The Winner Is Gold

It’s been a decent year for big league assets like the Dow, the dollar, and for the greatest asset of all, which of course is gold.

(Click on image to enlarge)

While the Dow traditionally struggles in ultimate money (gold) terms, it’s only down about 10% in 2022.

In contrast, stock market investors who tried to outperform the Dow with an array of “market leader” stocks… they are now almost financially annihilated.

Investors who consistently buy the Dow at my HSR (horizontal support/resistance) zones on the weekly chart are in great shape.

(Click on image to enlarge)

For 2022, the dollar is down only slightly against the ruble. A big USD/RUB rally likely means the Ukraine war is worsening. If so, gold should surge higher… against everything except the miners.

(Click on image to enlarge)

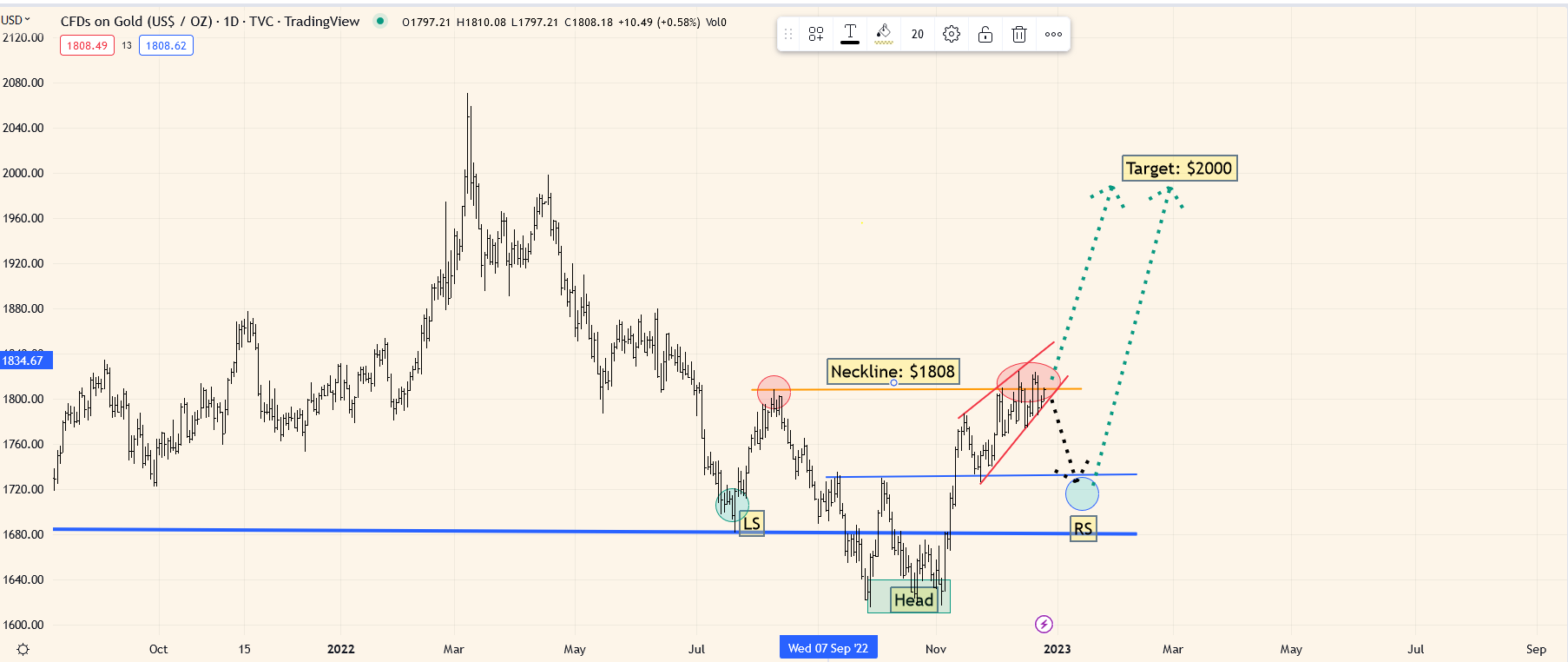

key daily gold chart

The more time that passes, the less likely it is that gold drops towards $1700 to form a right shoulder of an inverse H&S pattern…

And the more likely it becomes that the “Queen of Assets” simply soars towards $2000!

Also, the extended pause in the $1808 zone means that a significant breakout through that area turns it into a massive floor of support.

Together with a potential February gold tax cut in India, the Chinese lockdowns pivot bodes well for physical gold demand in the early months of 2023.

(Click on image to enlarge)

bullish oil price chart

New support zones are forming and there is substantial bull wedge action.

Also, as the Chinese pivot intensifies, Biden is ending the SPR sales and he’s beginning some purchases. A Fed pivot is madness. It would create hyperinflation, but a pause in rate hikes is likely as America slides into recession, and that’s more positive news for gold.

What about the new oil, aka copper?

(Click on image to enlarge)

In the spring of 2022, I outlined $3.20 as a key buy zone for copper and suggested investors focus on the COPX ETF and related component stocks.

Is it too late to buy now? Once the 2021-2025 war cycle ends, the transition from brown to green energy will resume in earnest. Copper should trade in the $10-$20 range then, and copper companies (many of whom also mine gold) should become gigantic cash cows.

As the world becomes totally dependent on copper as the conduit for its electrical energy, spikes to $100/lb could occur.

(Click on image to enlarge)

COPX chart

While the July lows are almost certain to be viewed as generational lows in the years ahead, there’s still fantastic value for investors who get their grub stakes now.

What about US interest rates? Gold bugs and stock market investors have vivid memories of the 2008 OTC derivatives and the 2020 Corona crisis. Those were mammoth events.

A regular recession (which likely lies ahead) is not that kind of event. It is not grounds for a huge Fed pivot that features QE and rates near zero.

(Click on image to enlarge)

long-term US rates chart

Gold and silver do well when there is a deflationary or liquidity crisis and the Fed pivots to easy policy…

But they do even better when the Fed goes into panic mode and hikes rates to try to stop inflation that threatens to go out of control… and fails to stop inflation.

That happened in the 1970s and America is likely at the cusp of a similar era now.

Silver tends to outperform gold in these types of situations. The miners tend to outperform everything… and do it by a country mile.

(Click on image to enlarge)

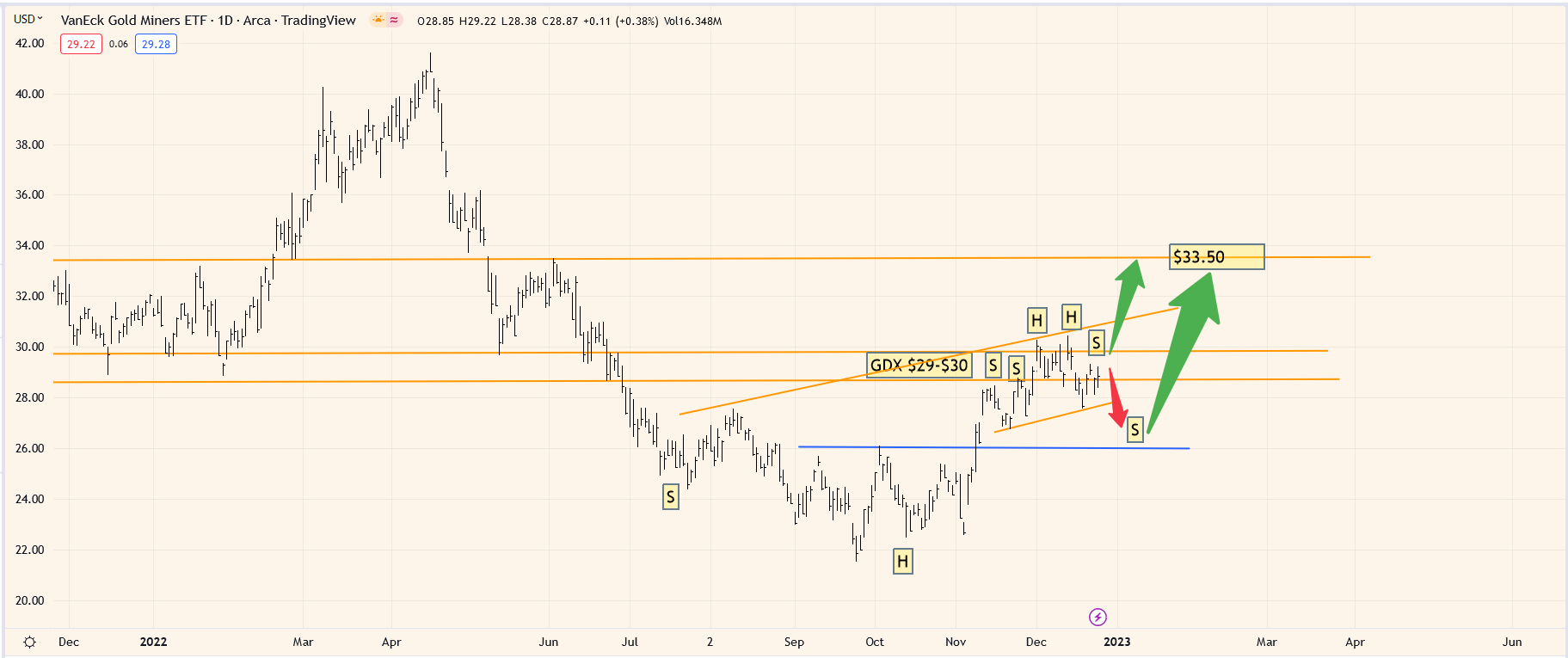

enticing GDX chart

While there’s some minor H&S topping action, the overall technical action is bullish.

The short-term target is $33.50, but fresh all-time highs are possible in 2023, given the incredibly positive action of USD/RUB, oil, copper, and gold!

More By This Author:

Gold, War, & Central Bank Panic

An Era Of Stagflation: Investor Tactics

Exciting Times: It's All About Gold