Some Like It Not-So-Hot

The “extraordinarily elevated” CPI numbers hit, and they weren’t so extraordinary after all:

- CPI M/M 1.2%, Exp.1.2%

- CPI Y/Y 8.5%, Exp. 8.4%

- Core CPI M/M 0.3%,Exp. 0.5%

- Core CPI Y/Y 6.5%, Exp. 6.6%

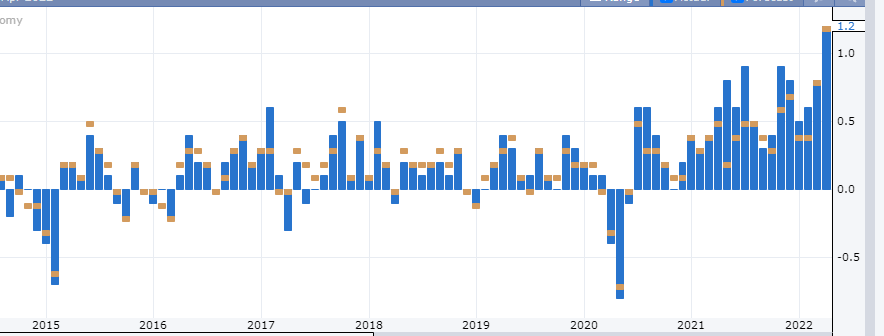

To be sure, inflation is heating up, but there was nothing eye-watering about the report. Here is the monthly CPI over the past six years, and you can see clearly things have changed:

(Click on image to enlarge)

Of course, the numbers concocted by the Federal government is quite tame, having been adjusted literally dozens of times during its existence, and every single time for lower numbers. Over at ShadowStats, they try, God bless ’em, to actually get to the truth, and you can see there’s definitely some delta between reports and reality:

(Click on image to enlarge)

(Click on image to enlarge)

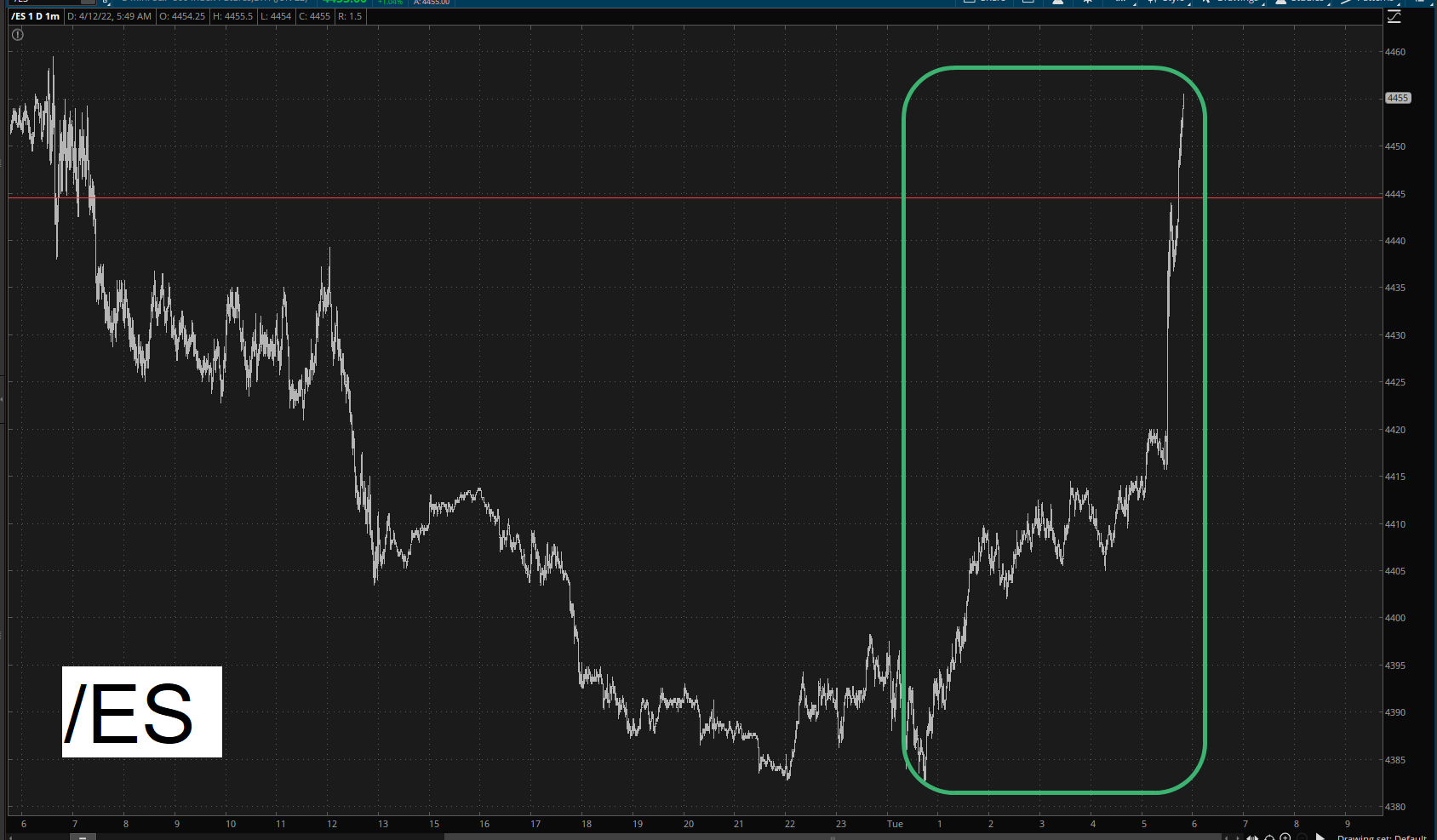

Regardless, for the moment, the equity markets are absolutely gobbling it up with relish.

(Click on image to enlarge)

And this, my friends, is why I buy puts that don’t expire for months. I don’t want to get caught up in this knee-jerk madness. I would also point out that, over the course of the year, this has become a regular thing. The only “twist” is that the bounces are happening faster each time.

(Click on image to enlarge)

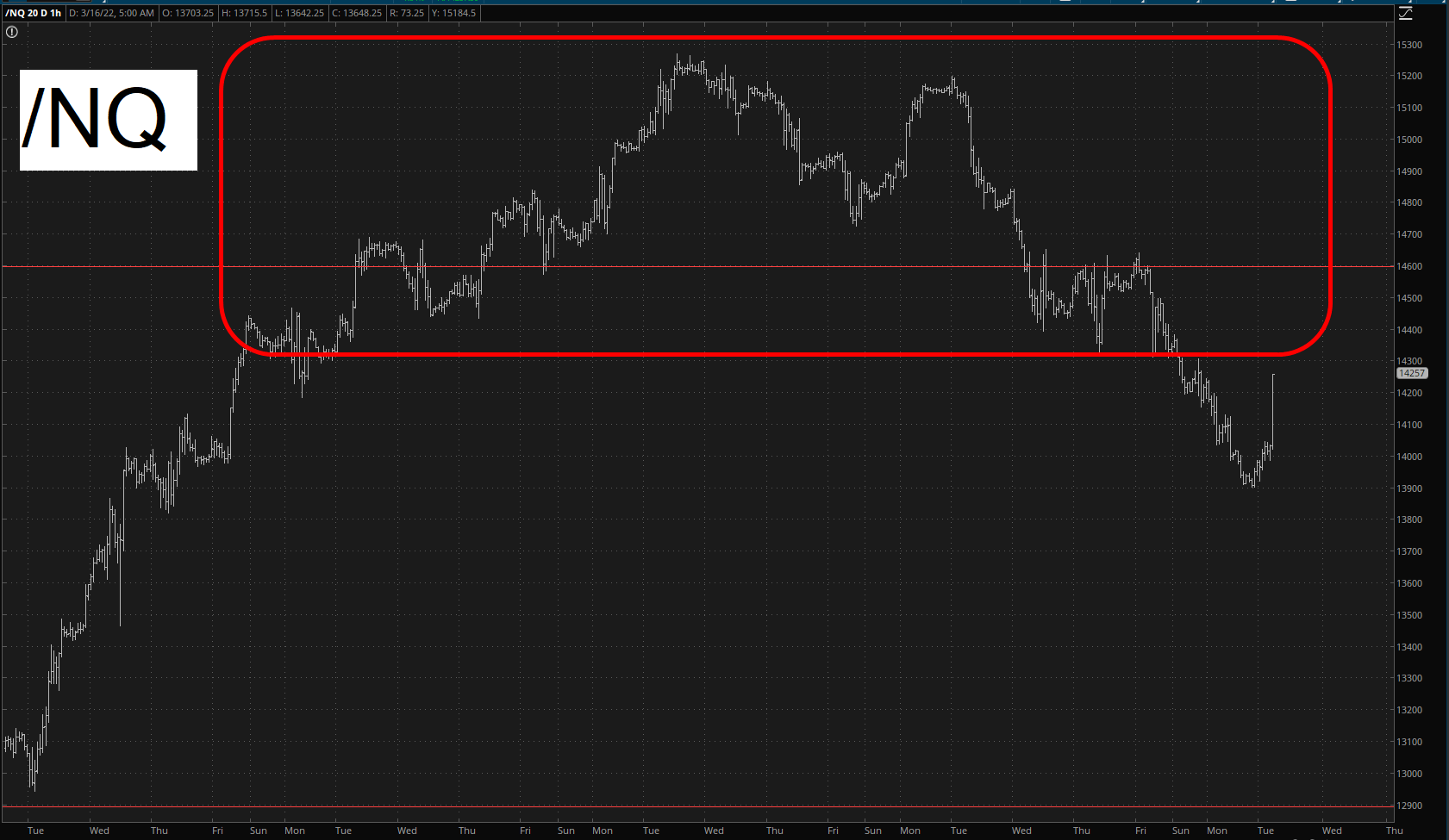

It isn’t just the /ES, of course; here’s the Nasdaq with its own triple-digit explosion higher simply pushing up against the giant distribution top.

(Click on image to enlarge)

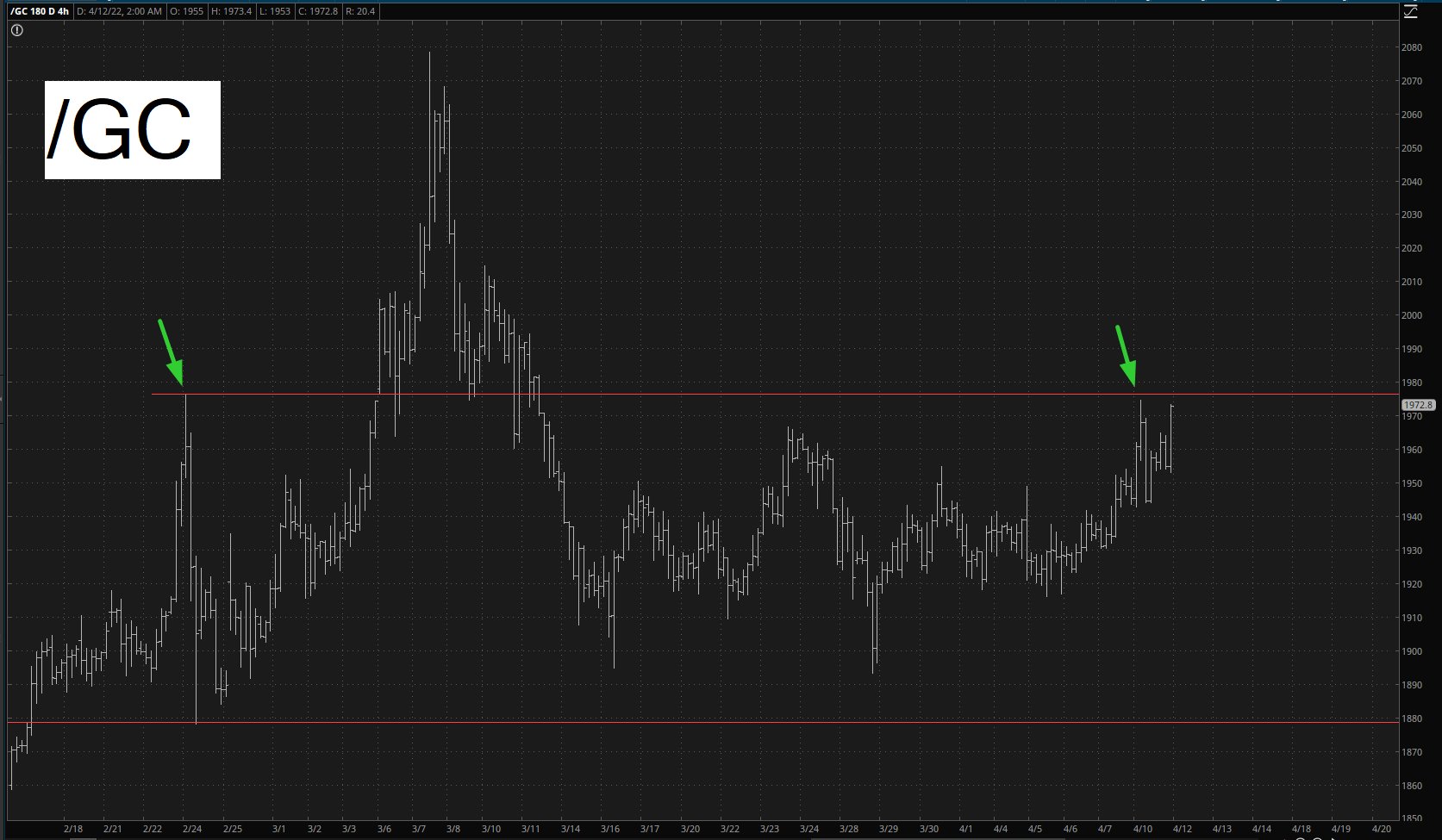

Something I find interesting is that gold is actually participating in this rally. Usually when equities are dancing in the middle of the ballroom, gold is sitting on a chair next to the wall, unloved and unwanted. Well, as I’m typing this, gold is up nearly $30 per ounce, and it’s threatening to push past that horizontal line.

(Click on image to enlarge)

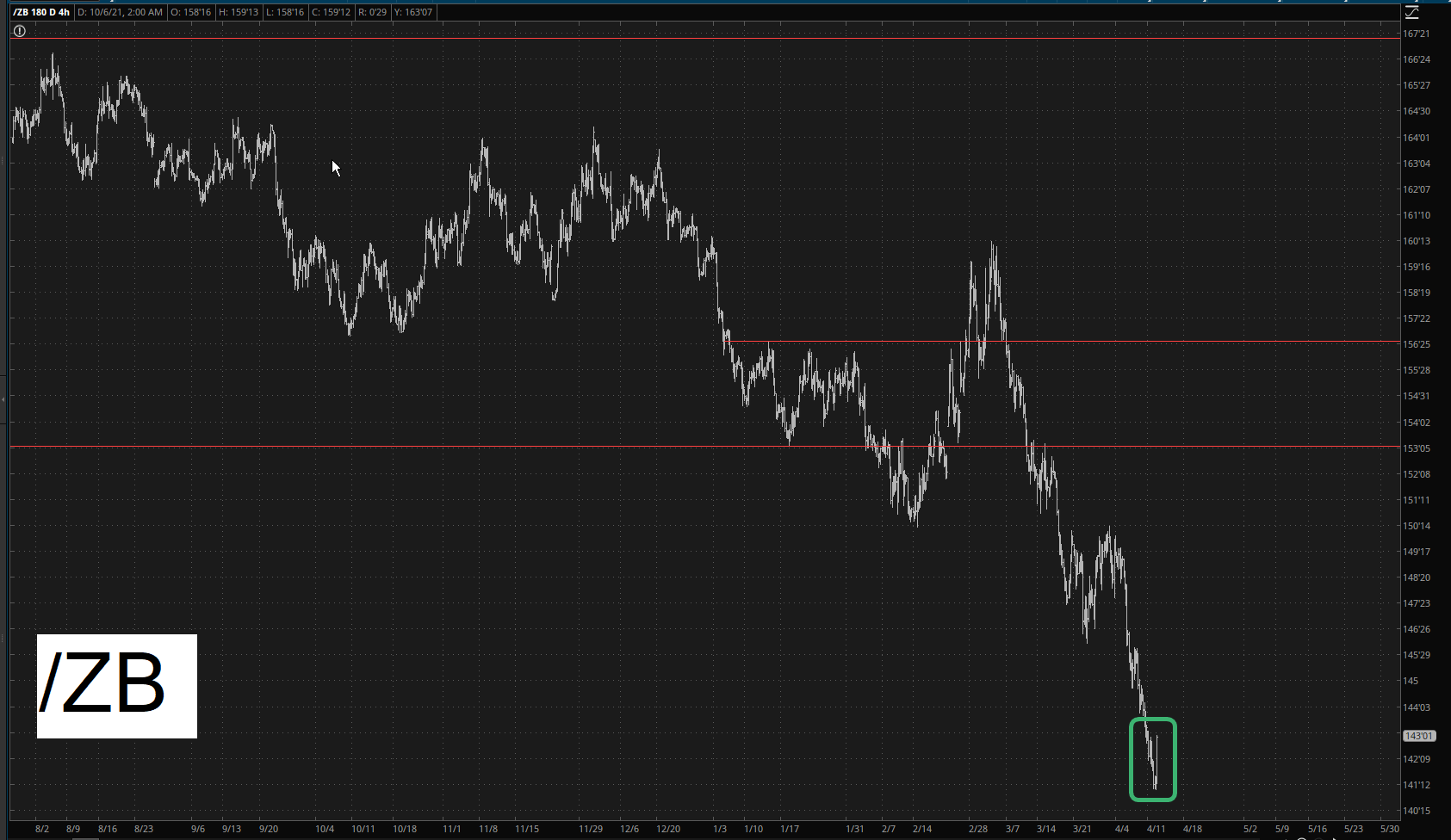

As for bonds, they, like everything else, are rallying right now as well. As always, though, I ask you to keep this in context. Bonds have been smashed to pieces for many months, so a sustainable rally here is entirely possible (more so than an equity rally, I’d say).

(Click on image to enlarge)

As I enter the day, I’m in 28 bearish positions and will certainly be retaining almost all of them (if not all; it depends on if any seem ripe for an exit). Let’s see how things shake out as the market has a chance to digest these not-at-all-shocking CPI numbers.