The Newsletter For August 2025

Image Source: Pexels

Markets in July - A Historic Month for Cryptocurrency

July 2025 will be remembered as a breakthrough month for digital assets, as Bitcoin soared past the $120,000 threshold. This incredible rally was ignited by “Crypto Week” (July 14-18), during which the U.S. passed the GENIUS Act and other friendly legislation, providing long-awaited regulatory clarity that attracted a flood of institutional investment.

The Federal Reserve Holds Steady

In its meeting on July 29-30, the FOMC decided to maintain the federal funds rate at 4.25% to 4.50% for the fifth consecutive meeting. While this was expected, the decision was not unanimous; two governors dissented in favor of a rate cut, signaling a growing debate within the committee about the economic path forward.

Geopolitical Tensions Escalate

On the global stage, trade disputes between the U.S. and China continued, with new tariffs disrupting supply chains. Furthermore, the conflict between Israel and Iran heightened instability in the Middle East, adding to volatility in energy markets.

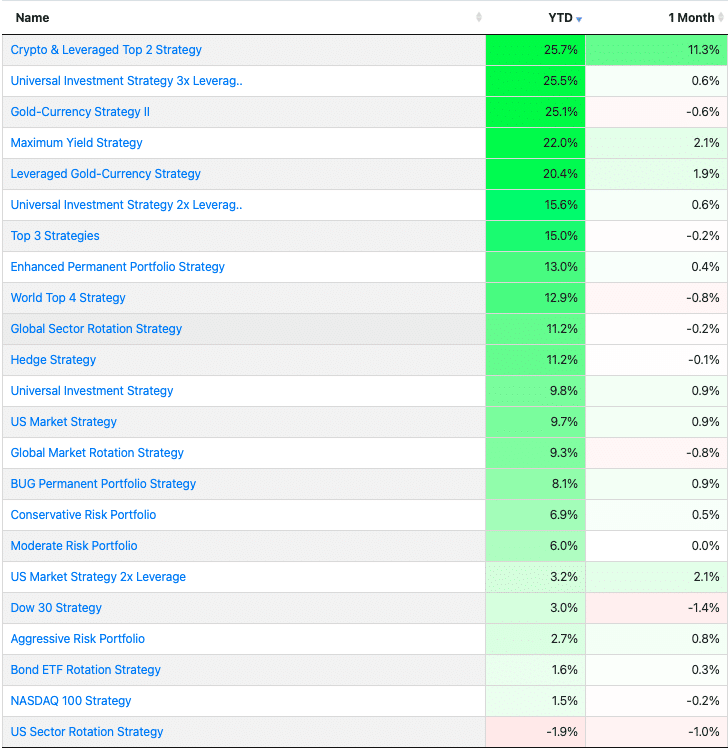

Performance

(Click on image to enlarge)

Strategy Spotlight: The Top 3 Strategies

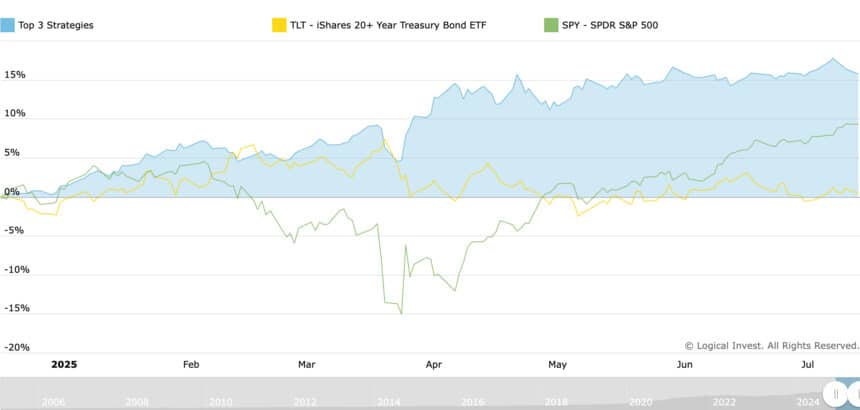

A favorite among our subscribers, the Top 3 Strategies (MST3), continues to demonstrate the power of building a portfolio with diversified, rules-based models. This meta-strategy combines three of our core strategies into one, creating a robust portfolio that adapts to changing market conditions. Its performance so far in 2025 is a perfect case study.

Impressive Performance with Lower Risk

Year-to-date, the Top 3 Strategies portfolio has delivered a return of 15%, significantly outperforming the SPDR S&P 500 (SPY), which returned 8.5% over the same period.

(Click on image to enlarge)

However, the headline return only tells part of the story. The real strength of this approach is in its risk management. The strategy has achieved this outperformance with roughly half the volatility of the market (11.6% vs. 23.9% for SPY).

Most impressively, its maximum drawdown for the year has been a mere -4%, compared to the jarring -19% drawdown experienced by SPY investors. The performance chart clearly visualizes this, showing a much smoother path to growth throughout the year.

Adapting to a Changing World

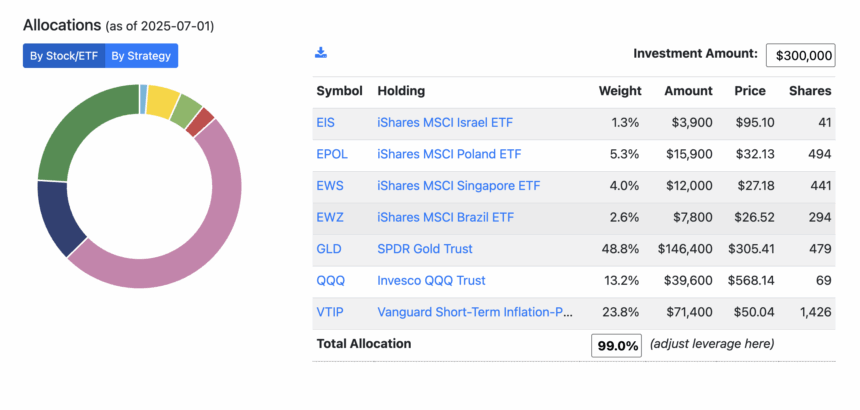

So, how does it achieve this? By being adaptive. Our models are designed to identify and rotate into assets with the strongest momentum. A look at the July allocations shows the strategy’s recent shift toward international markets, finding opportunities outside of the U.S..

(Click on image to enlarge)

July Allocations for MST3 (Subscribe for current allocations)

The portfolio's allocations over the past month include holdings in foreign equities ETFs including Poland (EPOL), Singapore (EWS), and Brazil (EWZ). This isn’t a discretionary call—it’s the quantitative model objectively following strength wherever it emerges.

At the same time, it maintains significant defensive positions in Gold (GLD) and inflation-protected securities (VTIP), which are key to its low volatility and capital preservation.

This dynamic approach—participating in global growth while rigorously managing risk—is what makes the Top 3 Strategies approach a cornerstone for many of our investors.

More By This Author:

The Logical-Invest Newsletter For July 2025The Logical-Invest Newsletter For June 2025

The Logical-Invest Newsletter For April 2025

For Top 4 World Strategy subscribers: The MSCI Columbia ETF GXG changed its name to COLO. Please use the current ETF short ...

more