Weekly Market Pulse: The Broadening

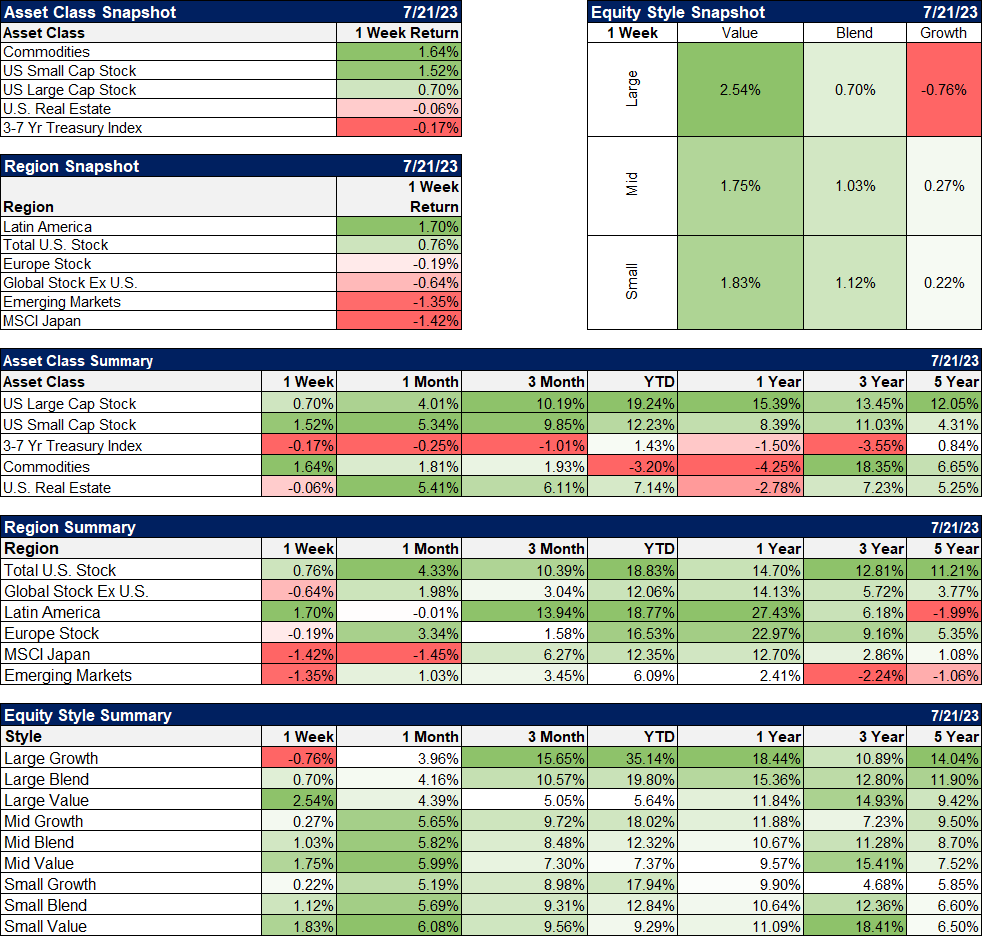

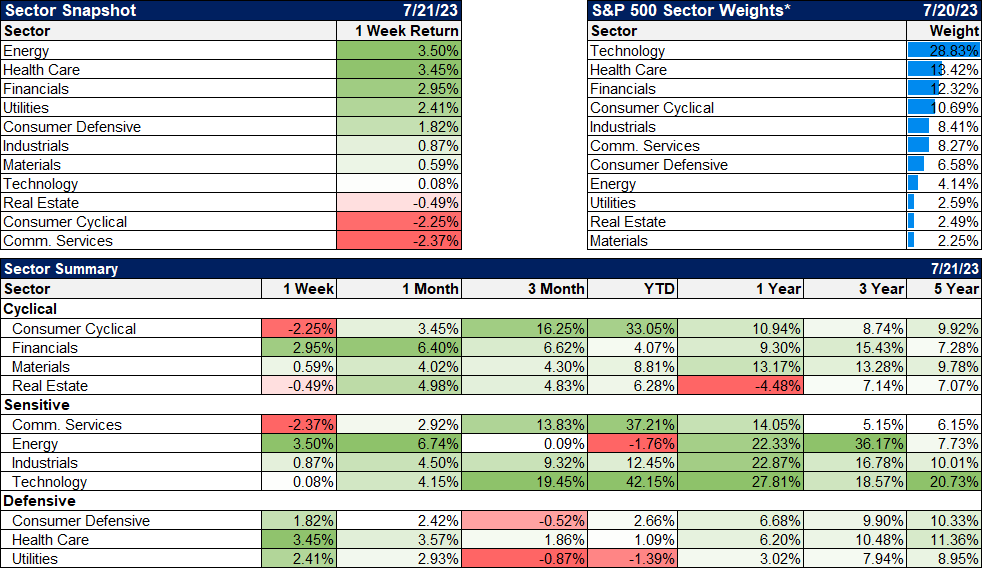

This market rally from the lows of October 2022 continues to surprise and impress. It started off as a very narrow rally where a few big tech names were pushing the S&P 500 higher, but there is much more participation now. This stock market run has really broadened out as even real estate is performing once again. 75% of stocks in the S&P are now above their 200-day moving average, while 88% are above their 50-day MA. These are spectacular numbers, but as we all know, nothing just goes up forever. We are probably getting close to a short-term top here, especially given that 50-day MA reading.

The classic weak dollar plays are (finally) starting to emerge. Small cap stocks, value stocks, and commodities all had a good week. As a matter of fact, small cap stocks and real estate (another weak dollar play) have outperformed US large cap stocks over the last month. Real estate in particular has been an unloved asset class for some time now, but there are reasons you want to invest soon. The work-from-home/return-to-office mess is really a US-centric dilemma, and one that afflicts only certain demographic areas of the country. Vacancy rates are healthy in various regions in the US, and as for the rest of the world, they already went back to the office. Vacancy rates in Europe are at normal pre-COVID levels. There are, as there always are, places with issues (London Canary Wharf for instance) but overall international real estate doesn’t have the same issues as the US.

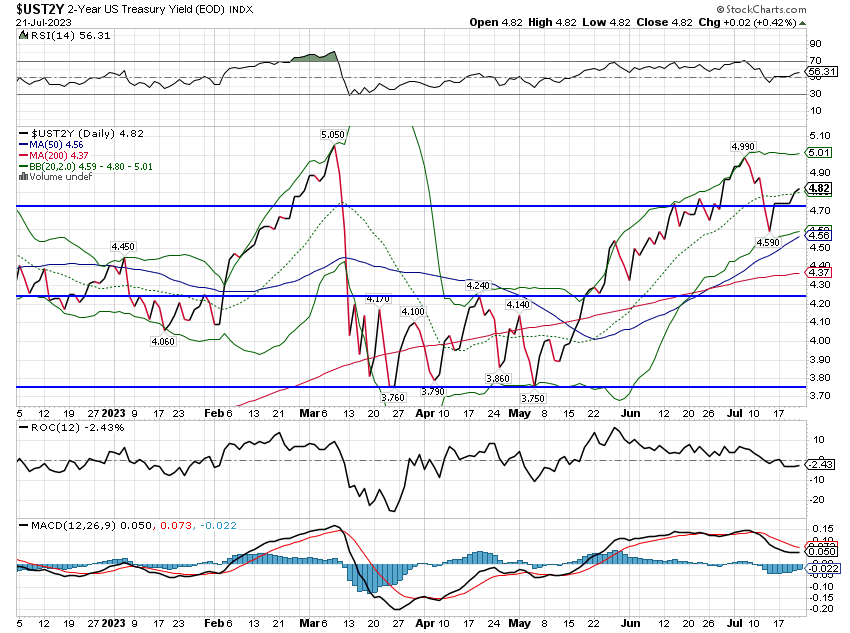

Environment

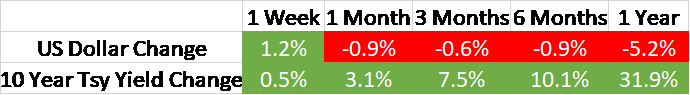

After dropping over 2% last week, the US Dollar rebounded some to take it back above its Bollinger band. You have to be a seller of the dollar here if it can’t clear the 102 level (intermediate-term downtrend line) soon. The longer-term trend remains higher but it finds itself in a precarious position. A tick under 98 and that will be at risk as well.

(Click on image to enlarge)

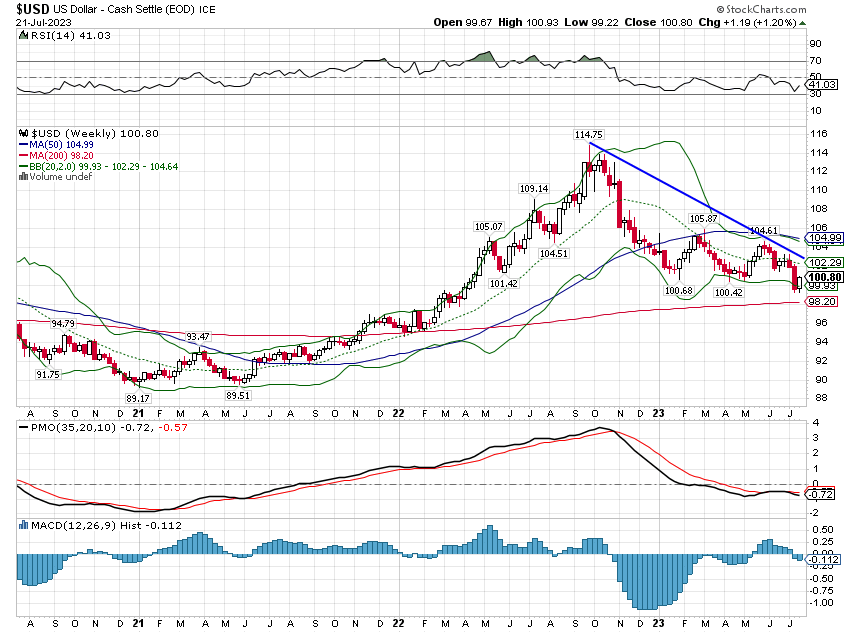

As for the 10-year Treasury yield, its uptrend remains on track, both in the short and intermediate term, this following last week’s close to 6% drop. Over the last few days, the 50-day moving average crossed over the 200-day MA in what is known as a Golden Cross. In technical terms, it tends to be a bullish signal when the index holds above the 50-day MA (as it did this past week) amidst the commencement of a Golden Cross. The big bond rout may not be over just yet.

(Click on image to enlarge)

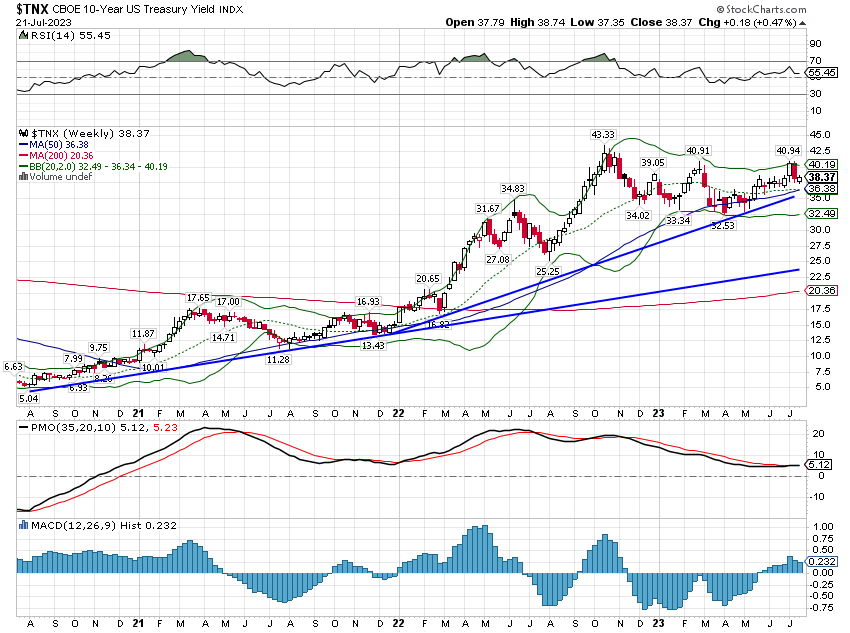

The 2-Year Treasury yield is also trying to break higher but still finds itself below its March highs. Could we retest that level this coming week?

(Click on image to enlarge)

Markets

(Click on image to enlarge)

Commodities led all asset classes for the week, with US small caps a close second. Crude oil was up 2.2%, natural gas was up 6.9%, and most agricultural commodities (wheat in particular) were also higher because of the collapse of the Black Sea grain deal and Russia’s renewed threats towards any seaborne vessel in the Black Sea.

(Click on image to enlarge)

US small caps have been on a tear since its own Golden Cross technical signal last month. It now finds itself testing the recent high of 208. A pullback to the 200 level, as represented by VB (Alhambra owns), is likely.

Regionally, non-US markets were mostly down with the exception of Latin America (1.7% gain for the week). Latin America’s outperformance was due to its commodity-centric economies, while the rebounding US Dollar impacted the rest of the world. Japan was the big loser, down 1.4%. The Yen fell at the end of the week on speculation the BOJ would leave policy basically unchanged. We at Alhambra are a bit skeptical of that and we remain bullish on Japan.

Europe continues to benefit from a falling US Dollar, as it was down only slightly even after a big 6% gain last week. Emerging markets, pulled down by China, were one of the worst performers in the last week (-1.35%).

Now onto equity style: Value outperformed Growth in the last week, by a spread of over 3% in the large cap space. Large value was up strongly as energy (3.5%), healthcare (3.45%), and financials (2.95%) surged in the last week. While growth (ie. tech, communication services) is the story of 2023, we do believe that value will be the place to be for the next few years.

(Click on image to enlarge)

Market/Economic Indicators

(Click on image to enlarge)

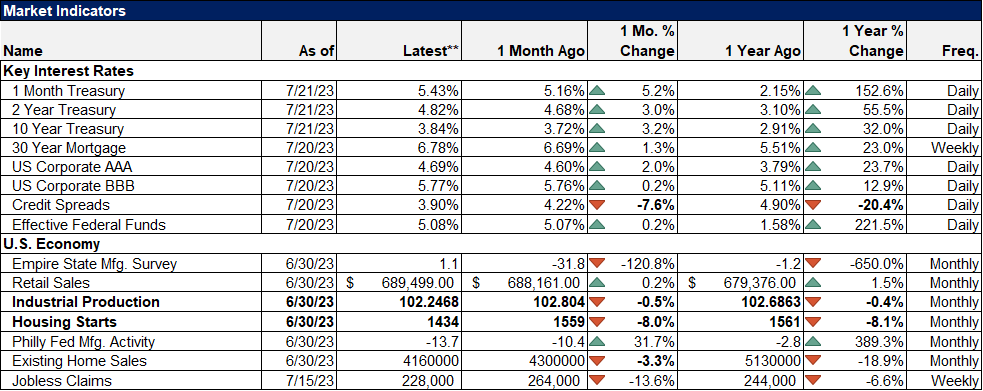

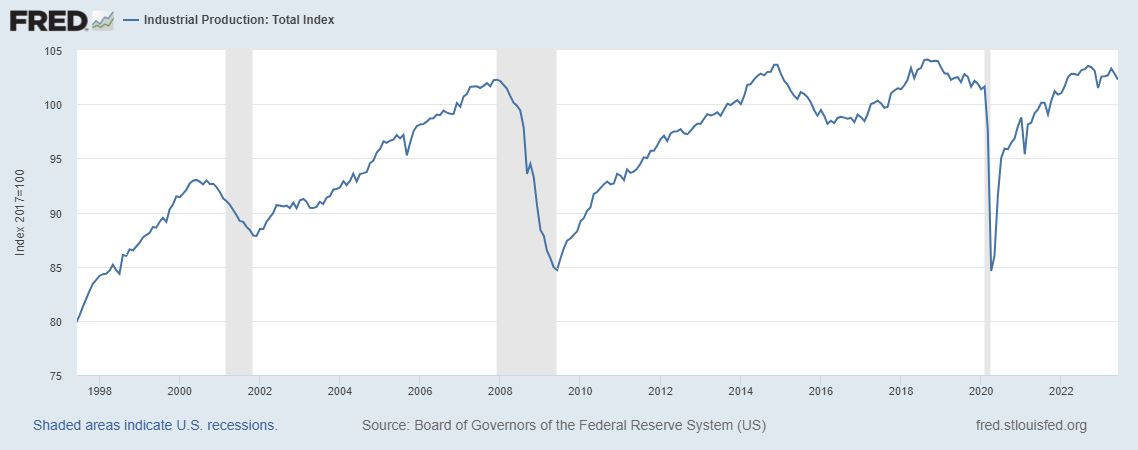

Bonds were down on the week as rates rebounded strongly. This despite the weak economic data trickling in in the last few days. Retail sales were up just 0.2% and 1.5% year-over-year and that isn’t adjusted for inflation. A gain of 0.5% was expected by economists. Ex. gas and autos were slightly better at 0.3% but still disappointing. Industrial production was down 0.5% when a 0.1% gain was expected. Production has been restrained by a soft export market, efforts to work down inventories, and more limited consumer spending. Industrial production is not a particularly useful tool to predict recessions though; the index remains essentially unchanged since December of 2007.

(Click on image to enlarge)

All this to say that despite the risks and uncertainties that prevail and absent some seismic market/economic event, recession is just not on the horizon. Credit spreads have narrowed back to levels that reigned prior to the start of Fed rate hikes in the spring of last year. There just isn’t enough stress in the credit markets to back away from the markets at this moment. Now that doesn’t mean that we can’t get a correction or two in certain segments of the market in the coming months. As a matter of fact, we still expect some kind of a sell-off in the large-cap indexes later this summer as sentiment is getting a bit frothy and too bullish given the uncertainties at play. But this is exactly why we diversify across multiple asset classes, including real estate, commodities, bonds, international stocks, and small-cap stocks. While one asset class zigs, the other may zag, and over time you have a portfolio with solid and comparable returns** while taking less risk overall.

**compared to a traditional 60/40 portfolio

More By This Author:

Weekly Market Pulse: Where’s That Correction?

Weekly Market Pulse: Recession 2025?

Weekly Market Pulse: Growth Stocks Win The First Half

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more