Market Analysis - Tuesday, April 8

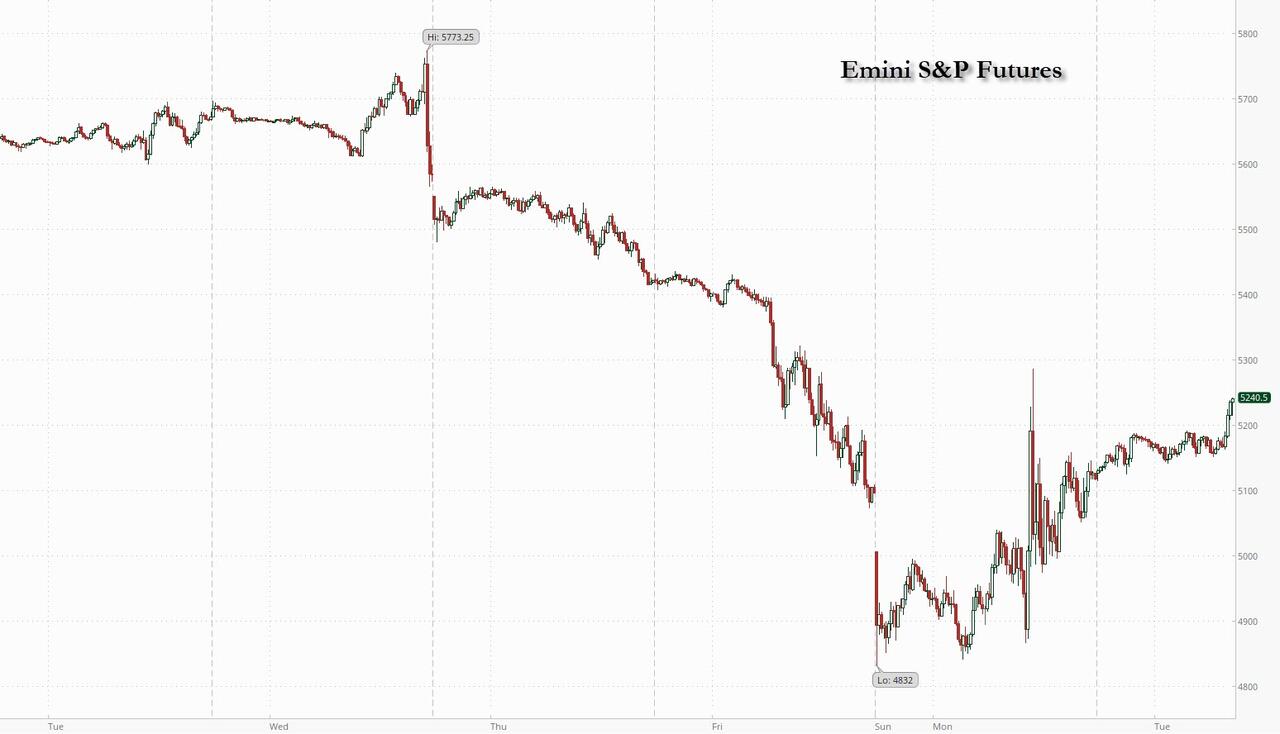

SPX futures have bounced to 52008.00 thus far this morning, leaving it 15% off the February 19 high. Yesterday the SPX plummeted to 4835.00, a 21.34% total decline, more severe than a median bear market. In order to break that (short term) trend, it must rise above yesterday’s high at 5246.67. However, the Cycles Model infers a deeper low to come, possibly at 4744.00 to 4660.00. That may complete the Master Cycle low inferred in Path 1. Despite the strong bounce, there is some (capitulation) selling left to do, especially by retail investors.

Today’s options chain shows Max Pain at 5000.00. Long gamma begins above 5050.00 while short gamma resides beneath 4950.00.

ZeroHedge reports, “After three days of big losses and record-breaking volatility, equity futures are rebounding sharply following somewhat soothing comments from Treasury Secretary Bessent (although how long the relative calm lasts is anyone’s guess, given there’s little clarity about what Trump wants in exchange for cutting tariffs). As of 8:10am, S&P futures are 2.9% higher, a bounce which started around the time we informed readers that Goldman’s head of risk of risk had turned bullish yesterday afternoon; Nasdaq futures are up 2.7%, with all Mag7 names higher with Semis and Cyclicals also outperforming. European and Asian markets are also broadly higher. The VIX is down 10 vols below 40, while Chinese ADRs are mixed. Bond yields have reversed earlier losses and are up 1bp to 4.22% with the USD dropping. Todays’ macro data focus is the Small Business Optimism report which saw sentiment tumble to 97.4 from 100.7 the lowest since the Trump election (Hiring Plans also slumped; these tend to have a lagged but positive correlation to NFP).”

(Click on image to enlarge)

VIX futures have pulled back to a morning low at 39.71 thus far. Today is day 263 of the current Master Cycle. The fractal pattern, however, is not complete. A potential target may be the August 5 high at 65.73.

TNX continued to rise above the mid-Cycle resistance at 42.13. This may set the stage for a panic rally in the 10-year yield. It is now on a buy signal. A potential target for this rally may be the Cycle Top at 47.88.

Bitcoin has bounced, yesterday, but the fractal construct may not be complete. The Cycles Model also agrees, suggesting another possible week of decline. Today is day 253 of the Master Cycle, suggesting the decline may be nearing the end. A reversal in the SPX may spark a reversal in BTC.

US Dollar futures are in consolidation after a sharp rally out of its Master Cycle low. While not on a confirmed buy signal, the current action supports buying on the pullback. The new Master Cycle may continue higher until mid-May.

Gold futures have formed a bounce at yesterday’s low with a possible retest of the Cycle Top at 3058.71 before resuming its decline. The Cycles Model suggests the decline may last another month before a meaningful reversal. A possible target may be the lower trendline near 2800.00. Should it decline through the trendline, the next support may be near 2500.00.

More By This Author:

Market Analysis - Friday, Feb. 21Market Analysis - Monday, Feb. 10

Market Analysis - Thursday, Feb. 6

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more