Slow Grind Higher, Bonds Trying, Crude Not So Much

No matter how many times people argue with me, I am not changing my position. The election has almost no bearing on the markets nor economy until at least Halloween, if at all until the big day. Sorry not sorry. Data bear that out.

Many of you know that we run a purely quantitative election model based on market performance over three time periods as well as recent economic data. The model has correctly predicted every election since 1996. The closer to the election, the more accurate it is. I will start running it at the two week mark.

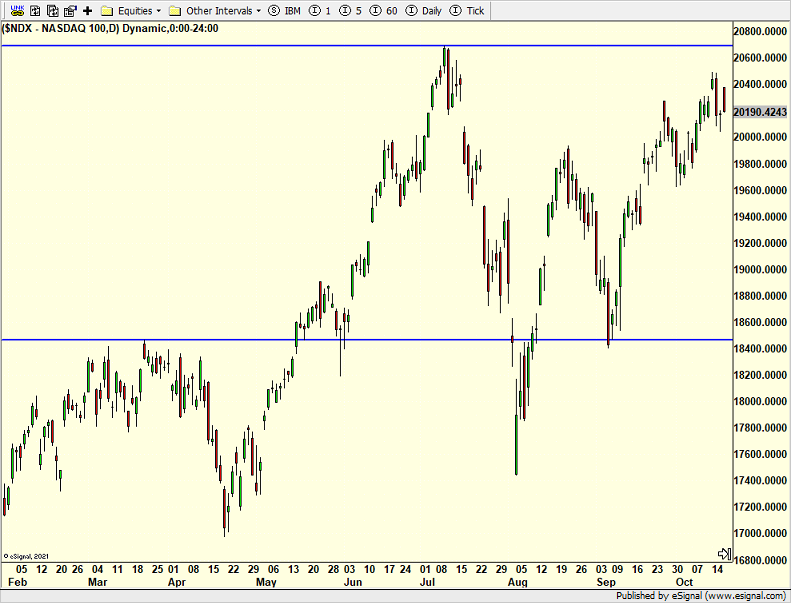

The quiet grind higher continues for the Dow Industrials, S&P 500, S&P 400 and Russell 2000. Only the AI-driven Nasdaq 100 isn’t behaving like that. However, it’s not exactly bad either as you can see below. I do think the tech index will be enjoying new highs this quarter.

(Click on image to enlarge)

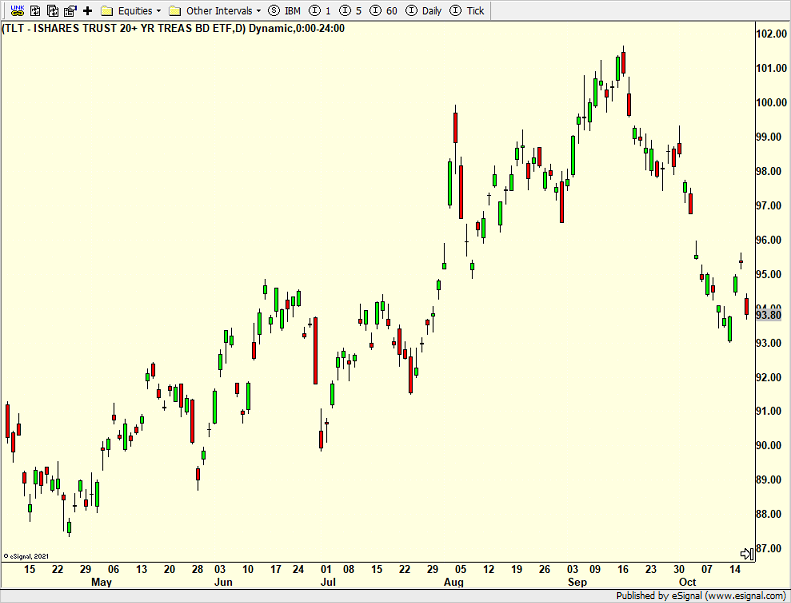

Last week, I wrote about the opportunity I saw in long-term bonds. We use the ETF TLT to express our view. While we still have the position on and we actually added to it on Thursday, it hasn’t rallied as much as I thought it would by now. A close below $93 would tell me that I am very wrong and to take action.

(Click on image to enlarge)

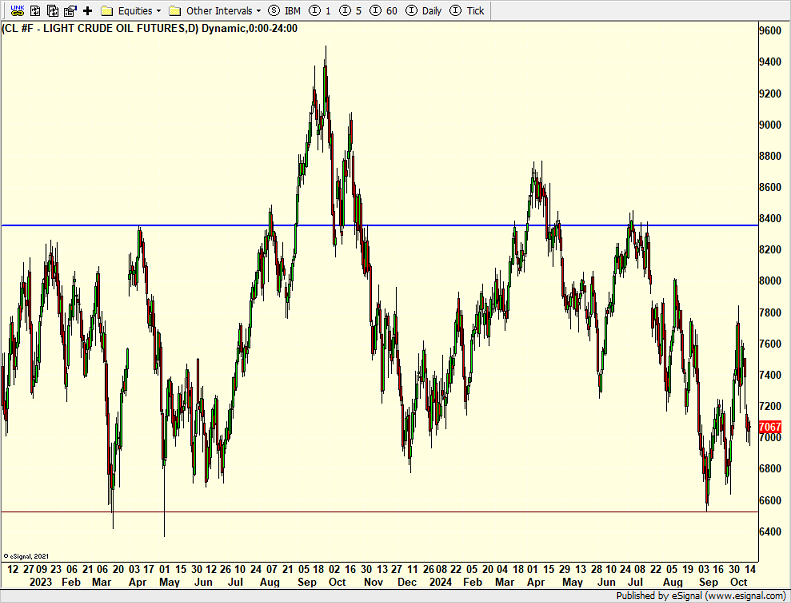

Crude oil has gotten a lot of attention with the tensions in the Middle East. When it could not rally smartly, it was certainly telling us something about the lack of escalation. Additionally, with the massive stimulus package in China, crude oil should have also rallied more. Remember, it’s not what the news is, but how markets react.

(Click on image to enlarge)

Big warm up coming in CT after a very cool week. More fall baseball on tap with some great college football games, MLB playoffs and a party will occupy the weekend. The Yankees had one of their worst playoff losses ever last night and they better score early and win tonight. I have said all year that you can’t hide your flaws in 7game series and the bullpen was exposed last night. Yes. I do know that it had previously been unhitable.

On Wednesday we bought XBI, DXHYX, QLD, SPYB and more TQQQ. On Thursday we bought IYR, more XBI, more TLT and more IWF. We sold PDBC, RYHRX, DXHYX, some IBB and some QQQ.

More By This Author:

Canary In The Coal Mine – What’s Up With Semis?

Small And Mid Cap Stocks Leading

Market Still Poised To Move Higher

Please see HC's full disclosure here.