The Dichotomy Between Paper And Physical Precious Metals Markets

Shortages of Gold and Silver

We are still dealing with the dichotomy between the paper and physical aspects of precious metals markets. There's a shortage of silver and a tightening of the physical gold market, yet the paper price goes down. We have never had such a bullish fundamental situation with the pandemic, debt levels, unemployment levels, and all of the other consequences of COVID-19 on the economy.

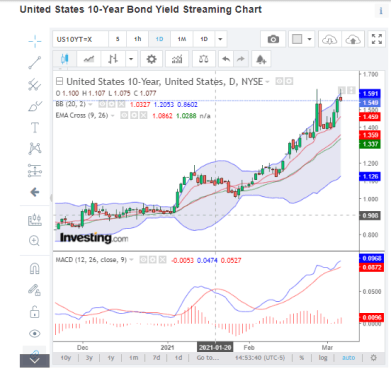

The printing of massive amounts of money will in all likelihood lead to rising interest rates and inflation. The 10-year note has recently been up at 1.578, a new high. The yield on the 10-year note has been near 1.60. The market is reacting to the fact that the 10-year note was at less than 1% in early January. It has jumped to 1.60%, which means that interest rates have gone up.

Most contemporary wisdom will interpret a rise in interest rates as bullish for precious metals, since it may indicate a stronger economy. The 10-year note is beginning to validate that current monetary policies are going to be highly inflationary. The anomaly is that the rise in short-term interest rates is causing pressure in almost every sector, from stocks to gold. Stocks are reacting to the rise in interest rates.

However, we believe that's a misinterpretation. If we use the 1970's as a point of reference, the US went off the gold standard and inflation began as the US dollar was devalued against gold and other assets. Interest rates rose to 14% and gold shot up. A dime made out of silver from 1970, which was 99% silver, can buy a gallon of gas today.

The US dollar is a paper fiat currency. It's not backed by any natural resource that will maintain its intrinsic value. It's backed only by the faith and trust in the US government. As the dollar decreases in value, you begin to see what is real money by what retains value.

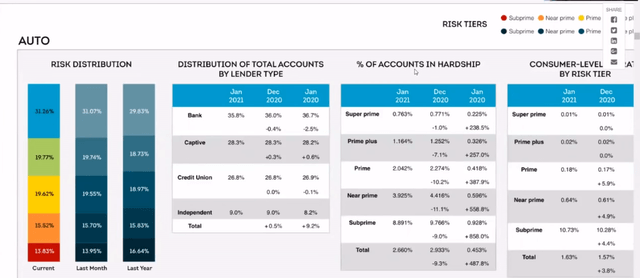

Loan Delinquencies

We are beginning to see sharp increases in defaults on various types of loans. Rob Kient recently highlighted rising delinquencies in various sectors, including the auto sector, bank cards, and mortgages. Most are experiencing several-hundred-percent increases in delinquencies.

The trend, Kient argued, is that eventually we are going to see mortgages get more in arrears. First are the unsecured personal loans, then cars, and then it will hit credit cards, and finally mortgages. People want their shelter and their credit cards to allow them to continue to live. As delinquencies increase, such loans will be harder to get, which will ripple across the economy.

Banks’ liquidity ratios get strained as delinquencies rise. There will be a cascade of defaults and banks will stop lending as much, especially to subprime borrowers. They will lose out first, but then other credit ratings will be hit with more difficulty in securing loans.

Texas and Mississippi are removing their COVID-19 restrictions, which is a move that is receiving a lot of criticism. However, Kient argued, if their leaders see this happening, they may be realizing that this significant problem is on the horizon and, unless the economy reopens, the whole economy could be in dire trouble through cascading defaults that could trigger a depression.

The Fed can print all the money they want, but if banks aren’t lending, then the economy will crash. Each round of quantitative easing is also less effective than the past one. The Fed can’t lower rates because we are already almost at zero. Usually you need about 5% in interest rates to jumpstart an economy, but we don’t have that now. We may be nearing the end of the fiat currency system.

Banks are beginning to raise mortgage interest rates, so the age of ultra low rates is almost at an end. The 30-year mortgage rate is above 3%. US home loan applications fell to a nine-month low, so lending is going down and things will only get worse. Banks are raising mortgage rates because of the increasing number of delinquencies in other areas.

Bond rates are also rising. Rising rates will increase mortgage solvency for adjustable rate holders. That further decreases the liquidity of banks, which also decreases their ability to lend. Therefore, the housing market will be stressed and prices may fall.

All of these factors stress individual borrowers and banks. Less money is coming into the system, so the whole economy is starting to seize up, which will trigger a rise in precious metals prices as a safe haven. Kient argues that there are already shortages in silver and gold, which will only worsen with time.

He, like us, also highlighted the divergence between the paper and physical markets. All of these factors suggest strongly that gold and silver prices will rise significantly. We strongly recommend that you go long gold and silver. Short-term, the rising 10-year note rate is making the dollar stronger, which is affecting the price of gold and silver negatively.

Precious Metals

If you look at the COMEX reports for the last delivery date, the open interest for gold was about 317,000 open contracts. There were 5,000 contracts to stand delivery. The open interest went up from 317,000 to 367,000 overnight. As Kient argued, if there were only 5,000 contracts waiting for delivery, why were 50,000 contracts sold?

That is a 10-to-1 ratio of paper gold that does not exist. The paper shorts drove the price of gold down. There has never been as great an interest in taking delivery via future contracts in gold and silver, because it's almost impossible to buy physical gold and silver.

Short sellers have reduced the risk of their position in silver from about $40 billion to far, far less. Silver has been up to about $30, but it appears to have put in a short-term top. The Variable Changing Price Momentum Indicator (VC PMI) identified that level as an area where supply would come into the market.

Courtesy: cmegroup.com

Now for silver, we have been at an extreme point below the weekly mean of $27.11. We see bearish trend momentum, which activated the extreme levels below the mean.

Now we will have to see if there is more selling pressure, or if the VC PMI is right and we will find buyers coming in at these levels. A close above $25.61 or $25.75 would activate a weekly buy trigger. This is how the VC PMI identifies the entry points for trades that are high probability. The daily and weekly triggers are aligned, which is one of the strongest signals to buy.

Gold

Gold has recently been trading above the weekly buy signal of $1694. We have been going back and forth between buy triggers and hitting VC PMI targets. We are seeing $20 and $30 swings, as if they were just a few dollars in the old days before volatility increased. We may be seeing a reversion all the way up to $1780.

$1694 is the weekly buy trigger. We are neutral, as we are waiting to see if gold comes down and activates another buy trigger. If activated, the target above will be $1715. Based on trend lines, if we close above $1701, we will confirm that we are at a bottom. So we have several indicators showing that we are near a seasonal bottom.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company ...

more