TalkMarkets Tuesday Talk: Post-Thanksgiving Reality Check

Good Morning. It is December 1 and we take note to mention that amidst the COVID-19 pandemic, the Presidential transition and a blazing market rally, it is also, "World Aids Day".

Yesterday, the US markets closed down from the record highs recorded in the run-up to the Thanksgiving holiday, the Dow Jones Industrial Average closed at 29,639, down 272 points, the S&P 500 closed at 3,622 points, down 17 points and the Nasdaq Composite closed at 12,199 down 7 points. Currently, futures for the Dow are up 321 points at 29,951, S&P 500 futures are at 3,660, up 37 points and the Nasdaq 100 futures are at 12,387, up 110 points. Though the current climate in the market seems to be set to follow historical trends for a strong December, with positive vaccine news adding further impetus, some market pundits are cautioning that the strength of the November rally may mute this month's results.

Charles Hugh Smith in his article, 2021 Is Already Optimized For Failure cites 4 warning signs that dispute the "getting back to normal in 2021" line of thought.

A contrarian view, indeed.

TalkMarkets contributor Cullen Roche takes a look at the resurgence in interest in Modern Monetary Theory or MMT. Writing in Revisiting S = I + (S – I) Cullen Roche examines the claim by many MMT proponents that "“private sector saving = “net accumulation of financial assets” and that in order for this to happen, governments must run deficits. "MMT constructs a view of the world where the government MUST provide a Job Guarantee and MUST be spending in deficit in order to let the private sector net save and MUST spend before it can tax." In fact government deficits have been shown to promote economic activity.

But Roche argues that "The private sector is constantly borrowing and creating corporations to create debt and equity which means that balance sheets are pretty much always expanding and helping to support an ever-growing amount of private sector saving WITHIN the private sector. Whether we are better or worse off in the long-run is largely contingent on how we spend for investment and help to create real assets and financial assets that we can then leverage in the future."

Cullen Roche is not arguing against deficits " I think it’s great that the USA has such a dynamic economy that it can afford to have large deficits with low inflation. This allows us to leverage our private sector into many more public services. This is a good thing.", but rather seems to be pointing out that "there is no “must” in here".

As we see Republicans and Democrats gearing up for a new stimulus battle (with some Republicans changing their tune, now that Trump is not going to serve a second term) I am wont to listen to the fine points Roche is making at the end of his article:

"We shouldn’t neglect the fact that most of that saving is created within the private sector from the I (investment) component... and the more we invest within the private sector the more we can leverage that output into expanding the government sector. They are not fighting one another as so many people like to make it appear. "

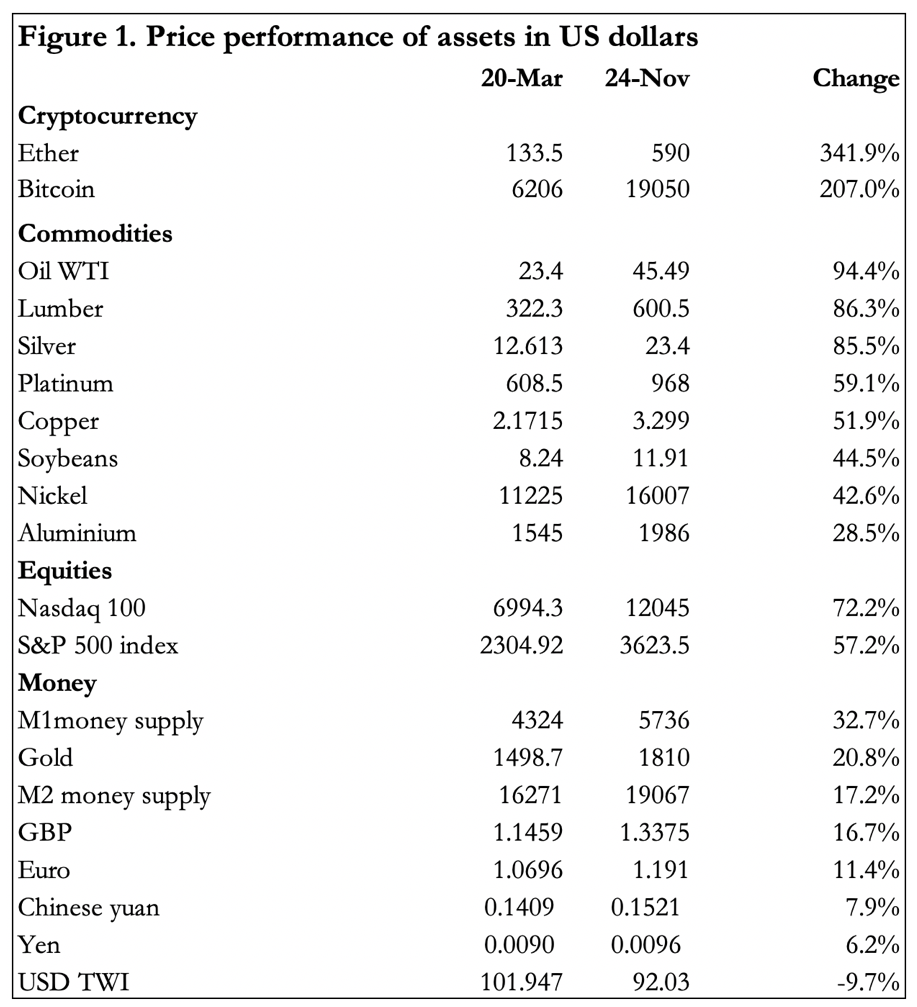

In a TalkMarkets Editor's Choice column, Alasdair MacLeod refutes the current "no inflation, yet" talk and writes in Global Inflation Watch that if we look at the cost of currency instruments and commodities there is plenty of inflation to be found globally as the year comes to an end. MacLeod provides the following chart of the price performance of assets in US Dollars to point to inflationary activity.

MacLeod is a strong advocate for gold as the asset to hold in these "potentially hyperinflationary times" but his extensive article which includes information about the growth this year in the US budget deficit and as well as the concern that as more "wealth is transferred from the productive private sector to a generally unproductive government, the less there is to transfer. And far from serving to stimulate the economy, these monetary transfers are impoverishing the economy and reducing the government’s tax base at an accelerating pace."

So gold enthusiast or not, this is an article which provides food for thought.

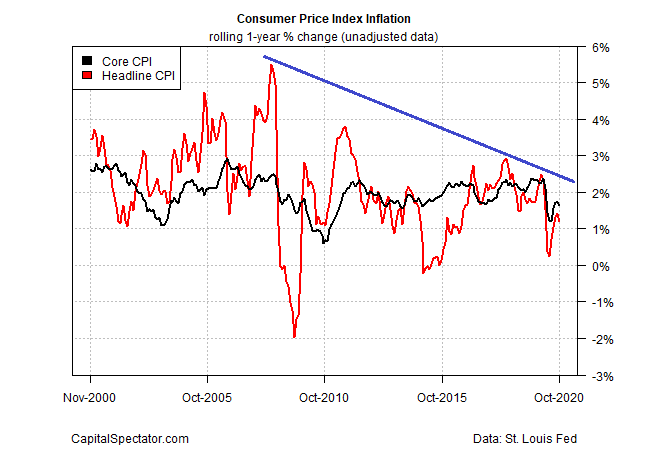

James Picerno in another Editor's Choice piece, also has inflation on his mind. Writing in The Delicate Art Of Forecasting Inflation Risk, he does not seem to be over concerned about a rise in inflation in the near term, but notes that it is quickly become a topic of conversation among academics and in the media.

"US inflation was low before the pandemic started and as the nation heads into what’s shaping up to be a rough winter of resurgent COVID-19 the odds appear low for higher pricing pressure in the near term. But as investors, economists and policy makers consider life on the other side of the coronavirus crisis, contemplating the possibility of firmer inflation is gaining traction as a forecasting exercise.

The Wall Street Journal this week provocatively wrote that “Inflation could be poised for a comeback,” explaining that “some economists are starting to embrace the idea that a prospective COVID-19 vaccine could allow people to once again spend money on travel, restaurants and other services—and drive up prices in the US.”"

Picerno includes a historical chart of the year over year US Consumer Price Index since 2000 which shows a downside trend in inflation in recent years with little to suggest that will change.

The article continues by reviewing where potential risk indicators for inflation could come into play, such as a rise in Fed rates or overheating in the economy next year, but for now these factors do not seem likely. Picerno leaves readers with this observation and question:

"Nonetheless, the upside pressure for inflation may be increasing, which begs the question: If a post-coronavirus economic recovery in 2021, fueled by a vaccine rollout, doesn’t materially lift inflation, what will?"

While today's column has taken a step back from "market rally frenzy" and looked at what TalkMarkets contributors have been saying in a more economics oriented vein we end with a look at some strong tech picks from Zacks Equity Research in their article Grab These 4 Stocks From Promising Computer Networking Industry.

The Zacks team notes that, "Further, rapid deployment of 5G networking is aiding the proliferation of Internet of Things (IoT), Advanced Driver Assistance Systems (ADAS), Augmented Reality/Virtual Reality (AR/VR) devices, and 5G smartphones, which necessitates a future of robust networking infrastructure."

Investors interested in profiting from these trends are advised to look at the following companies: NETGEAR (NTGR), Lantronix (LTRX), Extreme Networks (EXTR) and Digi International (DGII). In their article Zacks Equity Research staff provide profiles (complete with trend graphs and consensus data) for each of their four picks, as well as their thoughts on the outlook for the Computer and Networking industry overall.

Have a good week and look out for leftover turkeys.

Very interesting indeed, albeit rather depressing. As for inflation, my gripe is that it destroys the value of my own assets for the benefit of the stock market crowd. Inflation benefits them because it reduces the value of the dollars that they owe. so it becomes an issue of who gets hurt, and who can help us.

and the table demonstrating that inflation is happening right now is rather disturbing also.

As for different systems "being optimized for failure", it does not really appear that they are optimized for anything. The appearance is far more that it is one group considering only their friends and not having any concern for the others. Or it may just be a failure to consider the secondary consequences of most actions.

The unfortunate part is that I see nothing to challenge or dispute. Times are not that good presently, and the course does not seem to be pointed in the right direction. So it is not as encouraging as some tout it to be.