Is There Still Time To Be Bullish On Bonds?

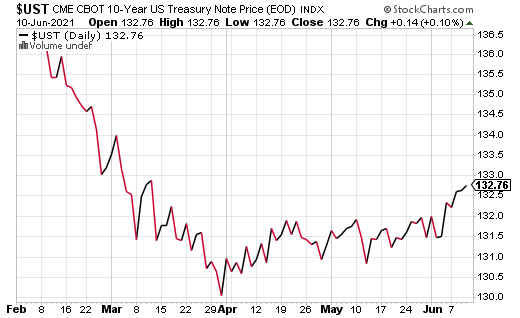

As low as interest rates have been lately, it doesn’t seem to have diminished investors’ appetite for government bonds. A yield under 1.50% for 10-year Treasury notes is not a detriment, apparently, when the rest of the developed world is also in an ultra-low rate cycle.

Bond investors may have assumed the looming threat of inflation would send bonds lower (and yields higher). Last week, we had a higher than expected CPI come up (the consumer price index). Higher consumer prices are one signal that inflation has arrived.

CPI came in at 5.0%, the highest number in 13 years. Core CPI, which doesn’t include the volatile food and energy categories, was 3.8%. That’s the largest annual increase since 1992. Surely a number that big caused a selloff in bonds… or not.

Bond prices actually went higher after the CPI news. How is that even possible? Here are a few possible reasons…

First off, many economists assume current inflation is temporary. It’s due to supply chain bottlenecks and a short-term surge in demand. In a few months, they expect CPI to return to more normal levels. What’s more, even though the current CPI number may have been higher than expected, it also suggests that peak inflation (temporary or not) is not as high as some people feared.

What’s more, there is simply a lot of demand for treasury bonds. US bonds are still considered the safest in the world. And they still pay a higher rate than many other developed nations. Ultimately, financial markets are driven by supply and demand, not based on what investors think should happen.

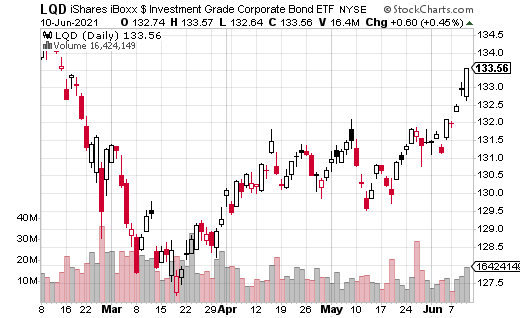

It’s not just Treasury bonds that saw a boost after CPI. Corporate bonds also have been trending higher. The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) is one of the most popular vehicles for investing in corporate bonds. As you can see from the charts, LQD’s price has followed the path of a 10-year Treasury note.

Corporate bonds are rate-driven, just like government bonds, so the move higher in LQD is not necessarily a surprise. The question is, will LQD keep climbing? At least one options trader seems to think so.

This trader (likely a fund of some sort) purchased 10,000 August 20th 135 calls in LQD with the stock price at $133.35. The price paid was $0.43 or $430,000, which is the max loss on the trade. The breakeven point for the position is at $135.43 by August expiration.

There is no defined max gain, but realistically the price of LQD (and corporate bonds) can only go so high. The ETF did climb above $139 last summer, so there certainly is some decent upside potential. While we aren’t likely to see levels like that this year, this trade may indicate that there could be more upside in LQD before the end of the summer.

Disclaimer: Information contained in this email and websites maintained by Investors Alley Corp. ("Investors Alley") are provided for educational purposes only and are neither an offer ...

more