Monday, August 22, 2022 6:13 PM EST

Quote of the day: “Use your eyes to see the possibilities, not the problems.”

— Clintonian Maximus

Commentary

The old adage of “no news being good news” doesn’t always apply. There were no notable bullish or bearish events, e.g., earnings or economic data, to report in today’s trading session. Fed Chairman Powell will provide stock market investors with plenty to consider when he speaks this Friday at the annual Jackson Hole Economic Policy Symposium. Aside from that, Tuesday will reveal the latest update for Manufacturing PMI numbers. Given recent trends and expectations, a contraction instead of an expansion would not be a surprise.

(As a sidebar note, a weaker economy accompanied by continual interest rate hikes is a recipe for stagflation and becomes a difficult quagmire for the market and Federal Reserve to navigate. Fortunately or unfortunately, most of the inflation the U.S. and other global regions are experiencing is not directly attributable to domestic policies but is rooted in geopolitical issues, e.g., supply-chain disruptions from the Covid pandemic and the Russia vs Ukraine war. A reversal in either of these at some point would have a positive impact on relieving inflation.)

Similar to Friday, there are no safe places to hide and protect capital, with the exception of the US Dollar. Market breadth for 5-day highs vs 5-day lows and 52-week highs vs 52-week lows is overwhelmingly negative. Even more disturbing has been the rapid deterioration of support for the percentage of stocks trading above their 200-day moving average: SP-500 (36.77%) and Nasdaq-100 (28.43%). While on the topic of bad news, we might as well disclose all. The latest analysis of the TMI 100-Club, which represents stocks belonging to the SP-100 and Nasdaq-100 indexes and comprises 173 members, indicates more than 76% are in death-cross mode (50-day moving average below 200-day moving average). Yikes… Pretty scary and it’s not even October yet.

|

Bullish Events

|

|

| |

|

|

Neutral Events

|

|

| |

|

|

Bearish Events

|

|

Technically Speaking

How bad can it be or how bad can it get? The S&P 500 is currently testing support at the lower range of its short-term bullish channel and two recently previous support levels. The probability of it breaking support is fairly high as its intermediate trend is showing a bearish channel pattern in which it has zigged and zagged upward and downward since the beginning of Jan-2022. Based upon my analysis, the daily chart indicates fairly solid support @ 3916 or @ -5.36% of downside risk. The next two lower support targets show downside risk ranging from -9% to -12%. If one is not willing to tolerate this level of risk, then hedging strategies may be considered.

(Click on image to enlarge)

Capital Markets

|

Stocks

|

- Performance: SP-500 @ 4138.00 (2.14%); Nasdaq-100 @ 12980.54 (-2.66%); Russell-2000 @ 1915.74 (-2.13%); DJ-30 @ 33063.62 (-1.91%); DJ-Transports @ 14539.02 (-1.58%); DJ-Utilities @ 1040.96 (-1.43%); VIX @ 23.81 (+15.64%)

- Leading Sectors: n/a

- Lagging Sectors: Consumer Discretionary (XLY); Financials (XLF); Materials (XLB); Technology (XLK)

|

|

Bonds

|

- Performance: 10-Yr Treasury rates @ 3.03 (+1.68%); 10-Yr T-Note @ 117’27’5 (-0.21%)

- Comments: 10-Yr Treasury Yield makes a new 21-day high.

|

|

Currencies

|

- Performance: USD @ 108.96 (+0.80%); EURUSD @ 0.99409 (-0.93%); JPYUSD @ 0.72700 (-0.44%)

- Comments: US Dollar makes new 6-week high. However, the Euro is extremely oversold and may see a correction to the upside. Anticipate a relief rally soon in EURUSD.

|

|

Cryptocurrencies

|

- Performance: Bitcoin @ 21127.27 (-0.70%); Ethereum @ 1581.304 (-6.22%); Binance @ 298.828 (+5.09%); Cardano @ 0.455071 (-0.94%); Ripple @ 0.336837 (-1.31%)

- Comments: n/a

|

|

Commodities

|

- Metals: Gold @ 1735.40 (-0.66%); Silver @ 18.9823 (-0.35%); Copper @ 3.6835 (+1.01%)

- Energy: WTI Crude Oil @ 90.23 (-0.59%); NatGas @ 9.680 (+3.68%); RB Gasoline @ 2.8912 (-4.19%)

- Grains: Wheat @ 777-2 (+3.29%); Corn @ 708-4 (+0.89%); Soybeans @ 1528-0 (-0.33%)

|

|

Real Estate

|

- Performance: DJ Real Estate Index @ 381.70 (-2.09%); DJ Home Construction @ 1195.53 (-2.16%)

- Comments:

- DJ Real Estate makes new 3-week low and violates support of 22-day m.a.

- DJ Home Construction makes new 5-week low and testing support @ 55-day m.a.

|

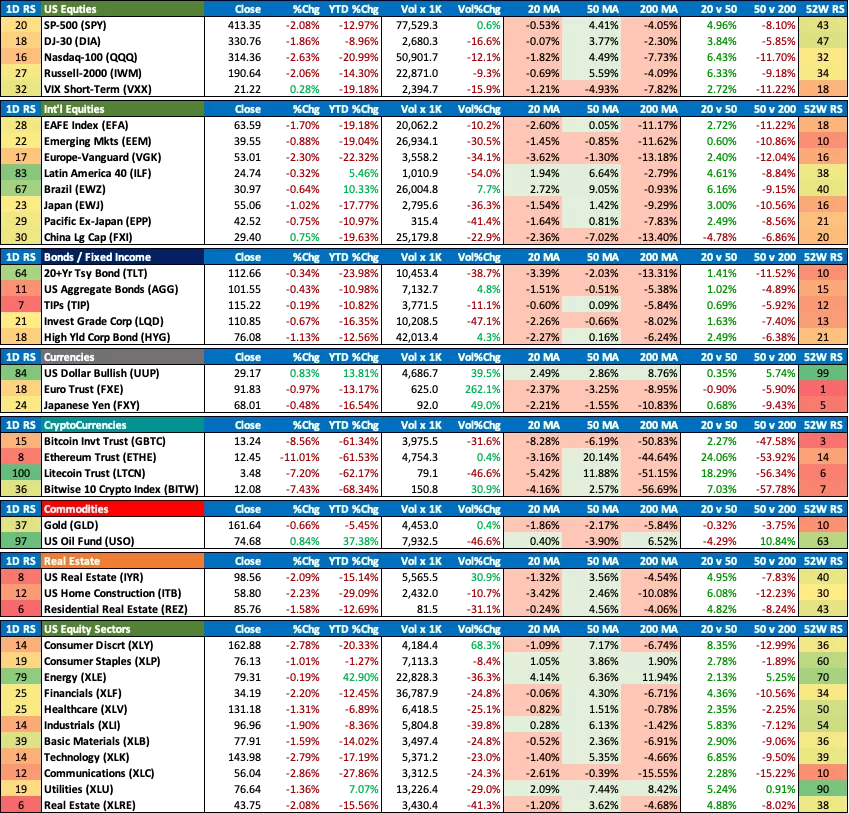

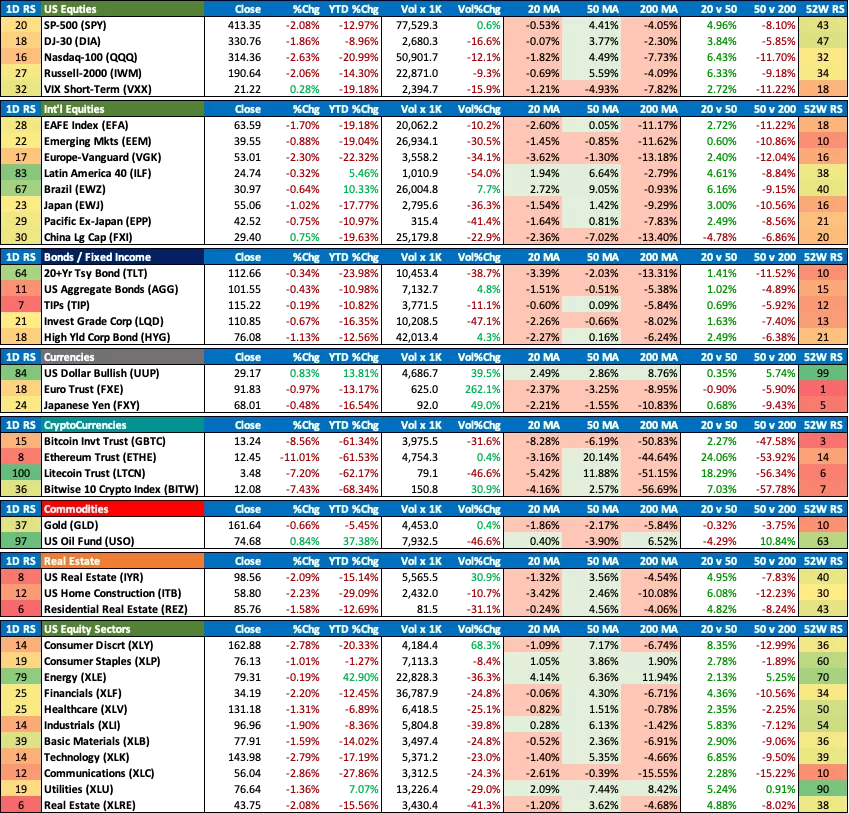

Daily ETF Performance Monitor

(Click on image to enlarge)

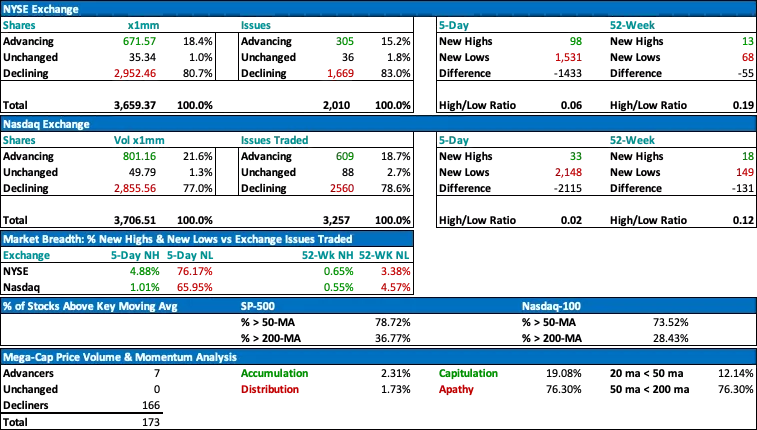

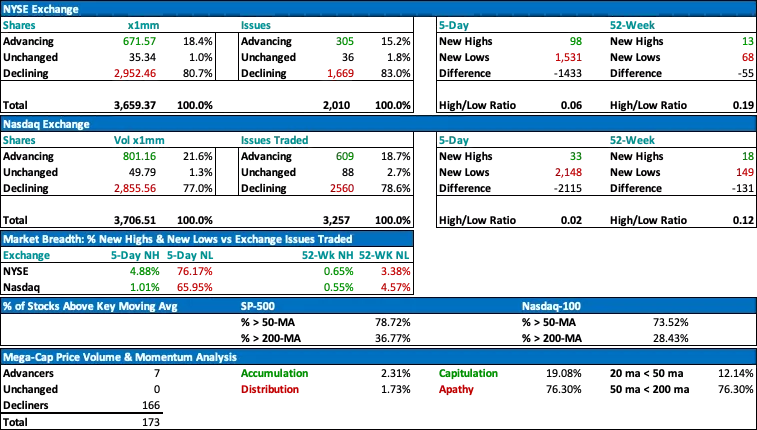

Market Diary

(Click on image to enlarge)

Earnings

|

Sector

|

Positive Surprise

|

Meeting Expectations

|

Negative Surprise

|

|

Technology

|

ZM*; PANW*

|

|

|

*Earnings reported After-market hours

Market SWOT Analysis

|

Strengths (happening now)

|

Weaknesses (happening now)

|

- Energy Production Capacity Growing: Decline in WTI Crude Oil rapidly accelerating and the mantra that higher prices correct higher prices is being realized. Even more significant is the contraction in RBOB Gasoline futures, which ultimately translates into relief at the gas pumps for American consumers.

- Strong Employment Situation: The July-2022 employment report indicated a 528k increase of new jobs vs June-2022’s already robust gain of 398k. The unemployment rate is ticked lower to 3.5% vs prior @ 3.6%. It’s a tight labor market and therefore wage inflation should be expected. However, it the Fed is able to reign in high fuel and food prices by raising rates, then this creates a situation for a strong recovery in consumer activity.

- Cryptocurrencies: Bitcoin and Ethereum are proxies or investor sentiment toward risk and appear to have found support and are initiating new uptrends. If so, this could have bullish implications for equity markets.

|

- Untamed Inflation: Consumer prices (CPI data), which are closely monitored by the Fed, have been trending above 8%+ with the potential for double-digit inflation. The June 2022 report to be released in July 2022 could trigger more aggressive rate hikes.

- Geopolitical Risk in Greater China: House Speaker Nancy Pelosi’s visit to Taiwan has clearly upset China and emboldened it to step up its military exercises and threaten invasion of the island. The risk of confrontation with the U.S. must be balanced and taken into consideration.

- Continued Disruptions in China Supply Chain: Covid infection rates are increasing and prompting Chinese officials to once again shut down its economy, thus exacerbating supply chain bottlenecks.

|

|

Opportunities (could happen)

|

Threats (could happen)

|

- Lower Energy Prices: The Federal Reserve’s resolve to combat inflation with aggressive rate hikes will have the collateral effect of creating a stronger dollar and, if a soft landing is achieved, a mild recession will contribute to demand destruction for energy and lower prices for consumers. A decline in energy prices could reignite consumer demand and confidence, especially if the labor market remains stable.

- Cutting a deal with Iran: The U.S. and Iran are currently negotiating to end sanctions and bring Iranian oil back online if certain parameters for nuclear testing and development can be accomplished. If so, this would immediately alleviate any supply imbalance in the energy markets as Iran has the capability to restart production almost immediately. A successful outcome for these negotiations could happen instantaneously and presents a legitimate risk for anyone committed to long exposure to crude oil futures or the actual product itself.

- EU negotiations with Iran: More than 15 months have been invested between the U.S. and Iran to revive the 2015 nuclear deal. It is reported that EU officials have submitted a final text for Tehran to sign. In the event this actually happens, it would have the same aforementioned bearish implications for Oil prices.

|

- EU Winter Energy Supply: Russia could weaponize its energy supplies to EU countries for the upcoming winter in response to sanctions imposed against it as well as the military and financial aid it is providing Ukraine to thwart its invasion. If so, energy prices could explode higher.

- Analysts Downgrades and Revisions: As the Fed continues to tighten, another wave of negative earnings revisions would require recalibration of equity market valuations.

- Global Food Inflation and Famine: Russia vs Ukraine conflict has the potential to destabilize food supplies and create a domino effect of food inflation and famine in LDCs as well as more developed countries.

- Mid-term elections: The outcome of the upcoming election in November is uncertain and given the divided state of the US, it could bring about more uncertainty and exacerbate the gridlock for which Washington DC is notorious.

|

More By This Author:

TMI Market Notes: Overbought Market Consolidating But Vulnerable To Correction

TMI Market Notes: Overbought Stock Market Confirmed By Buyer Apathy

TMI Market Notes: Market Gets High on the Latest CPI

Disclosure: JCH Investment Advisory and Consulting Services, Technically Macro Insights LLC (“TMI”), or its affiliates may own positions in the equities or securities mentioned ...

more

Disclosure: JCH Investment Advisory and Consulting Services, Technically Macro Insights LLC (“TMI”), or its affiliates may own positions in the equities or securities mentioned in this report. Lastly, note that no form of compensation is received from any of the companies covered in this report.

Disclaimer: This report is not distributed for the purpose of providing individualized market advice. The information published in it regards securities in which it is believed that readers may have interest and this report only reflects sincere opinions on the investment markets and events or news impacting them. Nevertheless, this report is not intended to be personalized recommendations to buy, hold, or sell securities. Investments in the securities markets, and especially in options or futures, are speculative and involve substantial risk. Each individual investor should determine their respective appropriate level of risk. It is recommended that you seek personal advice from your professional investment advisor and conduct further independent due diligence research before acting on any information published in this report. Most of the content contained herein is derived directly from information published by the companies mentioned in this report and/or from other sources deemed to be reliable, but without independent verification of such. Therefore, no assurance of the completeness or accuracy of information contained within is guaranteed and in no manner warrants or guarantees the success of any action which you take in reliance on its statements and opinions.

less

How did you like this article? Let us know so we can better customize your reading experience.

Good stuff. Have anything more current?