Market Analysis - Thursday, May 8

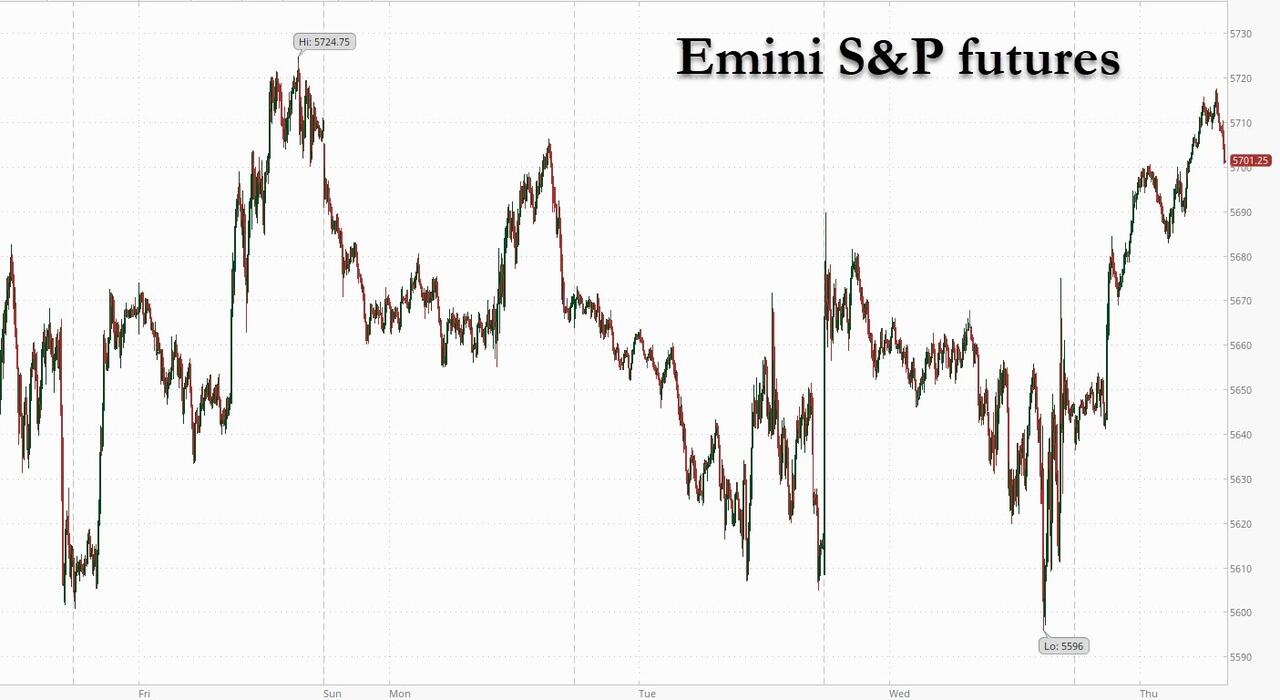

SPX futures rose to 5698.40 this morning, just points away from the retracement high at 5700.70 made last Friday. Yesterday was a high volatility day, according to the Cycles Model. Naturally, I interpreted that as a result of the FOMC announcement. Whether the SPX makes a marginal new high or not, the fractal structure indicates an imminent decline to test the lows. Note that (technical) overhead resistance appears at 5700.00, while the mid-Cycle resistance lies at 5775.90.

Today’s options chain shows Max Pain at 5635.00. Long gamma may begin above 5640.00 while short gamma does marginally better beneath 5630.00.

ZeroHedge reports, “US equity futures storm higher, and are back to their post-Liberation Day highs on positive trade news (Imminent “comprehensive” trade agreement with UK the first of his promised deals; removal of chip export restrictions) and a neutral Fed (economy has strength to wait to see trade war impact hit hard data) even as China again reiterated that the US should cancel unilateral tariffs ahead the first official meeting between the countries this weekend amid reports the US is considering exempting child-related goods from its 145% tariffs on China. As of 8:00am ET, S&P futures rose 0.9% while Nasdaq futures are 1.2% higher, both near session highs. Elsewhere FTSE +40bps, DAX +1.2%, CAC +1%, Shanghai +28bps, Hang Seng +37bps, Nikkei +41bps. Intel rose more than 3% in premarket trading, while peers such as Nvidia and Micron also gained on news Trump will rescind restrictions regulating the export of semiconductors to various countries. Outside of tariffs, Norway and Sweden central banks left rates unch (expected) while we get the BoE this morning (25bps cut expected). US Bond yields are 4-5bp higher across the curve and USD is poised to have its best day 6 sessions with DXY +50bp. Today’s macro data focus is on jobless claims, NY Fed 1-year inflation expectations, and labor costs.”

(Click on image to enlarge)

VIX futures made a new Master Cycle low at 22.33 this morning, on day 262 of the current Master Cycle. While the SPX Master Cycle may become “stretched” with a new high, the VIX is not. The apparent calm may not last.

Bitcoin rose to 99869.10 this morning, being attracted by 100,000.00 (round number). The fractal structure appears complete. Should it halt near there, Bitcoin may begin its decline. The Cycles Model anticipates the downdraft to last until mid-June.

TNX futures declined to 42.88 while the cash market bottomed at 42.95 this morning. The consolidation may be over. The Cycles Model suggests a resumption of the uptrend with the Cycle Top resistance at 48.03 as the potential target.

The Japanese Yen is pulling back to 68.99 to retest Intermediate support at 68.69. It may not last, since a surge in trending strength may be imminent. Should that occur, the rally may be inclined to break through the Lip of the Cup with Handle formation. The Cup with Handle is related to the Head & Shoulders formation, but has a softer target. Longer term indicators suggest a target near 75.00.

More By This Author:

Market Analysis - Tuesday, May 6

Market Analysis - Thursday, April 17

Market Analysis - Wednesday, April 9

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more