Looking At Yields Again

Image Source: Pixabay

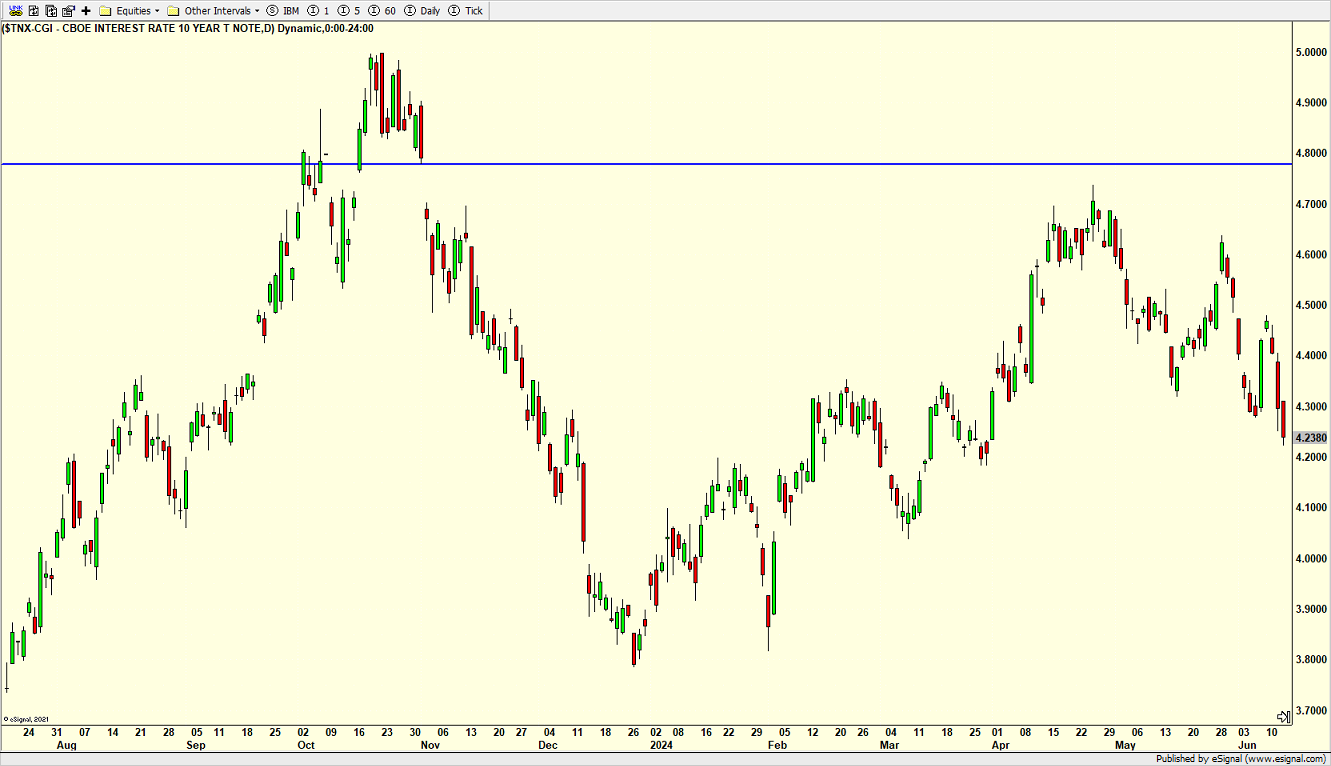

Between the cooler inflation numbers and the FOMC meeting this week, yields on bonds have come down in a rather large way. As you may know, the 10-year yield is the long-term benchmark and the most heavily traded. Let’s take a look at the 10-year while using two different time frames.

Below are treasury yields over the past year. 5% was the high profile peak last October, with 3.75% being the low in December. I had thought yields would have visited 4.8% before they saw 4%. While yields have risen in 2024, they have certainly come down in Q2.

(Click on image to enlarge)

Zooming out to mid-2021, we see a totally different picture. It looks like a strong bull market in yields where pullbacks should be bought. In other words, we have a solid bear market in bonds. Remember when bond prices rise, yields fall, and vice versa.

(Click on image to enlarge)

The $64 billion question is whether that 5% peak last year is a multi-year, durable peak. I do not have high conviction, but the longer it holds, the more likely it is. If that’s the case, then 0% GDP growth or even a modest recession would be on the table over the coming six to 18 months.

Sending Father’s Day wishes to all the dads out there. May you be surrounded by your loved ones.

On Wednesday, we bought ProFunds Precious Metals UltraSector (PMPIX) and Direxion Monthly High Yld Bull 1.2X (DXHYX). We then sold some Rydex Energy Fund (RYEIX) and some Rydex Consumer Products Fund (RYCIX).

On Thursday, we bought Invesco Emerging Markets Sovereign Debt ETF (PCY), iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), Fidelity MSCI Utilities Index ETF (FUTY), more DXHYX, and levered inverse S&P 500. We then sold Rydex S&P 500 (RYSPX), and PMPIX.

More By This Author:

Fed Update – Cost Of Living Index At All-Time High – Dow To 50,000Now It’s A Slowdown

May Certainly Ended With A Bang

Please see HC's full disclosure here.