The Logical-Invest Newsletter For November 2025

Image Source: Pexels

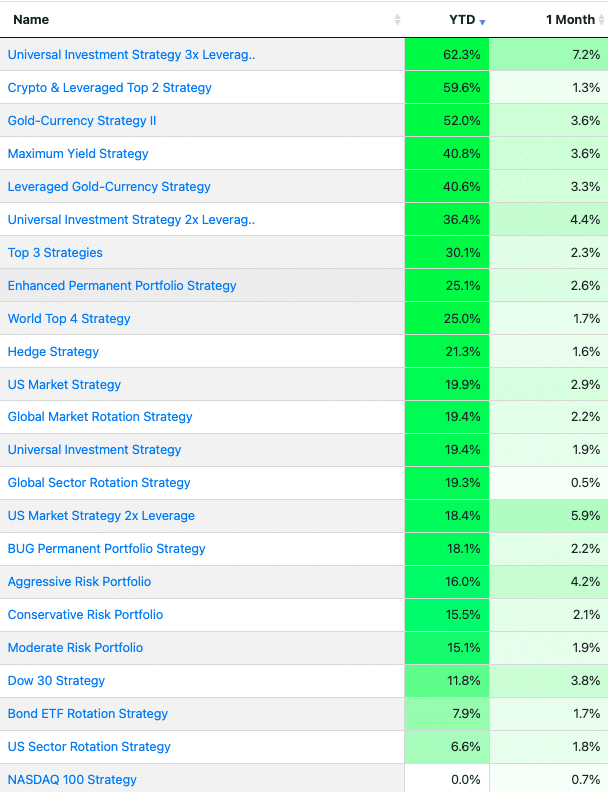

Leveraged strategies lead

YTD performance through October shows our leveraged strategies dominating the leaderboard. More conservative strategies such as the Enhanced Permanent Portfolio Strategy and the well diversified Top 3 Strategies had solid over 25% returns with excellent risk adjusted characteristics (YTD Sharpe above 2.9).

- Top Performers: The Universal Investment Strategy 3x Leverage leads with a spectacular 62.3% YTD return. The Crypto & Leveraged Top 2 Strategy follows at 59.6% with significantly higher 38.3% volatility (YTD).

- Gold Continues to Shine: The Gold-Currency Strategy II posted 52.0% YTD returns with a respectable 22% volatility and excellent Sharpe ratio. Gold currently trades around $4,000.

- Risk-Adjusted Winner: The Enhanced Permanent Portfolio Strategy achieved 25.1% returns with only 9.9% volatility. This strategy continues to deliver consistent performance for risk-conscious investors.

- All-Arounder: The Top 3 Strategies is one of our best diversified, safe and adaptable strategy-of-strategies. It is not meant to deliver high returns but rather navigate safely different type of environments and perform well in the long term. And still it returned a stellar 30.1%.

Average Performance: Across all strategies shown, the average YTD return stands at 25%.

The Market View: Flying Blind with a Hawkish Fed

October was a month of contradictions.

On the surface, markets finished the month strong. The S&P 500 climbed 2.4%, and the tech-heavy Nasdaq jumped 4.8%, fueled by strong earnings from mega-caps like Amazon and continued optimism in the AI sector. Year-to-date, the S&P 500 is now up over 17% and the Nasdaq has surged 23%.

But beneath this bullish surface, the picture is far murkier.

The main event was the Federal Reserve’s meeting on October 29th. As expected, the Fed cut its benchmark rate by 25 basis points to a range of 3.75-4.00%. This is the second rate cut this year, a clear shift from its previous tightening cycle.

Rising unemployment?

However, the “why” is what matters. The Fed is not cutting because inflation is solved. At 3.0%, it remains sticky and above target. Instead, the Fed is reacting to a “cooling labor market.” This is where the fog rolls in.

Due to the ongoing federal government shutdown, the Fed is “flying blind.” It has not received an official BLS jobs report since early September. It is making crucial policy decisions based on alternative data and a divided committee. In fact, the October vote had two dissenters: one who wanted a larger cut and one who wanted no cut at all.

No cut in December?

This division was clear in Chair Powell’s press conference. In a “hawkish cut,” he strongly signaled that a December cut is “not a foregone conclusion.” Markets listened, and the probability of a third cut fell from 90% to below 65%.

End of QT

In a final twist, the Fed also announced it will end its balance sheet runoff (Quantitative Tightening) on December 1st. This move is designed to ease pressure on the long end of the curve and should be supportive for bond markets.

So, what is the takeaway? We have:

- An end to QT, which is positive for bonds.

- Equities (led by a narrow group) rallying on AI optimism.

- A data-blind Fed cutting rates due to a slowing labor market.

- A “hawkish” Fed chair uncertain about the next move.

More By This Author:

The Logical-Invest newsletter For October 2025

The Logical-Invest Newsletter For September 2025

The Newsletter For August 2025

Disclaimer: Logical-Invest.com is not a registered investment advisor and does not provide professional financial investment advice specific to your life situation. Logical Invest is solely an ...

more