If The S&P 500 Plunges, The Gold Market May Follow

It was a sea of red across the financial markets on Aug. 19, as gold declined by 0.47%, silver by 2.03%, the GDX ETF by 2.17% and the GDXJ ETF by 3.06%. Moreover, the S&P 500 sank by 1.29% and the Nasdaq Composite by 2.01%. In contrast, the USD Index rallied by 0.64% and U.S. Treasury yields also rose sharply. As a result, the price action continues to unfold as expected (profits on our short position have just increased once again), and the trends should continue in the weeks ahead.

Stocks in the Spotlight

While last week proved that gold, silver, and mining stocks don't need the S&P 500's help to move lower, a sharp drawdown of the latter could intensify the drawdowns of the former. Thus, with bonds and commodities suffering recently, the S&P 500 should be next in line.

To explain, dovish comments by Fed Chairman Jerome Powell on Jul. 27 helped loosen financial conditions and uplift risk assets. In the process, the USD Index, real yields, and high yield credit spreads all retreated. However, with the damage reversing in recent days, financial conditions have re-tightened, and the developments spell trouble for the S&P 500.

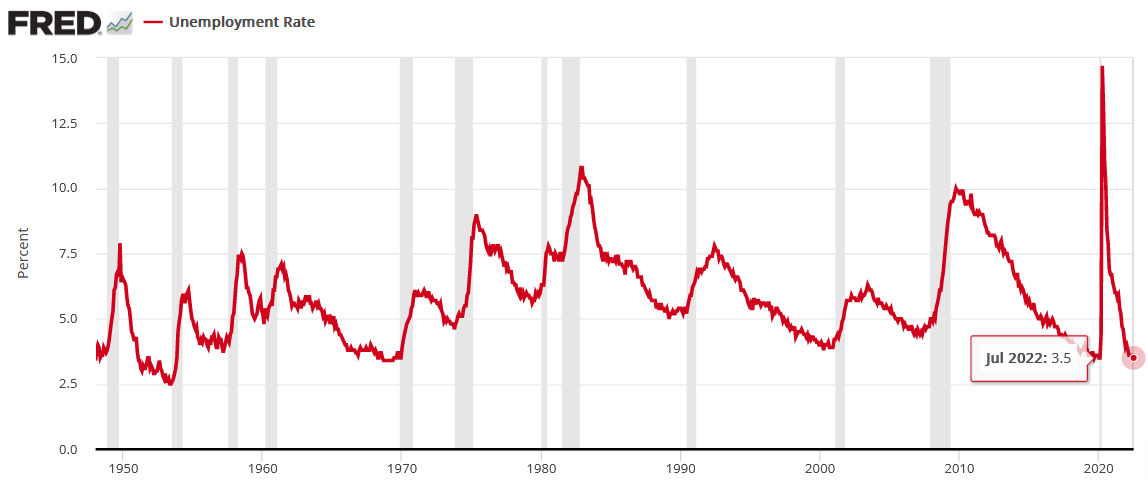

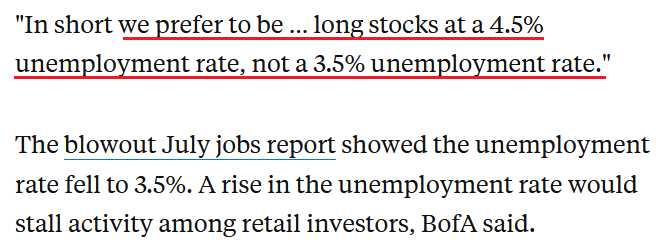

To that point, Michael Hartnett, Chief Market Strategist at Bank of America, told clients on Aug. 19 that we're in the midst of a "cyclical bear" market, and the "ultimate lows" are on the horizon. He wrote:

“[With] inflation on course to be 5%-6% next spring, quantitative tightening is likely to be stepped up significantly in coming months, which would be negative for credit spreads & equity multiples.”

Furthermore, with the crowd confusing Fed officials' poor communication skills for a dovish pivot, Hartnett shares our view that investors are ignoring the Fed at their own peril.

Please see below:

Source: Investing.com

For context, I warned about this phenomenon on May 20. With investors following the post-GFC script, they’re more worried about missing a dovish pivot than suffering the consequences of ignoring fundamental reality. However, with their misguided faith in the central bank likely to be their undoing, market participants’ belief that the Fed can control the economic cycle should result in plenty of pain over the medium term. I wrote:

While some claim that sentiment is extremely bearish on Wall Street, the reality is that no one fears the Fed (…).

With the consensus still fighting the hawkish realities that I warned about since 2021, the VIX is behaving as you might expect. I mean, why panic when the Fed is all bark and no bite? Therefore, everyone can relax because the Fed will turn dovish, inflation will rage, and in some alternative reality, this outcome is bullish for risk assets.

However, I’ve warned on numerous occasions that a dovish pivot would have dire long-term consequences for the U.S. economy. As such, Fed officials (should) know this, and a small short-term recession is much more attractive than a long-term hyperinflationary collapse. Yet, investors still assume that the latter option is more likely because the Fed can’t withstand falling stock prices.

However, with recency bias clouding investors’ judgment, they don’t realize that 1970s/1980s-like inflation is a completely different animal.

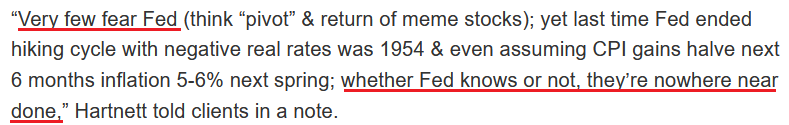

Furthermore, Hartnett noted the importance of the U.S. unemployment rate. Remember, bear markets don’t end with the U.S. unemployment rate at a ~50-year low; they begin with the metric at a ~50-year low. Thus, Hartnett realizes that the bottom in stocks likely awaits us.

Please see below:

Source: Markets Insider

For context, I explained the relationship on Aug. 17. I wrote:

The U.S. unemployment rate hit a new 2022 low of 3.5% in July. However, the metric always bottoms before a recession.

Please see below:

To explain, notice how the U.S. unemployment rate always troughs and then steadily rises before a recession hits? Thus, with the metric heading south in July, the bearish turn still awaits us (…).

All 11 instances of abnormally low U.S. unemployment rates since 1950 were bearish, not bullish. Furthermore, six readings occurred before/alongside profound S&P 500 bear markets, while five readings resulted in the S&P 500 giving back all of its prior gains. As a result, even if the latter occurs, the S&P 500 ended June at ~3.785, which implies more than 12% downside from the Aug. 16 close if the optimistic scenario unfolds.

However, with asset prices still in bubble territory and unanchored inflation forcing the Fed to tighten monetary policy at a torrent pace (rate hikes + QT), a soft landing is highly unlikely. Moreover, with the 1970s and 1980s highlighting the destruction that unfolds when inflation reaches unanchored levels, the bulls have a laundry list of excuses that only hold if ‘this time is different.’

Thus, while investors still have complete faith in the Fed, fundamental realities should shake their confidence over the medium term. Moreover, with their current expectations in la-la land, a realization leaves plenty of room for re-ratings of the PMs and the S&P 500.

Please see below:

To explain, the blue line above tracks the recession odds priced into the S&P 500. For context, Bank of America forecasts the metric by dividing the change in the equity risk premium (ERP) since March 2021 by the average change in the ERP during historical recessions. If you analyze the high in early 2022, peak fear had investors pricing in a 75% chance of recession. Yet now, the metric stands at 20%.

However, uninformed investors don't realize that the Fed hasn't curbed unanchored inflation without triggering a recession since 1954. Therefore, history implies that the recession odds are 100%. As such, with sentiment likely to shift when investors lose faith in the Fed, asset prices should suffer mightily as they re-price to reflect their fundamental values.

Continuing the theme, I've warned repeatedly that the Fed needs higher real interest rates to curb inflation. Moreover, Powell understands this, and he made the point for me during his June FOMC press conference.

Please see below:

Source: U.S. Fed

Thus, with a higher U.S. 10-Year real yield extremely harmful to the PMs and the S&P 500’s fundamental values, further upside should weigh heavily on their medium-term prices.

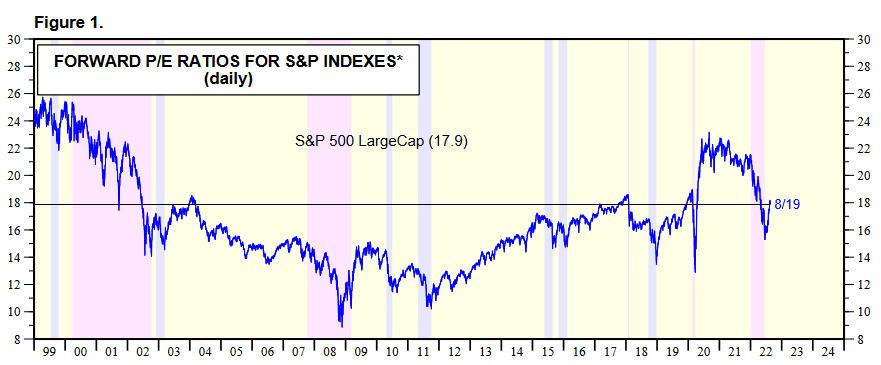

Please see below:

To explain, the dark blue line above tracks the S&P 500’s forward price-to-earnings (P/E) ratio, while the light blue line above tracks the inverted (down means up) U.S. 10-Year real yield. If you analyze the relationship, you can see that a higher U.S. 10-Year real yield compresses the S&P 500’s forward P/E.

Likewise, while it’s hard to see on the right side of the chart, the light blue line has moved lower once again as the U.S. 10-Year real yield recouped roughly 40% of its recent decline. In contrast, the S&P 500’s forward P/E has barely budged and is at 17.9x as of the Aug. 19 close. Therefore, a decline to the 17x implied by the U.S. 10-Year real yield would result in an immediate S&P 500 downside of 5%.

However, this would only erase the short-term imbalance. Please remember that the U.S. 10-Year real yield surpassed 1.1% in 2018, which is much higher than the current reading of 0.43%. Moreover, the U.S. had much lower inflation in 2018, so one could argue that the metric should exceed its 2018 highs given today’s fundamental environment.

Either way, a rally above 1% would put immense pressure on the S&P 500’s forward P/E. In addition, the projection only accounts for the ‘P’ (price) side of the equation. With the ‘E’ (earnings expectations) likely to decelerate sharply as the Fed hammers demand to cool inflation, the S&P 500’s forward P/E should have plenty of medium-term downside.

To that point, modern history reminds us that the S&P 500’s forward P/E falls well below 17.9x when recessions occur.

Source: Yardeni.com

Rents and the CPI

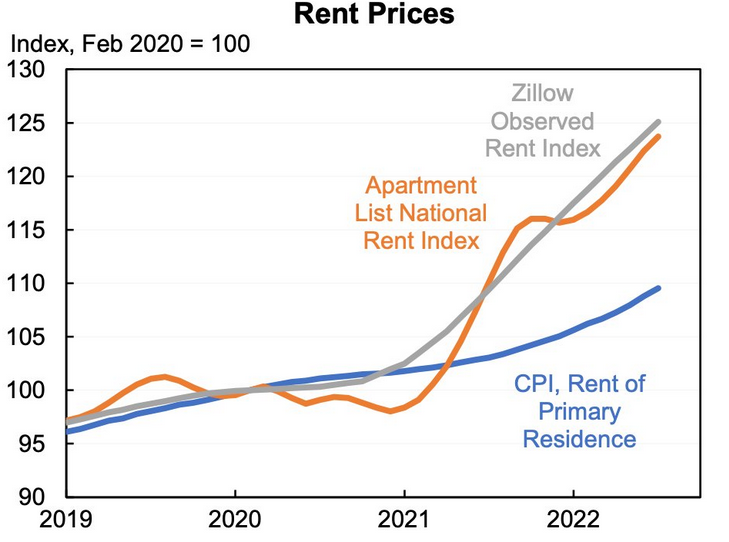

While I’ve been warning for months that higher rents would put upward pressure on the Consumer Price Index (CPI), the Shelter CPI hit a new 2022 high in July. Moreover, with the ascent likely in the early innings, a realization should make the Fed’s job increasingly difficult in the months ahead. For context, the Shelter CPI accounts for more than 30% of the headline CPI’s movement.

Please see below:

Source: Jason Furman

To explain, the gray and orange lines above track the index values of Zillow and Apartment List’s rental indices, while the blue line above tracks the rent component of the CPI. As you can see, the latter has materially underperformed the former.

However, please remember that the CPI component tracks the average of all rental prices, which includes new and renewed leases. In contrast, Zillow and Apartment List’s data only tracks new leases, where prices are rising much faster. Therefore, as new leases become a greater percentage of the rent CPI, they will put upward pressure on the Shelter CPI and the headline CPI.

As evidence, Apartment List researchers explained the discrepancy. They wrote:

“Our repeat-rent index tracks the change in rent prices for new leases, while the CPI measures the price change in market rents for all housing units. New leases always see the most significant price increases (or declines) in any given market, whereas renewal leases tend to see more modest rent adjustments.”

“And more importantly, only a small fraction of households sign a new or renewal lease in any given month, while the large majority of households see no change in their housing costs. As a result, housing price changes will always appear more muted when considering all households rather than only those who signed new leases.”

Thus, while the consensus assumes that inflation will subside and the Fed can cut rates in 2023, the realities on the ground suggest otherwise.

Source: Apartment List

The Bottom Line

While gold, silver, and mining stocks have materially underperformed the S&P 500 recently, they are still far from reflecting their fundamental values. Moreover, with the Fed still behind the inflation curve and quantitative tightening (QT) set to double to $95 billion per month next week, several assets should suffer sharp re-ratings as reality sets in over the medium term. As a result, the PMs' fundamental outlooks remain profoundly bearish for the next weeks or months. Consequently, it’s likely (no guarantees, of course) that the profits on our short position will increase much further in the not-too-distant future.

In conclusion, the PMs declined on Aug. 19, as the S&P 500 suffered a mild sell-off. Moreover, with real yields rising and the USD Index gunning for its 2022 highs, the S&P 500's bear market is likely far from over.

More By This Author:

The USDX Situation Suggests The Peak in Gold Is Already In

Why Is The USDX Weak Lately And Gold Not Responding To It?

The GDXJ Didn’t Benefit From Investors’ Bullish Frenzy

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more