Junk Is As Good As Gold

Treasury yields are near their all-time low; the financial conditions index shows conditions are very loose. Investors are optimistic about the economy and fiscal policy is still extremely easy. It doesn’t get much better than this for the bulls. As you can see from the chart below, junk bond yields are 3.78% which is a record low. Keep in mind, this is lower than investment-grade bond yields in the pandemic, in 2019, and 2018. Investing in junk yields doesn’t make much sense with great dividend stocks yielding 2% or more.

The yield desert gets drier with a new all-time low for U.S. junk-bond yields, of 3.78%. That's less than the all-in yield on investment-grade corporate bonds as recently as during the pandemic and again in 2019 and 2018. pic.twitter.com/JIBmbOV8gN

— Lisa Abramowicz (@lisaabramowicz1) June 29, 2021

As you can see, there are cycles of stress in the corporate bond market every couple of years. There can easily be another widening of spreads next year for an unknown reason. That being said, just because junk yields are at record lows, doesn’t mean a catalyst is coming in the next few months. Don’t jump to a bearish conclusion until we see a negative catalyst. The good news is some of the debt that was rated junk might be upgraded with the pandemic over. Anything in the travel sector probably will get its debt upgraded as sales come back and balance sheets are repaired.

Some Extra Real Disposable Income Still Left

Spending will shift this summer from durable goods to services such as vacations and dining. You can see in the chart on the left that real spending on furnishing, recreational vehicles, and other durable goods peaked, while spending on motor vehicles crept higher. A lot of demand was pulled forward. Some demand was added of course due to added use. However, there should be a multi-quarter mean reversion in the future.

🇺🇸 GS: "Businesses report the worst supplier delivery delays in decades and expect them to partially last through year-end." pic.twitter.com/rNVH3hNai9

— Michael Goodwell (@MichaelGoodwell) June 29, 2021

The chart on the right shows historical real disposable income since 2018. The 3 spikes were from the stimulus checks. As you can tell, there is still some extra disposable income ready to be spent in the next few months. Consumers are saving for sunny days when the economy is fully normal. It will take a while for all that added savings to be deployed on leisure services. This summer is looking really good for consumer discretionary businesses.

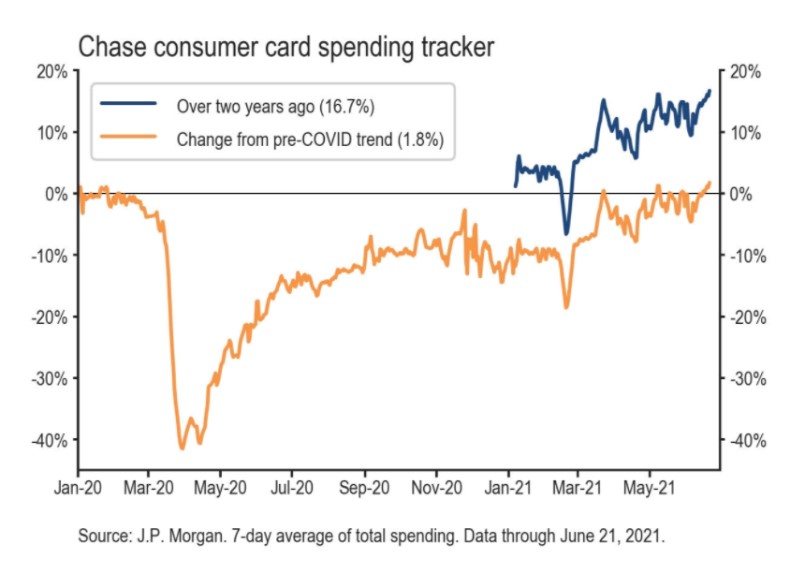

The chart below shows the 7 day average of JP Morgan card spending growth since pre-COVID-19 has increased to 1.8%. The better comparison is 2019 since it looks at the same time of year. This growth rate is up to 16.7%. The data is as of June 21st which means the June retail sales report should be great. Retailers will end the quarter on a high note. Management teams should be optimistic on their Q2 earnings calls this July.

Oil Is Primed To Increase Further

The oil market is in backwardation which means current prices are higher than prices trading in the futures market. As you can see from the chart below, the level of backwardation has increased sharply in the past few months. This means the spot price increase we have been seeing recently hasn’t been supported by prices in the futures market. These are contracts in 2022, 2023, etc.

'The US crude oil curve is moving deeper into backwardation.' https://t.co/bFIVt2TaRe via @SoberLook pic.twitter.com/6KP1YY2lRO

— Jesse Felder (@jessefelder) June 25, 2021

The current backwardation makes sense if you believe the current spike in demand and lack of supply won’t be maintained. On the other hand, if suppliers see the futures market showing lower prices, they might not want to commit to more development investments. This is a game that is complicated severely by politics because many countries where oil is drilled have uncertain futures.

If all oil was in developed countries, the price per barrel wouldn’t spike as high as it sometimes does. The marginal production by US frackers has been amazing for suppressing oil prices. The major problem has been that they haven’t produced cash flow. This next energy cycle should have higher prices because of this.

🛢️💰 RBC | Crude price fiscal breakeven estimate revisions for OPEC and Russia pic.twitter.com/w00xc9uiR6

— PiQ (@PriapusIQ) June 28, 2021

The chart above shows the breakeven oil prices for various governments in oil producing countries that aren’t capitalistic. As you can see, Saudi Arabia’s government breaks even at $77 per barrel. That could mean OPEC will increase production when oil gets to the $80s. Russia’s government breaks even with oil at $72.

While US production has come down from its prior peak, it has been incredibly resilient. OPEC might not want another battle for market share which causes prices to plummet. OPEC should recognize that energy capex has already come down. There is no need to flood the market with oil. Plus, some government officials probably believe the world will move off fossil fuels in future decades which means it makes sense to maximize profits now so the money can be used for green investments. We’re not taking either side. It’s simply a matter of probability analysis and risk mitigation.

Goodbye Inflation

Inflation isn’t going to be an issue in 2022 because the supply constraints will go away, demand growth will fall, and fiscal stimuli will be gone. The initial rush of spending post-pandemic will be mostly over. As you can see from the chart below, supply chain constrained categories of core PCE inflation will swing from a 105 basis point positive now to a 35 basis point positive by the end of the year. They will have a negative 55 basis point impact by the end of 2022. Once these weak core PCE readings come through next year, the Fed will end all chances of hikes in 2022.

🇺🇸 GS: "Businesses report the worst supplier delivery delays in decades and expect them to partially last through year-end." pic.twitter.com/rNVH3hNai9

— Michael Goodwell (@MichaelGoodwell) June 29, 2021

Conclusion

Junk bond yields are at a record low. This doesn’t mean a volatility event is coming soon, but one will come within the next few quarters like they always do. Consumers still have extra disposable cash which means they can spend heavily this summer. Spending growth has been strong in June. Oil is in backwardation. The Russian and Saudi governments can survive with oil in the $70s. That might keep a lid on prices. Production will be free-flowing if oil gets to the $80s. Core PCE inflation won’t be strong in 2022 especially with supply constraints going away.

Disclaimer: The content in this article is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be ...

more