U.S. High-Yield Default Rates Double…Quality Matters

While March seems like a long time ago (at least for me), the repercussions of perhaps the worst two-week period in the U.S. high-yield (HY) arena are now showing through some five to six months later. Interestingly, the news seems to have flown under the radar up to this point, but according to Moody’s, speculative-grade default rates in the U.S. have been increasing at a rather swift pace through the summer months. Naturally, from a fixed income portfolio perspective, this development underscores our thesis that screening for quality within the HY sector remains of paramount importance.

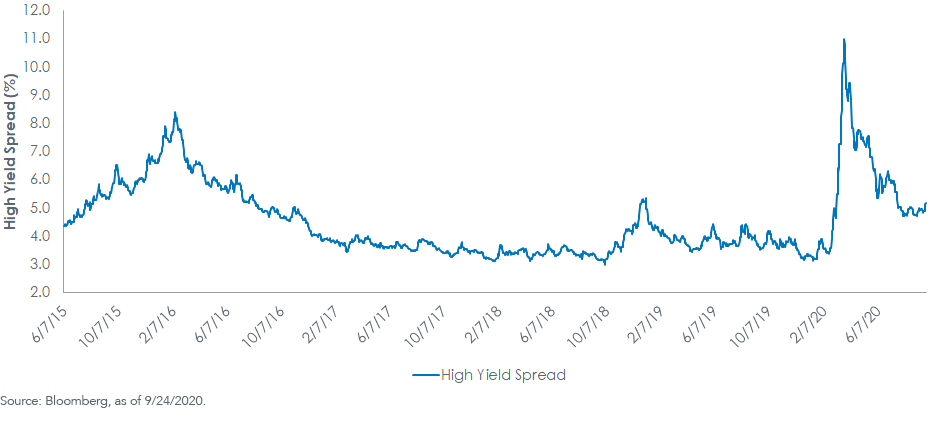

Before I get into the default numbers, let’s take a look at recent developments within the HY market. Spread levels have been on a noticeable downward trajectory from their peak level on March 23. At its “wide,” the spread had spiked to 1,100 basis points (bps) (the second-highest on record), representing an incredible 750 bps increase from about the President’s Day holiday. Since then, the reading has narrowed by 580 bps, retracing about 77% of the aforementioned widening (see graph).

High-Yield Spread

Back to the default numbers. As I’ve written before, HY spreads and default rates have an interesting relationship. Using the previous two periods of spread widening, the peak in high-yield spreads occurred 11 months prior to the peak in default rates in both instances. It appears as if history is repeating itself on this front. When the high watermark in HY spreads was printed in March, the U.S. speculative-grade default rate for the month was 4.9%, according to Moody’s. For August, that number had risen to 8.7%. For more perspective, the December 2019 level was 4.3% while the year-ago reading was only 3.2%. It certainly seems as if the default rate is heading back toward double digits for this cycle, and if the prior trend holds, the peak will register around February 2021. For the record, the number got up to 14.7% following the financial crisis/great recession, an all-time record. In fact, there have been only three other times the default rate was in a double-digit territory in the modern era.

Fixed Income Solutions

We continue to believe there is relative value in the U.S. HY market, but as I mentioned, screening for quality is of paramount importance. The WisdomTree U.S. High Yield Corporate Bond Fund (WFHY) follows this approach by focusing solely on public issuers and eliminating those with negative cash flow. This strategy is designed to mitigate potential default risk, a key factor to consider given the expected HY backdrop in the months ahead.

Unless otherwise stated, all data sourced is Bloomberg, as of September 24, 2020.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more