Long Energy, Short Treasuries And Tech

Focusing On The Big Picture

For the last few months, I’ve been writing about the big picture in the markets, as I see it: higher inflation and higher rates are bullish for energy but bearish for bonds and technology companies still trading at multiples more suited to a zero interest rate environment.

In that post, I included our system’s top names that week:

Long Energy, Short Treasuries and Tech

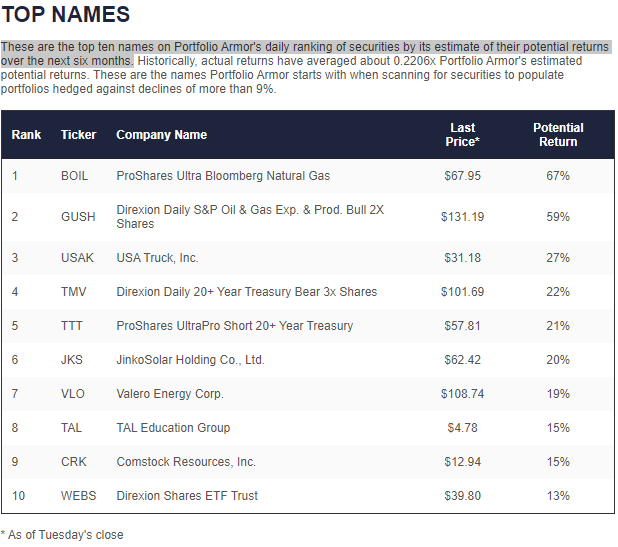

Our system doesn’t consider the macro picture when selecting its top names. Instead, it gauges stock and options market sentiment to estimate which securities are likely to perform the best over the next six months. Nevertheless, that bottoms-up approach painted a fairly clear picture in our top ten names as of Tuesday’s close:

- Long Energy: ProShares Ultra Bloomberg Natural Gas (BOIL), Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares (GUSH), Valero Energy Corp. (VLO), Comstock Resources, Inc. (CRK).

- Short Treasuries: Direxion Daily 20+ Year Treasury Bear 3X Shares (TMV), ProShares UltraPro Short 20+ Year Treasury (TTT).

- Short Tech: Direxion Daily Dow Jones Internet Bear 3X Shares (WEBS)

Screen capture via Portfolio Armor on 7/19/2022.

Here’s how those top names have done as of Wednesday’s close, following the Fed meeting: our top ten was +15.95% on average since July 19th, while the SPDR S&P 500 Trust (SPY) was -4.04%.

So far, focusing on the big picture has paid off.

More By This Author:

Gold Guns Girls

The Fed Doesn't Care About The Midterms

The Case Against China Invading Taiwan

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more