Value Vs Growth

These are always separated by the media and investors. I prefer Buffett’s quote on it:

“Value without growth is like sex without orgasm”

Both are extremely important factors.

“Davidson” submits:

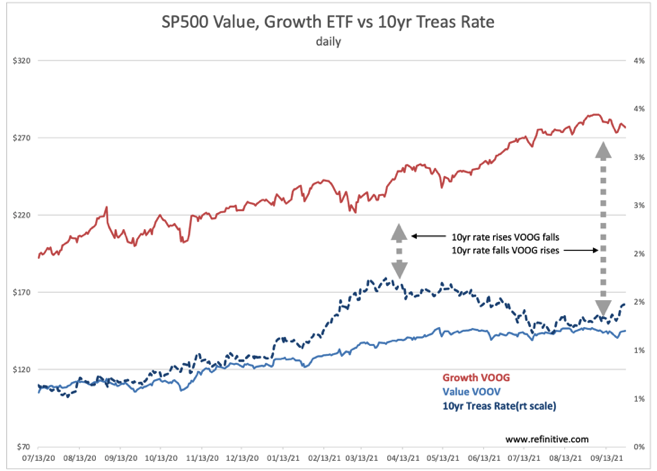

Value (VOOV) vs Growth (VOOG) vs 10yr Treas rate provide insight of trading algorithms at work. Investing based on anticipating short-term market psychology swings is always problematic Momentum Investors, the developers of trading algorithms, will always be first to detect a price-trend change. Even if they are eventually shown to have been mistaken by fundaments which emerge slowly over a much longer time frame, they always have an impact on market pricing, at least for the period of adding/withdrawing capital from positions, simply because they trade with leverage to multiply their impact on the trend. Such a flow of funds shift appears in the works currently. In SP500 Value, Growth ETF vs 10yr Treas Rate there is a correlation of higher rates weaker VOOG/stronger VOOV that relates to headlines favoring economic reopening. This is opposed to further issues from COVID the belief of which has favored VOOG.

Media reports have one believe that economic activity is always on tenterhooks ready to improve or weaken at a moment’s notice. They would have you believe the economic trend is identifiable in the most recent report. Few seem to notice that past monthly reports are revised, you got it, monthly! The data on which so many hang analysis and trading activity on is routinely made irrelevant the following month. Yet, these investors remain supremely confident even after decades of revisions denigrating past assertions.

The phrase “on tenterhooks” means “waiting nervously for something to happen”. A tenterhook is literally a sharp hook that fastens cloth to a tenter, a frame on which cloth is stretched, like a tent, for even drying to prevent shrinkage.

Because Momentum Investors use leverage to boost quarter-to-quarter returns on which they live or die, it is this binary when using leverage at levels up to 10x, price-trends which are their immediate focus are their basis for assigning positive/negative commentary to any current fundamental report. They routinely treat reports based on opinion, the PMI for example, as an economic indicator of equal value to employment which is hard-count data. Another example is treating Job Opening data as having the same value as the Household Survey. The former is an anticipated outcome based on those expecting to hire, which is market psychology that is not cast in stone. The Household Survey, while being a statistical survey, is the best count of employed individuals and not revised monthly. Job Opening data and the Household Survey are nowhere of equal value. Taking this further, it is only the multi-month trend that has value in assessing economic direction. With individual equities it is more complex requiring a multi-year assessment of management capability, comparing what they said they would do vs what they eventually did. Even more important for businesses are the actions management took to deal with unexpected events and whether they remained consistent with their history.

With a fundamental approach, investors must be continuously aware of short-term shifts in market psychology. Surges in pessimism or optimism always provide opportunity even if the net decision is to simply hold current positions. Being aware of conditions on the go is educational and reminds one how much Momentum differs from what is occurring fundamentally. Being aware makes one a better long-term investor.

Rates rising since mid-Aug 2021, WTI rising(not shown on this chart) results in VOOV rising as VOOG stalls.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more