Market Analysis - Wednesday, April 9

NDX futures have declined to a morning low at 16607.30. There is a risk of making a further low this morning, with a potential target near 15000.00. An emerging crisis in the basis trade, primarily in the Treasury markets, has drained liquidity across the spectrum of equities, especially among the Mag 7, which are highly leveraged. The Cycles Model suggests today may be a high volatility reversal day with a hair trigger in either direction. Yesterday 53% of the Nasdaq stocks made a new 52-week low, nearly matching the January 2022 low in the Nasdaq, but not at the level of the March 2020 low.

ZeroHedge remarks, “Like orbiting space debris, every loan that has been collateralized by an illiquid asset is a high-speed projectile with the potential to disable any other part of the system it impacts.

Complex systems can undergo what’s known as phase shifts, where the state of the system changes abruptly. The classic example of this is liquid water turning to ice. Since the mechanisms at work–temperature, saline levels, etc.–is known and measurable, then this phase transition is predictable.

Complex systems with emergent properties are unpredictable, and so their phase transitions catch us off guard. The system looks stable, as the risk of sudden instability resolving in a phase shift is not visible.”

SPX futures made a morning low at 4842.00 thus far. It also has the possibility of a final wash-out that may not have occurred yesterday. Two possible supports lie at 4744.00 and 4660.00. Today is day 267 in the current Master Cycle, a turn date with a potential for high velocity. The Cycles Model calls for a two week bounce out of the low. Approximately 33% of the NYSE stocks made new 52-week lows.

Today’s options chain shows Max Pain at 5175.00. Short gamma offers some support above 5275.00 while short gamma becomes strong beneath 5000.00 with a put wall at 4740.00, 4600.00 and 4500.00.

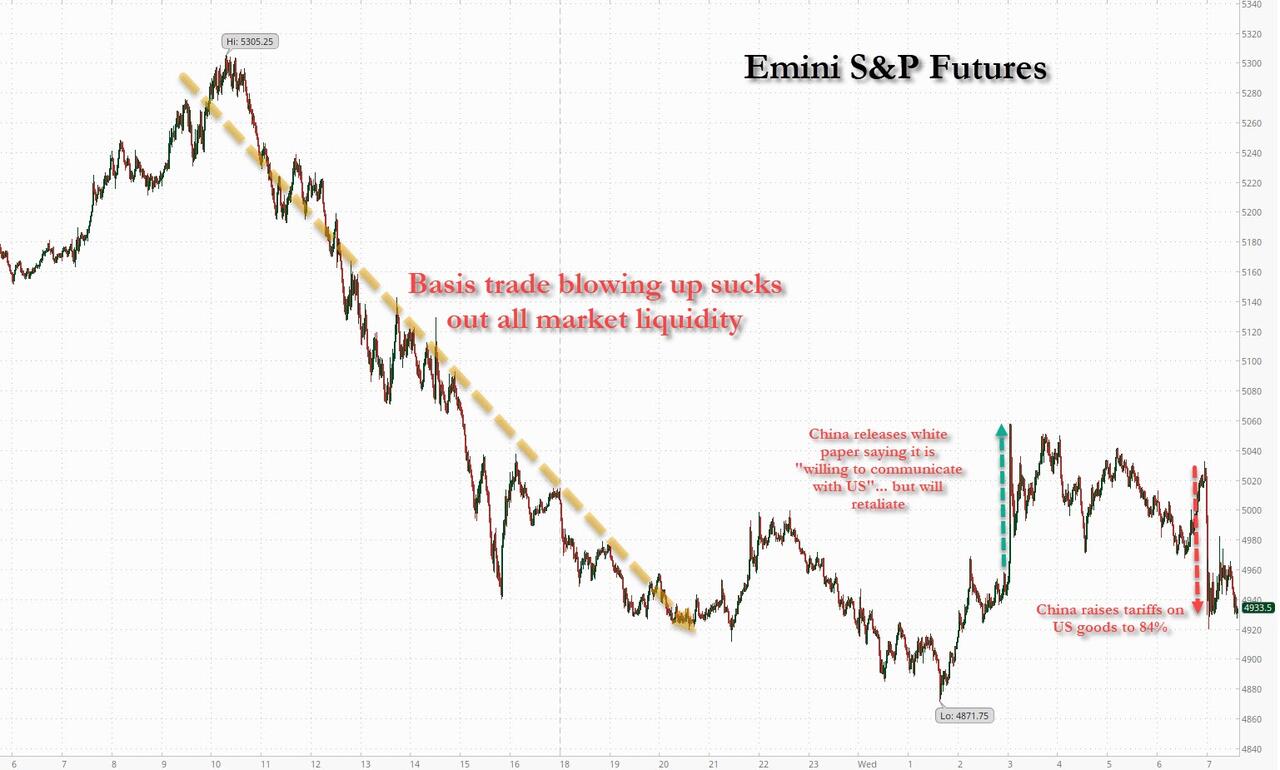

ZeroHedge reports, “The rollercoaster goes on as stock futures continue to swing wildly, and now we have the extra kicker of the $2 trillion basis trade blowing up and sending bond yields soaring in the US and across most developed economies just as stocks tumble, leading to a complete wipe out of all 60/40 “balanced” portfolios. US futures had slumped as much as 3% overnight amid the ongoing collapse of the basis trade, which we first profiled here, only to reverse and turn briefly green just after 3am ET after China released a White Paper on US trade in which it hinted that it was “willing to communicate with the US” but that initial bounce quickly faded after China also warned it would retaliate… and then it did just that after 7am ET, when Beijing announced it would match Trump’s latest and raise tariffs on US goods to 84%; this quickly sent futures back near sesion lows and down 2%. Pre-market, Mag 7 names were mixed (Tesla +0.39%, Nvidia +0.22%, Apple +1.1%, Meta +1%, Amazon +1%, Alphabet -0.9%, Microsoft -0.8%), while healthcare stocks were lower as pharma tariffs are earmarked to be released soon. Meanwhile, as we described first late last night, forced sales resulting from the unwind of the basis trade have slammed the Treasury market, where yields surged over the last few sessions and 2Y to 30Y yields are higher again today. At one point the 10Y was as high as 4.50%; this morning JPM asks a question: “If trade imbalances are zeroed out, do foreign countries need to hold Treasuries?” USD is weaker and commodities are mixed with Base Metals/ Energy lower, goal soaring higher, and Ags mixed. Fed Minutes are released this afternoon with CP| tomorrow.”

(Click on image to enlarge)

VIX futures ran up to 57.95 in this morning’s session. Should the SPX decline further, VIX may rise to the August 5 high at 65.73. A new high may complete the fractal structure that signals completion of the current iteration.

The April 16 options chain shows Max Pain at 20.00. Short gamma rests between 15.00 and 19.00. Long gamma begins at 2.00 and remains strong to 5.00.

TNX leaped above the 50-day Moving Average at 43.52, taking advantage today’s trending strength day. This is another blow to the basis trade, which may be leveraged between 20X and 56X. That means at 56X leverage, a 1.8% increase in the price of a 3-year Treasury would wipe out the business. At 20X leverage, a 5% increase in the price of a 3-year T-note would completely wipe out that business as well. This is reminiscent of the LTCM blow-up in 1998, where the entire financial system was at risk and had to be bailed out by the Fed amd a consortium of banks. The Cycles Model infers that the crisis may not be over until April 21.

More By This Author:

Market Analysis - Tuesday, April 8Market Analysis - Friday, Feb. 21

Market Analysis - Monday, Feb. 10

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more