An Era Of Stagflation: Investor Tactics

When humans are newborns, they rely on mommy and daddy or caregiver. Over time, most children grow up and begin to look after themselves.

Sadly, it appears that some of the kids didn’t make it to financial puberty. They think Jay Powell is Ben Santa Claus Bernanke. After drinking mugs of “hopium” flavored Eggnog, they hang Christmas stockings and wait for Jay to fill them with policy pivots, QE, and rate chops candy like Ben did.

These financial children are going to learn, the hard way, that what lies ahead isn’t policy pivot candy but instead… decades of pain.

For some key insight into the matter:

Ray Dalio, Mo El-Erian, and a few other heavyweight analysts understand that stagflation-oriented pain is what lies ahead, and now it appears that Blackrock does too.

The three Blackrock themes for 2023 are “pricing the damage” (stock markets haven’t priced in the big recession ahead), “rethinking bonds” (long-term bonds will be terrible investments), and “living with inflation” (even a severe recession and restrictive Fed policy won’t get inflation back to 2%).

(Click on image to enlarge)

horrifying US stock market chart.

I’ve suggested that America is in a period like 1965-1966. The end of a multi-decade sideways chop for the market this time… could be the opposite of what it was in 1982.

America’s aging population, the obsession with debt and fiat, and the relentless bullying and meddling in faraway lands while leaving 10 million Cubans in its backyard to rot… all this madness has put what could have been a bigger and better version of Switzerland into a suicidal death spiral.

Of course, this is spectacular news for most citizens of China, for all the “goldaholics” in India, and for the gold bugs of the West who are enjoying the action too.

On that note:

(Click on image to enlarge)

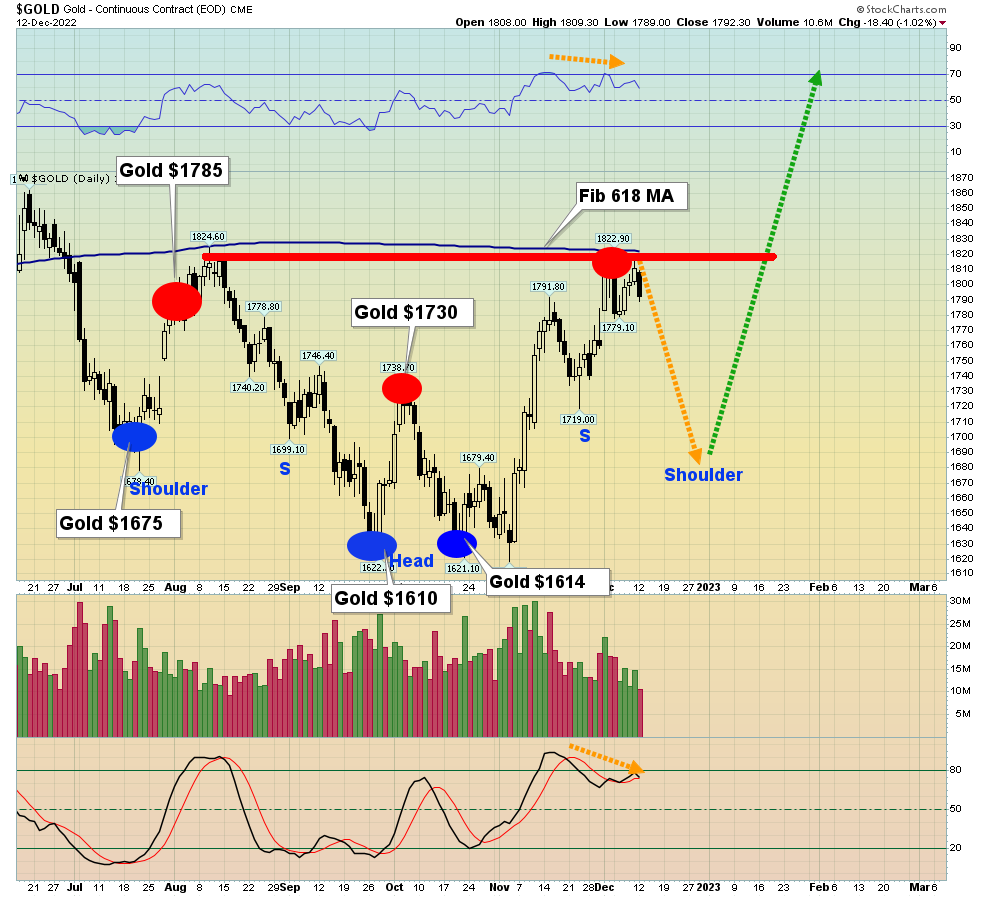

daily gold chart.

I suggested the $1808 marker would halt the advance, and it has.

(Click on image to enlarge)

gold futures chart.

Both charts look fabulous and both have price targets of about $2000, but in one scenario (the first chart) gold moves up from “about here”, and in the other, there’s a pullback to the $1700-$1680 zone first.

For a look at the weekly chart:

(Click on image to enlarge)

Stochastics is overbought. It can stay overbought, but with the CPI and Fed announcements dead ahead, investors should be open to a pullback to $1700 or so.

That would be a simple retracement of about 50% of the rally from $1610 to $1808.

(Click on image to enlarge)

short-term DUST chart.

Bear ETFs like DUST can help investors manage price reactions in the miners… with a smile!

Huge forces of transition are at work. As an inflationary force, the enormous size of the populations of China and India is under-appreciated by most analysts.

China’s government has two pivots in play, the first one being the Corona lockdowns pivot. The second pivot is the move away from focusing on growth and towards becoming self-sufficient. The bottom line:

America blew its chance to become “Switzerland 2.0”, but China appears to be on that path now.

Also, Goldman has called copper “the new oil”. Clearly, copper stocks are going to be an ideal holding for energy-focused investors… for the long term.

(Click on image to enlarge)

bullish COPX chart.

A pullback is likely, but if investors have no positions, grub stakes can be bought right now.

The inflation from the energy transition is being enhanced by the American government’s bungled war-mongering. Euro governments say, “How high?” when the US government says “Jump”. Following orders from America, most Euro governments are trying to penalize their own citizens for not moving fast enough with the green energy transition… while cutting them off from the Russian oil and gas that’s needed for a smooth transition.

This is an exercise in madness, and it’s one of many reasons why (in the medium term) the Fed will become even more restrictive in policy, regardless of the severity of the economic downturn that follows.

(Click on image to enlarge)

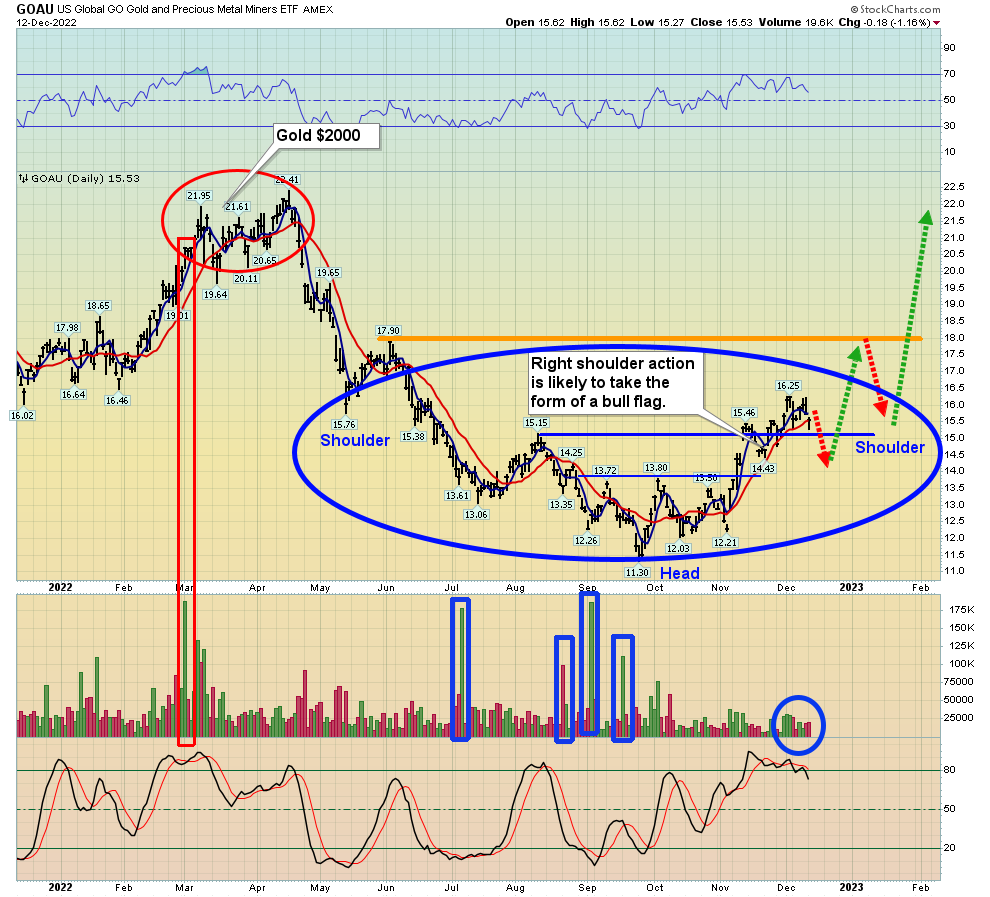

GOAU chart.

In time, mainstream money managers will likely view the entire $18-$11 zone as the huge base pattern that astute gold bugs see it as now.

In the 1970s, there were numerous Fed policy pivots. All were followed by more inflation and rate hike rivets. Over the next couple of decades, there will again be numerous Fed pivots, and all will also be followed with fresh waves of inflation and rate hike rivets.

Gold stocks are set for decades of great performance. The only question is, are gold investor cowboys and cowgirls ready to mount up and ride?

More By This Author:

Exciting Times: It's All About GoldGold Stocks & Gold A Bullish Divergence

Gold & Oil: Another Inflationary Wave?