The Market Continues Its Short-Term Downtrend

Image source: Pixabay

The market continues to be in a short-term downtrend. If you own only the very large-cap stocks, you might not even be feeling the impact of this part of the short-term cycle. But if you own small-caps, you are likely well aware that stock prices have been pulling back so far this new year.

The PMO index has now reached all the way down to the bottom of its range, which I where I start looking for opportunities to deploy cash that I raised while the PMO was at the top of its range. It seems a bit early in this brief short-term down cycle, but among the stocks with the best earnings there are a lot of stocks showing fresh buy signals, and I have been a buyer.

I am showing the chart below with the two panels because I'm just so happy with it. The A/D line momentum indicator is showing clean market buy-sell signals that currently correspond well with the market's short-term cycle, as shown by the PMO index.

The bullish percents have declined off the highs of late last year, but only barely so far. There are two ways to look at this. One, the lack of a significant decline indicates that the market still has a lot of work to do before presenting us with another stock-buying opportunity.

Or, two, it means that this is a very strong stock market at the moment that is reluctant to go down, and it makes sense to deploy available cash to take advantage of higher prices. I have chosen the second approach for now, but I'm carefully watching to make sure I made the right choice.

One reason to be deploying cash is that these buy-write indexes are pushing to new highs. This is a bullish indicator.

One reason to be cautious, however, is that some of the very best market indicators are pointing lower.

As mentioned earlier, large-caps are performing well despite the short-term weakness in the general market. This is a solid-looking uptrend line that hasn't been violated yet. I suspect that before this short-term down cycle is finished, there will be a pullback in the large-caps -- at least to the lows established so far this year.

I mention frequently that the level of new 52-week lows will tell us whether we have a healthy uptrend in which we can comfortably continue to hold stocks during short-term downtrends, or whether we have an unhealthy market in which we should be aggressive sellers at the short-term peaks of the cycle.

This next chart illustrates how the new lows just disappear when the market transitions at important times from a market with significant selling pressure to a market that is healthy and is ready to push higher after it rests and resets periodically.

The NYSE's new lows continue to be very well-behaved, and they make me optimistic about higher stock prices. The Nasdaq's new lows are still a bit high, but certainly a lot better than last October, so I need to retain a degree of caution toward stocks.

As I mentioned earlier, large-caps pulled back, but they have already recovered impressively. Smaller stocks, however, have pulled back in price, but continue to show weakness.

Bottom Line

I have about 15% of my accounts in cash after the buys I made this past week based on the bullish signals I have been seeing in my favorite stocks. Someone pointed out to me that I'm being a bit too aggressive too early in this cycle, and I lean towards admitting that he is right. But I will be a seller if these fresh buys turn into money losers.

It looked like yields were starting to head higher again and were likely to reach up to the December resistance levels. But then, on Thursday and Friday, the five-year yield pointed decisively lower, and slight weakness was seen in the 10-year and 30-year. Lower yields strongly favor tech stock prices, and that showed up in the higher prices on Friday among the tech leaders.

This next chart shows that tech appears to be pushing towards higher prices. The only other industry group showing equal relative strength is the construction stocks.

Here is a nice look at how the SPX backed off the highs in 2021, but since the 2022 lows, it has been stair-stepping higher along its uptrend line to the point where it is ready to challenge the highs. It looks a little extended to me at the moment, but, looking at this chart, I can't see how it doesn't get to new highs again.

I'm a big believer in owning the leading stocks and not trying to pick tomorrow's winners among today's losers. But I also think that it is fun to at least have a tiny amount invested in a long shot, and this is my pick.

It was so recently that the battery makers and suppliers were thought of as a sure thing, but then they tumbled and never recovered. It just makes so much sense to me that there will be a big technological breakthrough in battery technology that we'll finally be able to capture and save large amounts of energy from the sun in highly advanced batteries.

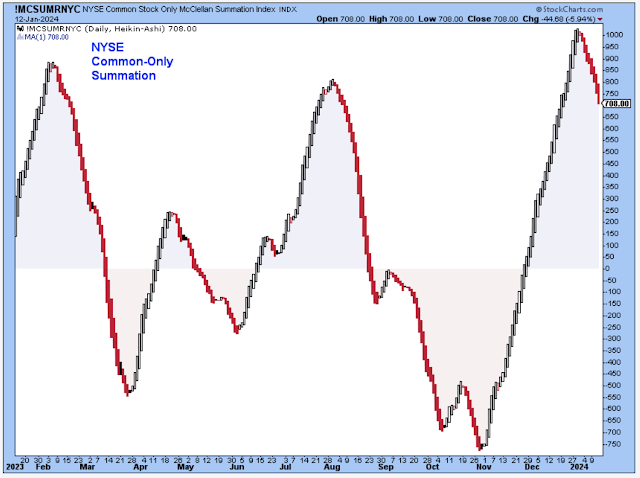

This chart is a reminder to myself, and to you if you regularly read my writings, that whenever the market feels invincible like it did in December, there will always be a period of price correction.

In other words, whenever the PMO index is at the top of the range, it always will find its way down to the bottom of the range again, no matter how good the market looks when the PMO is at the top. And, of course, vice versa when the PMO is at the bottom. Maybe it is a bit soon to deploy cash back into stocks, but that day is certainly coming.

Outlook Summary

- The short-term trend is down for stock prices as of Jan. 2.

- The ECRI Weekly Leading Index points to economic recovery as of July 2023.

- The medium-term trend is up for Treasury bond prices as of November 2023 (yields down, prices up).

More By This Author:

A New Short-Term Downtrend Started In JanuaryThe Short-Term Uptrend May Be On Its Last Legs

An Incredible Short-Term Rally

Disclaimer: I am not a registered investment advisor. I am a private investor and blogger. The comments below reflect my view of the market and indicate what I am doing with my own accounts. The ...

more