerged in the past. Will they again? You assume they will until they don’t. In this case the next stop is a challenge of the cycle high around 4.3%. It may not get there but that is the obvious target. Will it go through it and make a new high? I don’t know but remember the trend is up.

(Click on image to enlarge)

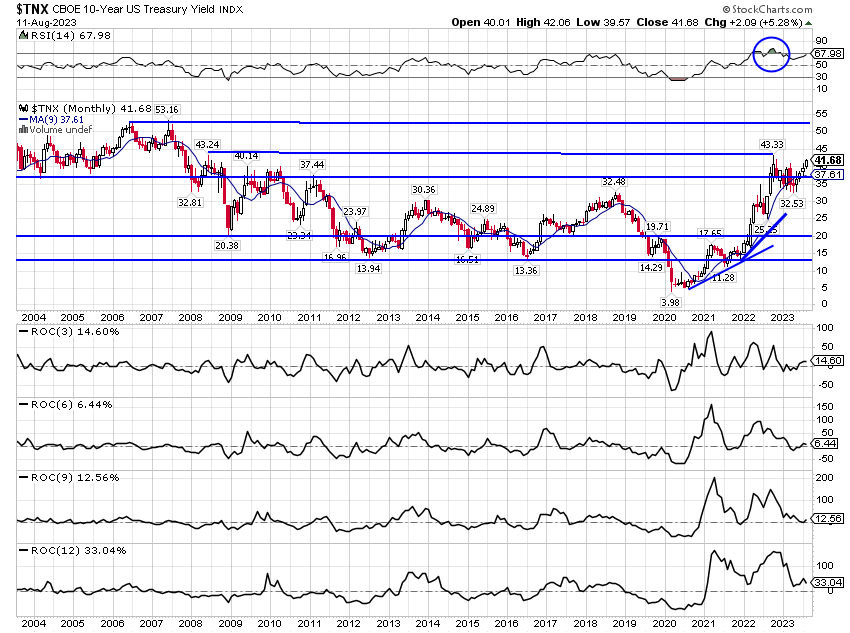

The other obvious question to ask is why? Why are interest rates rising? I think there is a feeling that this has something to do with the budget deficit, that issuing so many new Treasuries means that rates will have to go higher to attract buyers. Maybe, but that doesn’t seem to be what the market is telling us. Real rates hit their highest level since 2009 last week, the 10 year TIPS yield rising to 1.8%. Prior to the 2008 financial crisis, 10 year TIPS yields oscillated around about 2% so this is in the range of “normal”.

Rising TIPS yields are not an indication of worry about the US fiscal situation. They are a reflection of rising real growth expectations. Inflation expectations have risen some since March too but only about 25 basis points. So the rise in yields isn’t all positive, but it doesn’t appear to me to have much to do with the deficit.

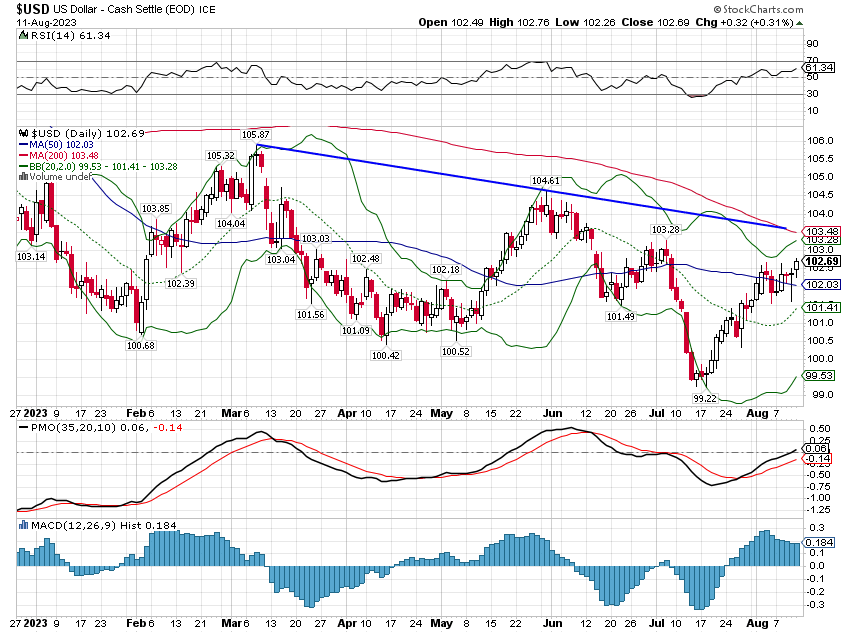

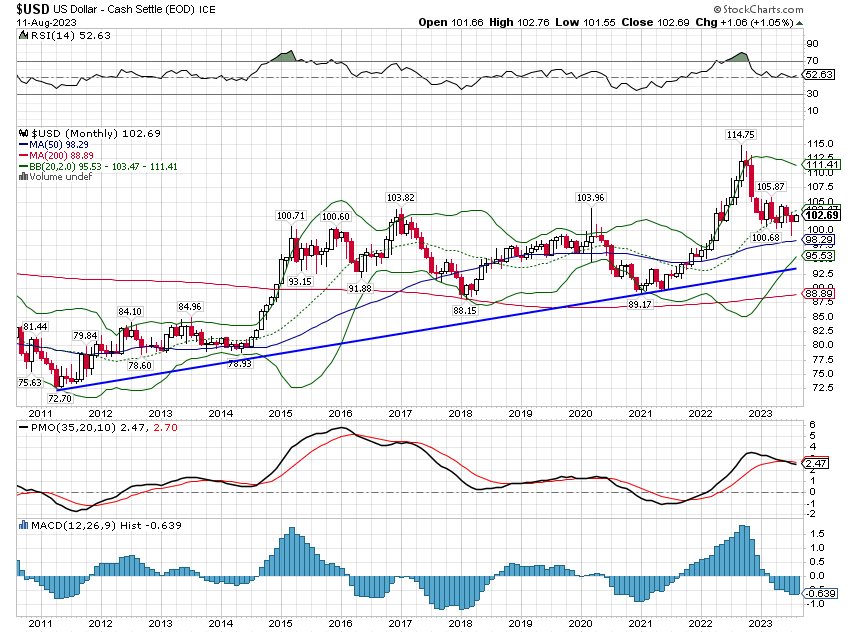

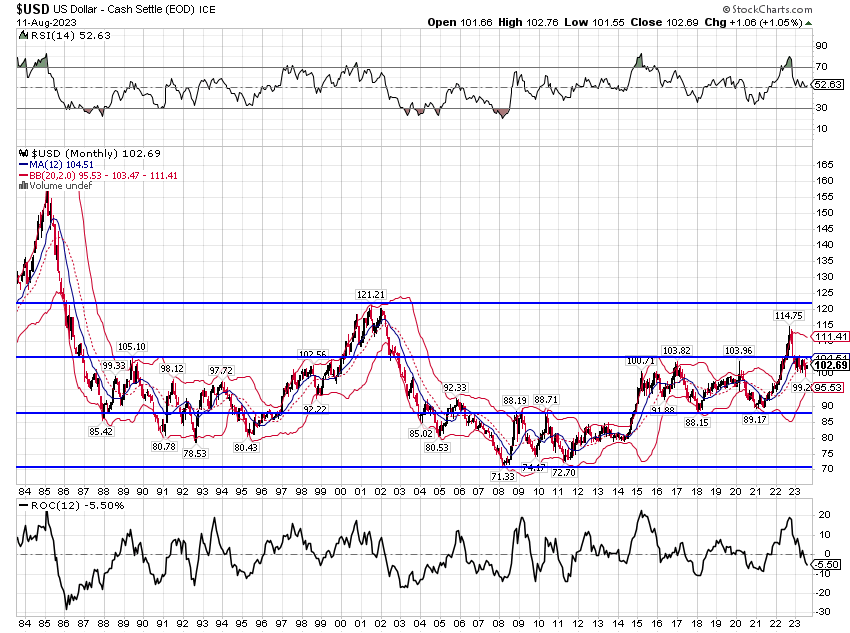

The short term trend of the dollar is neutral to slightly negative. The intermediate term trend is also fairly neutral but the level today is still roughly 13% higher than the beginning of 2021. The long term trend is more obvious and it is up although there is room for it to fall more to the long term uptrend line.

(Click on image to enlarge)

The real question – and it is a very important one – is whether the dollar’s short term downtrend that started in October of last year will be sustained. Will the dollar break the longer term uptrend? If so, the implications are huge as the tactical positioning proscribed for that environment is very, very different from what has worked since the uptrend started in 2011. A falling dollar means value over growth, international over US and commodities outperforming. We remain positioned for a weak dollar outcome because it has been cyclical in the past and macro fundamentals point in that direction (deficits). Long periods of strength are followed by long periods of weakness. At a minimum we expect the dollar to fall, over time, to the bottom of the middle channel in the chart below, a level around 90.

(Click on image to enlarge)

Long term trend changes in the dollar do not happen quickly or in a straight line. But they do happen as global growth prospects shift. In general, currencies move on changes in relative real growth expectations, which as noted above, means currencies move based on relative changes in real interest rates. US real rates have risen but the dollar hasn’t risen much because real rates are rising in other places too, particularly emerging markets (outside of China).

Of course, it really doesn’t matter why interest rates and the dollar are doing what they are. For investors, the reason is mostly irrelevant. It is the trends that matter and until they change, we have to respect them.

Markets

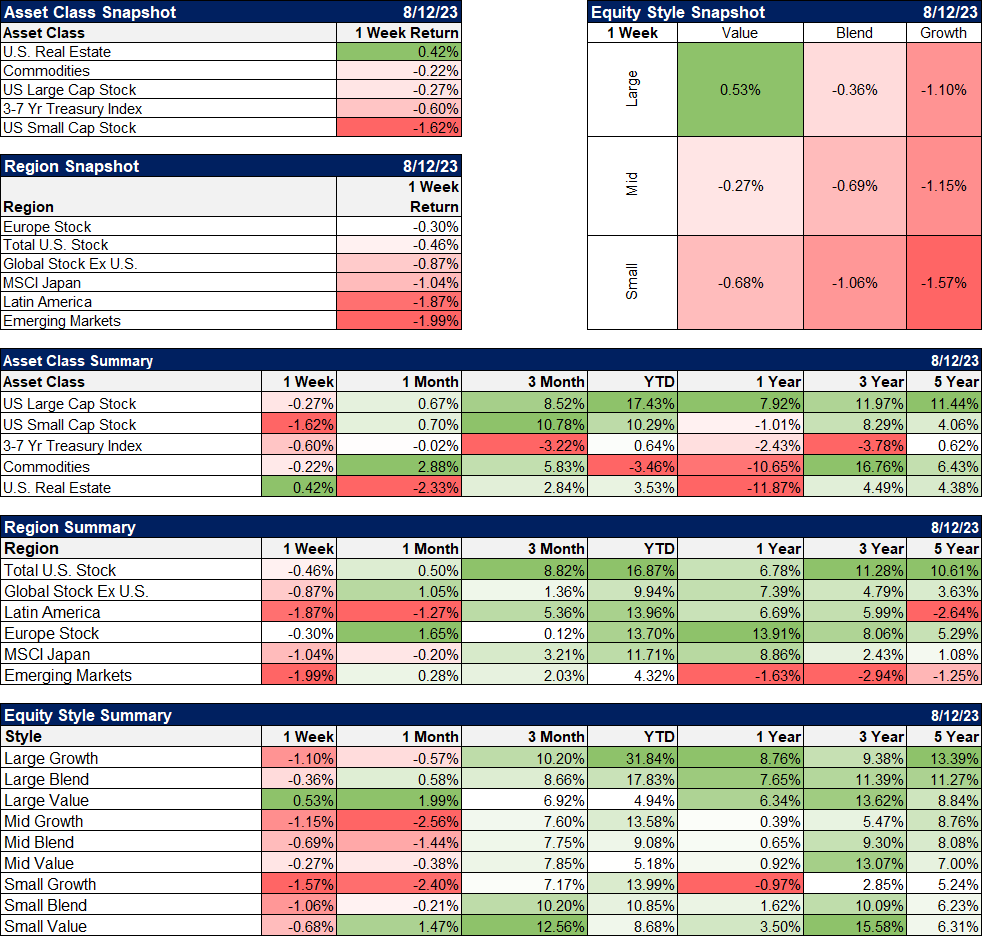

Real estate was the only major asset class to post a gain last week, which is somewhat surprising given the rise in rates but markets don’t always do what is expected of them. Real estate is still the worst performing of the major asset classes over the last 1,3 and 5 years. That doesn’t mean it should be avoided by the way. If you have a diversified portfolio that you rebalance regularly, you will periodically sell some of the winners and use the proceeds to buy some of the losers. That’s called the rebalance premium which is nothing more than the result of implementing the old buy low, sell high adage. Point being that when considering new investments, you should probably be looking at the asset classes that have done poorly recently, not the ones that have been hot.

Large cap value was positive last week and the one year return gap between growth and value continues to narrow. Small and mid cap value one year performance is already above the one year growth return and the three year returns for value are much better than growth. When thinking about value vs growth I think you need to look deeper than just the large cap space.

(Click on image to enlarge)

The reason value outperformed last week is pretty simple – energy and healthcare were the best performing sectors. Energy stocks have been the best performers over the last three months. They performed well last week despite crude oil being up less than 1% because natural gas prices surged by 7.5%. Natural gas has been in a choppy uptrend since April and along with crude oil, is on the verge of a breakout. The stocks look extended here but unless there is some big shift in the supply/demand picture, dips should probably be bought (Alhambra owns IEO and various individual energy stocks).

Healthcare stocks have gone nowhere for the last two years but a big surge in outperformance looks iffy on a valuation basis. Medical device makers in particular look quite expensive based on the recent growth rate. Maybe there is about to be a spate of innovation but it hasn’t emerged yet. Other parts of the healthcare market (healthcare providers and pharma) don’t look as expensive.

(Click on image to enlarge)

Market/Economic Indicators

The big data last week was obviously inflation related and it seemed okay but the moderation of inflation was well expected and didn’t have much impact on markets. Economic growth is probably the place to look for surprises.

Credit spreads fell again last week and are now a full year past their peak in July of last year. The trend is obvious and not what you would expect if we were on the verge of recession. While there are no guarantees in markets, spreads will likely be rising ahead of recession, not falling.

(Click on image to enlarge)

The rise in TIPS yields is not getting a lot of press but it is important for investors and the economy more broadly. It is an indication that fear of inflation has ebbed and that can only be a good thing. Will it last? That is the $64,000 question and I don’t have a definitive answer. But higher real rates are, in a way, a self fulfilling prophecy. Higher real rates today are evidence of increased investment and increased investment should raise productivity. And rising productivity in turn should reduce inflation and raise growth over the long term. I think that’s what we call a positive feedback loop.

Increased investment doesn’t necessarily mean productive investment. And the bipartisan fascination with industrial policy – government directed investment – may be evidence that today’s investment turns into tomorrow’s write-off. But we won’t know that for years. In the meantime, it certainly looks like good news.

More By This Author:

Weekly Market Pulse: Expect The UnexpectedWeekly Market Pulse: Soft Landing?

Weekly Market Pulse: The Broadening

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more