The Logical-Invest Newsletter For October 2025

Thriving in a High-Reward Environment

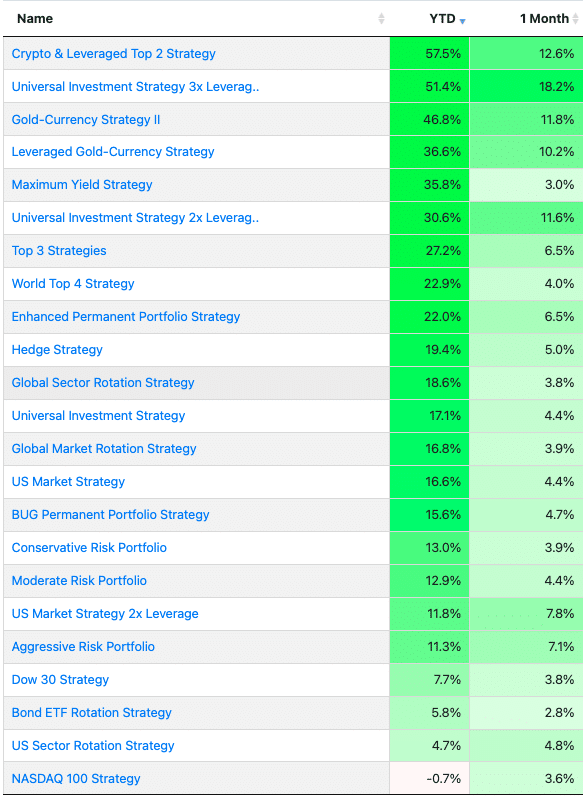

All our strategies were positive ranging from 2.8%-18.2% for the month.

Despite a potential U.S. government shutdown, major stock markets are hovering near all-time highs. This environment has been exceptionally rewarding for strategies designed to capture strong upward trends in equity as well as safe-heavens like gold.

Our performance table for September reflects this reality. High-momentum, leveraged strategies have delivered outstanding returns.

- Crypto & Leveraged Top 2 Strategy: Continues its stellar run, up 57.5% year-to-date.

- Universal Investment Strategy 3x Leveraged: Has also performed exceptionally, with a 51.4% gain year-to-date.

These results highlight the powerful returns possible in the current market. At the same time, the strong performance of our Gold-Currency Strategy II (+46.8% YTD) shows that strategies designed to hedge against uncertainty are also playing a crucial role in portfolios.

The Fed Makes Its Move

The main event of September was the Federal Reserve’s decision to cut its benchmark interest rate by 0.25%. This was the first cut in nine months, and Fed Chair Powell described it as a “risk management cut” to protect against a slowing labor market.

Rate cuts are all-around market positive as they stimulate investment. On the other side of the equation lies inflation. Bigger cuts trigger bigger inflation. The question is whether this is a one-off adjustment or the start of a longer easing cycle.

Markets are currently betting on more cuts to come in 2025, which has fueled the strong risk-on sentiment.

A Weaker Dollar and the Emerging Market Opportunity

The Federal Reserve’s new path of lower interest rates has a direct impact on the U.S. dollar. Typically, when U.S. rates fall, the dollar becomes less attractive to foreign investors, potentially leading to a decline in its value.

This brings us to an interesting potential shift in global capital flows. A weaker dollar makes it cheaper for emerging market countries to service their dollar-denominated debt and can make their exports more competitive. We are already seeing a trend of developing nations issuing more debt in their own currencies. Should the dollar’s weakness persist, we could see a significant rotation of investment capital into emerging markets, which offer different growth dynamics than the developed world. It’s an area we are monitoring closely.

More By This Author:

The Logical-Invest Newsletter For September 2025The Newsletter For August 2025

The Logical-Invest Newsletter For July 2025

Disclaimer: Logical-Invest.com is not a registered investment advisor and does not provide professional financial investment advice specific to your life situation. Logical Invest is solely an ...

more